CleanSpark, Inc., darling of the Bitcoin mining world (Nasdaq: CLSK), has landed itself a whopping $100 million Bitcoin-backed credit facility with the oh-so-institutional Two Prime. Announced on September 25, it means CleanSpark is now able to toy with a mind-boggling $400 million in collateralized lending. Call it the summer fling of the finance world!

Armed with this little lot, CleanSpark plans to doll up their data centers, jam up their high-performance computing efforts, and help their Digital Asset Management team – y’know, the folks who play with numbers. They’re sitting pretty with over 12,000 BTC in their treasury since January 2025, when they started with a modest 10,000 BTC, by the way.

“I’m incredibly proud we’ve been able to harness our impressive all-reliable bitcoin balance of nearly 13,000 to fund growth with top-shelf partners like Two Prime – all of it at a market-winning cost!” chirped out Gary A. Vecchiarelli, Chief Financial Officer and President of CleanSpark.

Miners Embrace Bitcoin-Backed Financing With Enthusiasm

The Two Prime deal follows CleanSpark’s earlier rendezvous with another $100 million line of credit arranged with Coinbase Prime. It seems Bitcoin-backed financial frolicking is all the rage among miners, seeking to keep shareholders happy without bleeding them dry via equity offers. According to their press release, this cunning strategy aims to push operational growth while keeping an eye on Bitcoin’s whimsical price movements.

– CleanSpark Inc. (@CleanSpark_Inc) September 25, 2025

Alexander Blume, CEO of Two Prime, greeted CleanSpark’s move as a testimony to Bitcoin’s stature in the world of institutional lending. Meanwhile, in the parallel universe of mining large numbers, companies like Riot Platforms dive deep into similar credit pools, highlighting Bitcoin’s metamorphosis in corporate financing.

Rambunctious CLSK Shares and Measured Public Reaction

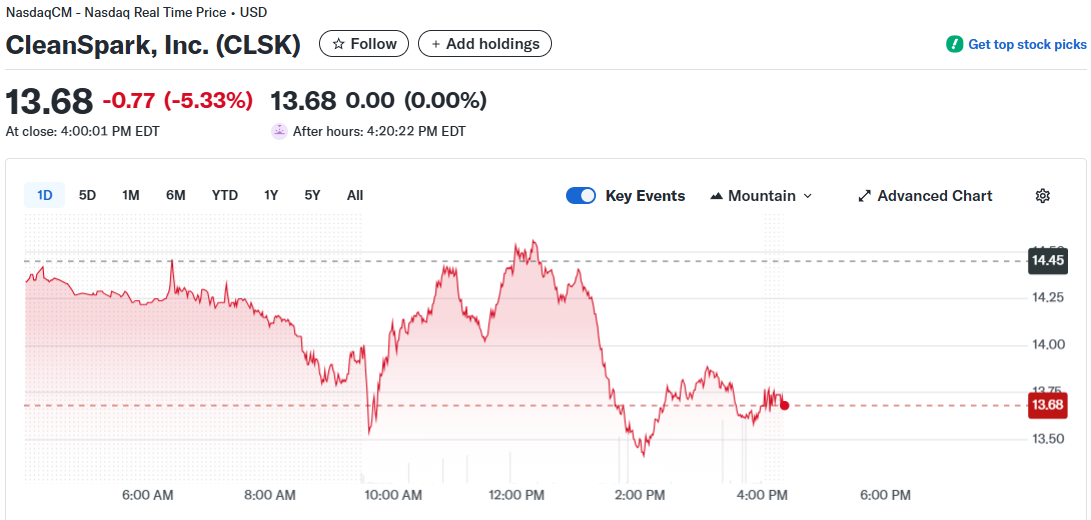

Despite seemingly significant funding developments, CleanSpark’s financial news was met with a yawn in the equity markets. As of September 25, CLSK shares sat content at $13.68, modestly rubbing shoulders with $14.85 from the week before and getting cozy near a post-Coinbase Prime announcement high of $14.44. Trading volumes reached dizzying heights with over 36 million shares traded – almost three times their usual nine-to-furl number, Yahoo Finance gleefully reports.

Graphic of stock price for CLSK. Source: Yahoo Finance

Their stock has seen a climb that’d make any mountaineer jealous, having tumbled upwards by 52% since mid-September. Investors seem to think CleanSpark will continue to flex without diminishing their shares. CLSK’s market cap playfully sidles around $3.9 billion.

As public miners continue to dominate Bitcoin’s digital domain with increasingly impressive valuations, CleanSpark secures its place with non-dilutive fundraising. The company’s strategic moves anticipate hefty infrastructure growth and bolstering of their treasury management. All this while following suit with industry trends of diversification and wise money moves. Can’t get any more joyous, can it? 🎉

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- TV Shows With International Remakes

- 8 Board Games That We Can’t Wait to Play in 2026

- All the Movies Coming to Paramount+ in January 2026

2025-09-26 03:32