Behold, the AI revolution! A tale of silicon and speculation, where the S&P 500 and Nasdaq Composite pirouette to all-time highs like ballerinas on caffeine. But lo! Is this a golden age-or a gilded cage? Let’s don our jester hats and peer into the fiscal funhouse.

Behold the kings of the chip: Nvidia, Broadcom, TSMC-trillion-dollar titans who’ve joined the aristocracy of the algorithm. Microsoft, Alphabet, Amazon, Tesla… oh, how the peasants (investors) cheer! Yet whispers echo in the castle corridors: “Bubble! Bubble!” But fear not, dear reader, for McKinsey’s $7 trillion scroll may yet turn skeptics into believers.

Data Centers: The New Knight’s Fee

McKinsey’s soothsayers predict global data center capacity will triple by 2030-rising from 82 gigawatts (a mere candle in the dark) to 219 gigawatts (a digital dragon’s roar). And who fuels this beast? AI, of course! 70% of the growth, like a scribe with a quill dipped in ink and ambition.

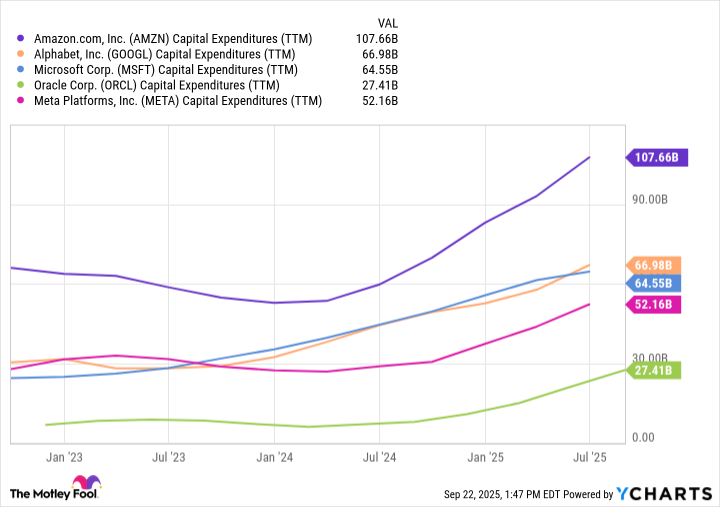

Capital expenditures? A princely $7 trillion over five years. Now, if you’ll pardon the pun, that’s not just a “power move”-it’s the financial equivalent of building a moat around the future.

Valuations: A Comedy of Errors

In the dot-com days, Cisco traded at P/S multiples like a blacksmith quoting gold. Today, Tesla and Palantir wear similar crowns of folly. But here’s the twist: back then, companies sold “clicks and dreams.” Now? AI sells… well, AI. Real revenue. Real robots. Real pharmaceuticals. Not to mention cybersecurity-because nothing says “trust us” like a firewall and a wink.

McKinsey’s charts whisper a truth: as data centers grow, so too will cash flow. It’s the financial equivalent of planting a money tree and hiring a gardener to water it with venture capital.

$7T: The Ballad of a Supercycle

Bubbles, dear friends, are made of hope. This? This is a supercycle-a fiscal opera where semiconductors sing arias and cloud hyperscalers take the lead. The $7 trillion isn’t a red flag; it’s a marching band. Chips, servers, energy systems… the next economy is being built, brick by gigabyte.

For investors, the lesson is clear: volatility is the opening act. The main event? Structural demand for AI, as inevitable as a tax audit. Semiconductor designers, cloud titans, energy innovators-these are the knights of the new kingdom. And you, dear reader, are invited to the coronation.

So, is it a bubble? Only if you’re blowing it with a $7 trillion breath. The future is here, and it’s laughing all the way to the bank. 🚀

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- TON PREDICTION. TON cryptocurrency

- Bitcoin’s Bizarre Ballet: Hyper’s $20M Gamble & Why Your Grandma Will Buy BTC (Spoiler: She Won’t)

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Nikki Glaser Explains Why She Cut ICE, Trump, and Brad Pitt Jokes From the Golden Globes

- Russian Crypto Crime Scene: Garantex’s $34M Comeback & Cloak-and-Dagger Tactics

- 30 Overrated Strategy Games Everyone Seems To Like

- Ephemeral Engines: A Triptych of Tech

2025-09-25 15:12