TL;DR

- HYPE limps at $44-45, like a soldier after a bad night; $50 still taunts from afar.

- Analysts whisper of $38-40 as sanctuary, with deeper pits at $30, $28, and $23.

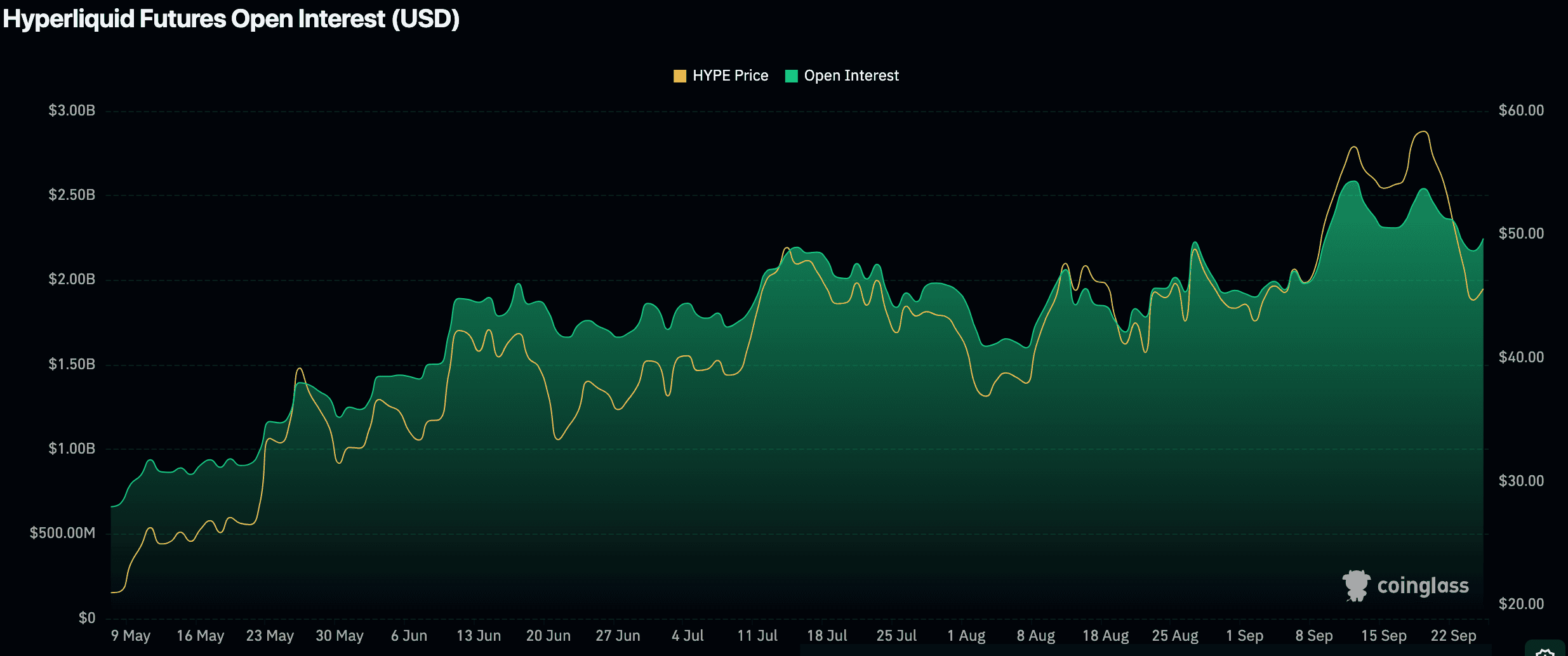

- Open interest clings stubbornly at $2.17B, as if daring fate to break it-traders remain unrepentant.

Price Pullback and Key Levels

Hyperliquid (HYPE) has tumbled over 26% in a week, a free fall from $59 to $42 that makes gravity blush. Daily volume tiptoes around $907 million, yet the price drops like it has a personal vendetta, down 4% in 24 hours.

The $44-45 range stands as a fragile defense, a paper wall against a storm. $50 glares like a distant mountain, daring anyone to climb. Beyond that, $52-53 forms a slightly sturdier barricade, but the wise know that walls are made to fall.

Analysts Note Support and Market Imbalance

Crypto Bully mutters that HYPE retraced more than expected but still clings to its POC like a drunk man to a lamppost.

$HYPE

– Retraced quite a bit more than expected. Yet somehow, the range before breakout still limps along.

– Could add here for a hopeful march back to $50, if the stars align and price doesn’t stage a tantrum…

– Crypto Bully (@BullyDCrypto) September 24, 2025

Ali Marinez cheerfully calls $42 a “golden buy-the-dip zone,” as if spotting treasure in a mud puddle. Charts hint at a rebound toward $55, provided the ground beneath $42 holds.

Husky notes the usual culprits: buybacks, whale selling, and token unlocks. “That last drop screams imbalance,” he observes, like a monk lecturing to empty air. Support lurks at $38-40, with deeper, darker levels at $30, $28, $23. Short-term resistance plays hide-and-seek at $47-50.

HIP-3 Update and Governance Proposals

Hyperliquid News hints HIP-3’s final draft is nearly ready. Staking for exchanges, fee tweaks, and slashing penalties promise thrills for those who like watching numbers blink.

HIP-3 final version almost ready.

– Bug bounties now match mainnet, because even bugs deserve recognition.

– To create a HIP-3 Dex, stake 500,000 $HYPE (subject to attrition over time).

– The first three assets escape auction; the rest… well, the rest is chaos.

– Hyperliquid News (@HyperliquidNews) September 25, 2025

DBA dreams of slashing HYPE’s total supply by 45%, promising investor smiles if approved. Reality, however, sits sipping tea, waiting.

Futures Open Interest

Open interest stays lofty at $2.17B. Since May, it crept from under $1B like a timid cat to this audacious number, a testament to stubborn market faith.

July to mid-September saw OI rise with price, hand in hand like childhood friends. The plunge from $59 to $42 barely shook positions, leaving markets ripe for melodrama if liquidations flare. Buckle up-this ride has more plot twists than a winter novel. 📖💥

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Ephemeral Engines: A Triptych of Tech

- AI Stocks: A Slightly Less Terrifying Investment

- 20 Games With Satisfying Destruction Mechanics

2025-09-25 15:12