Many years later, as the last semiconductor cooled in its silicon bed beneath the Arizona desert, historians would trace the tremors of that Friday morning when GlobalFoundries’ shares rose like a phoenix forged not in fire but in the alchemical furnaces of market speculation. The stock, metallic and restless, climbed 6.7% by 1:50 p.m. ET-a minor miracle in the arid landscape of 2024’s trading floors, where fortunes often evaporated like morning dew under the sun of algorithmic indifference.

The omen arrived in the form of a Wall Street Journal dispatch, its ink still damp with the urgency of midnight presses. The Trump administration, that spectral force perpetually resurrected in the annals of policy, had conjured a proposal to tax imported semiconductors at 100% unless manufacturers balanced foreign shipments with domestic production. The rule, unimplemented but already heavy with consequence, hung in the air like the scent of ozone before a storm-a storm that might, paradoxically, nourish the parched foundries of GlobalFoundries.

The Alchemy of Equivalence

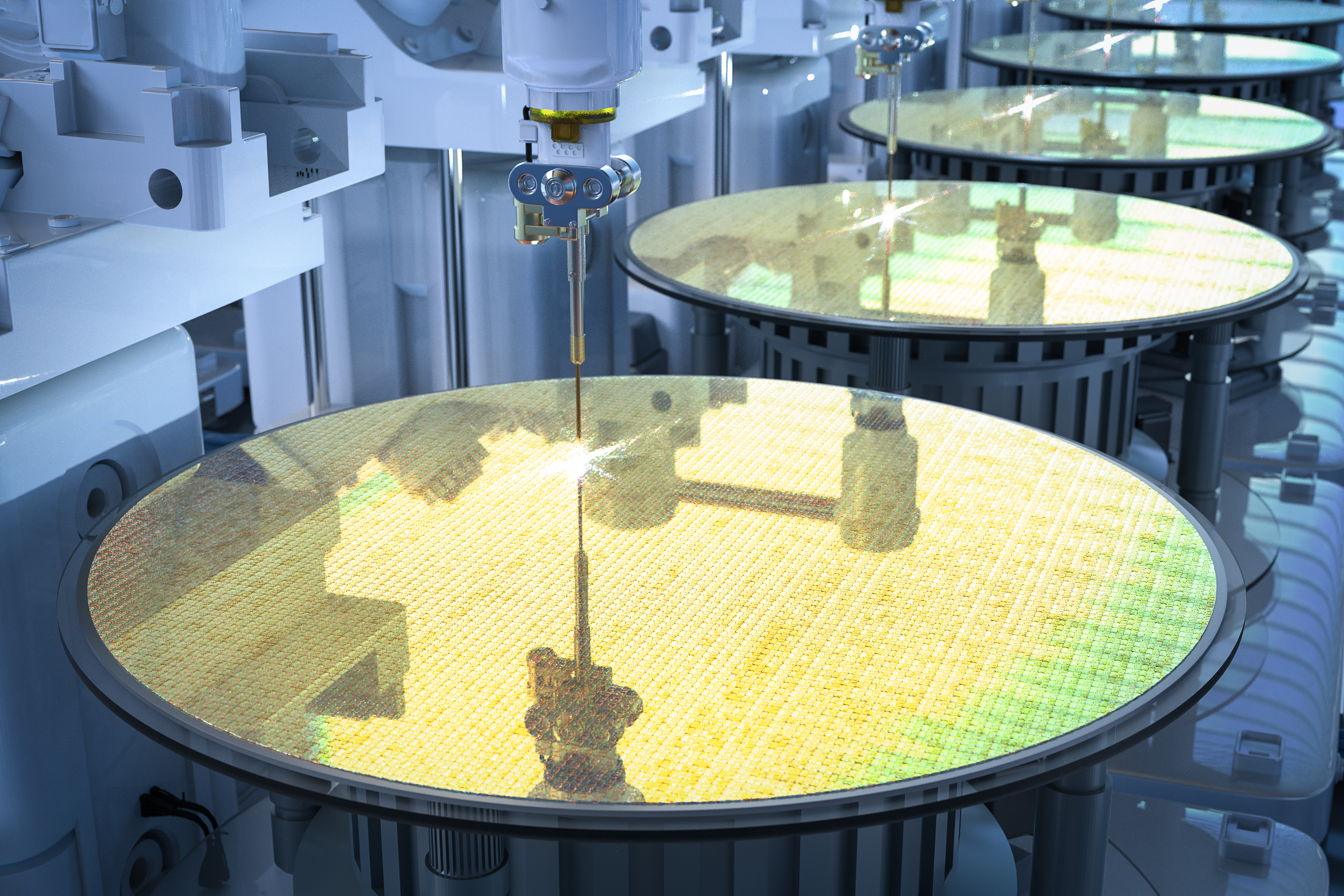

The proposal, dubbed the “1:1” doctrine by its architects, wove a paradoxical spell: chipmakers could import foreign wafers only if they forged an equal measure domestically, earning “credits” like pilgrims collecting relics to shield themselves from the tariff’s wrath. To the uninitiated, it seemed a ledger-keeper’s fantasy, but to those who understood the sacred geometry of supply chains, it was a covenant-a promise that U.S. soil might once again tremble with the footsteps of silicon pilgrims seeking sanctuary from geopolitical tempests.

Yet GlobalFoundries, that venerable smithy of “specialty” chips, existed in a purgatory of innovation. Its furnaces, though skilled in the rituals of trailing-edge fabrication, could not conjure the AI-era relics forged in Taiwan’s volcanic pits. Still, the company’s ovens hummed with the quiet dignity of an industry that knew the world’s hunger for the mundane was eternal-a truth as old as the pyramids, which too were built not for gods but for scribes and tax collectors.

The Oracle’s Dilemma

Analysts, those modern-day augurs reading entrails in quarterly reports, noted the company’s 3% revenue growth-a figure as unremarkable as a cloudless sky. Trading at 22 times this year’s earnings, the stock bore the weight of expectations inflated like a hot-air balloon over a carnival. Could the tariff winds sustain its ascent? Or would the market’s fickle breath send it spiraling into the arms of short sellers?

Here, the myth diverged. Intel, that faltering colossus of leading-edge innovation, stood poised to inherit the mantle of salvation-a phoenix with more credible flames. GlobalFoundries, meanwhile, remained a gambler’s darling, its fate tied to the caprice of policymakers and the slow, tectonic shifts of globalization. The analyst’s quill hesitated, then inked a verdict in the margin: a cautious hold, garnished with a footnote of doubt.

And so the markets drifted onward, their rhythms as inscrutable as the tides that once guided Phoenician traders. In the end, the story of chips and tariffs was not about circuits or quotas, but about the eternal human hunger to build, to barter, and to believe that this time-this time-the algorithm will love us back. 💻

Read More

- 21 Movies Filmed in Real Abandoned Locations

- Gold Rate Forecast

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- Crypto’s Comeback? $5.5B Sell-Off Fails to Dampen Enthusiasm!

2025-09-26 22:42