Dear diary, today I’m addressing a question that’s been gnawing at me like a raccoon in my garden shed: How does one achieve passive income without becoming a hermit, a gambler, or a victim of their own optimism? Spoiler: It involves ETFs and a dash of self-awareness.

Let’s be honest, most of us want to wake up to cash flowing in like a tap left on in a tropical resort. But life rarely hands us such luxuries. Unless you’ve mastered the art of the “lazy millionaire” (a title I’ve reserved for myself in a parallel universe), passive income requires strategy-and yes, a little elbow grease.

ETFs: The Lazy Investor’s Best Friend

Exchange-traded funds (ETFs) are the unsung heroes of the investment world. They’re like a trusty handbag-versatile, reliable, and curated by someone else. While I once thought picking stocks was the way to go (ahem, the time I invested in a “revolutionary” pet grooming app that folded by week three), ETFs offer a safer, smarter bet.

Think of them as a diversified cocktail party where the guests are stocks, bonds, or sectors. The host (the fund manager) ensures no one gets too tipsy (overexposed) and the bar tab (fees) stays manageable. Contrast this with real estate, which feels less like passive income and more like a never-ending home improvement show. Leaks, tenants, HOA fees-the drama is exhausting.

VYM: Dividend Darling or Overhyped?

Enter Vanguard High Dividend Yield ETF (VYM). Let’s dissect this beast. First, it’s passively managed, tracking the FTSE High Dividend Yield Index with a fee so low (0.06%) it makes my college cafeteria coffee taste like a luxury. For every $10,000 stashed in here, you’ll lose just $6 to fees annually. That’s less than my monthly subscription to a streaming service I barely use.

Now, let’s talk numbers. VYM’s 2.5% yield isn’t the flashiest in town, but it’s not chasing rainbows either. Its secret weapon? Quality holdings like Broadcom, JPMorgan Chase, and Walmart. These aren’t the flashy “get-rich-quick” types; they’re the steady, sensible friends who remember your birthday and don’t borrow your car without asking.

Here’s the rub: High-yield ETFs often trade off capital growth for immediate payouts. VYM, however, balances both. It’s like choosing a partner who’s not just charming but also has a pension plan. Over time, this balance helps combat inflation’s sneaky tax on your purchasing power.

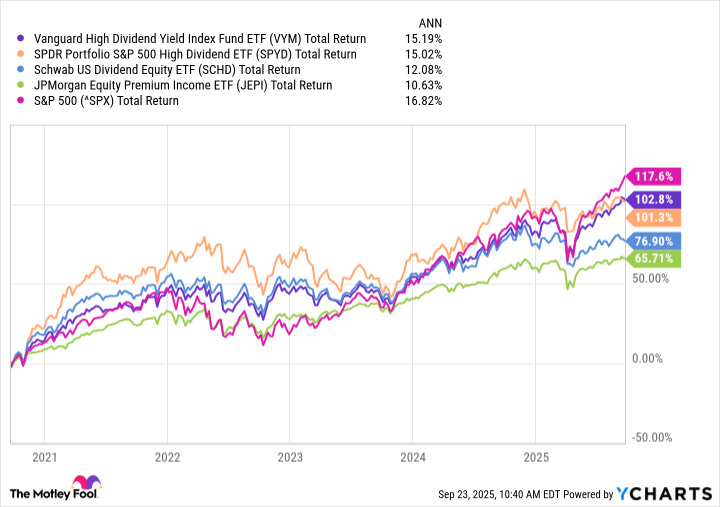

My lesson? Don’t fall for the siren song of “highest yield.” It’s a trap. Look at total return-the real measure of success. VYM’s five-year track record against its peers isn’t just solid; it’s a masterclass in patience and prudence.

Units of Cryptocurrency Lost: 12. Hours Spent Watching Charts: 9. Number of Panicked Texts to Friends: 24. 🤞

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Elden Ring Nightreign stats reveal FromSoftware survivorship bias, suggesting its “most deadly” world bosses had their numbers padded by bruised loot goblins

2025-09-26 20:38