For six decades, Warren Buffett steered Berkshire Hathaway like a riverboat pilot navigating the Mississippi-keen-eyed, steady-handed, and ever mindful of the hidden snags beneath Wall Street’s gilded surface. Under his watch, a single Class A share grew fat with the sweat of American industry, swelling into a 6,000,000% bounty. Yet now the old pilot prepares to dock his vessel for the final time, passing the wheel to Greg Abel, who swears to keep the compass set toward value’s True North.

But Buffett, that sage of Omaha, ain’t one to fade quietly into the prairie sunset. Though his words still hum with the optimism of a man who believes in the soil beneath his boots, his hands have been busy-slinging off $177 billion worth of stock since 2022. It’s a quiet sermon, preached in the language of ledgers, warning of fields overripe for the rot.

The Harvest Moon of Selling

Investors once hung on his quarterly 13F filings like pilgrims awaiting scripture, eager to trace the tracks of his mind. Yet for 11 straight quarters, the Berkshire vaults have echoed with the hollow clatter of sell orders. From Q4 2022 through mid-2025, the numbers drip like slow poison: $14.64 billion, $10.41 billion, $75.5 billion-a river of red ink flowing toward some unseen abyss.

- Q4 2022: $14.64 billion

- Q1 2023: $10.41 billion

- Q2 2023: $7.981 billion

- Q3 2023: $5.253 billion

- Q4 2023: $0.525 billion

- Q1 2024: $17.281 billion

- Q2 2024: $75.536 billion

- Q3 2024: $34.592 billion

- Q4 2024: $6.713 billion

- Q1 2025: $1.494 billion

- Q2 2025: $3.006 billion

Even the sacred ritual of buybacks-Buffett’s favorite hymn of confidence-has fallen silent. After 24 quarters of siphoning cash back into Berkshire’s coffers, the taps went dry in June 2024. The message? The grapes of Wall Street hang plump, but the wine they’ll make tastes bitter.

The Measure of a Folly

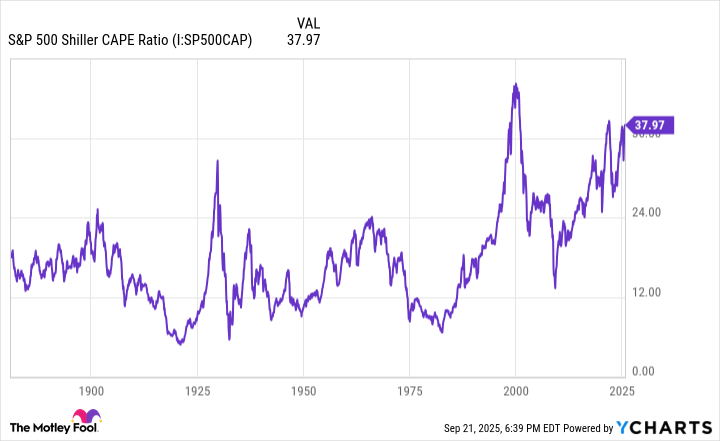

Markets, like rivers, are measured in many tongues. Some swear by the twitch of the Dow’s needle; others by the S&P 500’s Shiller P/E Ratio-a gauge that peers through the fog of time, averaging earnings over a decade. And lo, it stares back with a cyclopean eye: 39.95. The third-steepest valuation in 154 years of record-keeping, nipping at the heels of the dot-com inferno.

Twice before, the ratio clawed higher-January 2022’s frostbitten peak, and the fever-dream climax of 1999. Both times, the ground quaked. The S&P fell 25%; the Nasdaq, 78%. No prophecy of doom, but a farmer’s almanac of cycles: what rises swift must fall swift.

The Treasure and the Storm

Buffett’s hoard-$344.1 billion in cash and Treasuries-is no mere war chest. It’s a scythe sharpened for the harvest, a weapon to wield when the sky cracks and the locusts swarm. Recall Bank of America: $5 billion poured into the tempest of 2008, yielding $12 billion when the sun returned. Abel, the new steward, will inherit not just capital, but the patience of a man who knows all rivers bend eventually.

The market, for all its chrome-plated bravado, is a fragile thing-a candle guttering in the wind. When the storm comes, as come it must, Abel will sow where others reap. But for now, Buffett’s silence speaks loudest: the earth grows parched, and the barn doors creak in the gathering heat. 🌪️

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- TV Shows With International Remakes

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- Billionaire’s AI Shift: From Super Micro to Nvidia

2025-09-26 10:23