The opening act of Figma’s (FIG) stock market debut was positively operatic. On July 31, shares pirouetted from $85 to $115 with the elegance of a Fred Astaire solo. By August 1st, they’d struck a high note at $122. Alas, the orchestra has since tuned to a dirge. One might say the market’s enthusiasm evaporated faster than a martini at a dry party.

August delivered a 39.2% pratfall while the S&P 500 swanned about with a 1.9% gain. September, ever the drama queen, slashed another 16.4% from its value. The result? A 59% nosedive from its second-day peak that would make Icarus himself wince. Yet amidst this carnage, a question lingers: Is Figma now a diamond in the rough, or merely a cubic zirconia?

The Two-Act Tragedy of Figma’s Decline

Act I: The IPO. Fresh-faced and dewy-eyed, Figma burst onto the stage weeks ago. One expects volatility from such newcomers – they’re the financial equivalent of debutantes with champagne tastes and overdraft fees. Seasoned investors typically steer clear until the theatrics subside.

Act II: The Earnings Report. On September 3rd, management delivered a performance so lackluster it made the audience check their watches. Revenue surged 41% to $250 million – a figure that would make a debutante blush with envy. But growth decelerated from 46%, and guidance for Q3’s midpoint implies a 33% saunter. By year’s end, they’re projecting a 37% gallop that masks a 30% canter in Q4. Growth stocks, darling, don’t thrive on saunters.

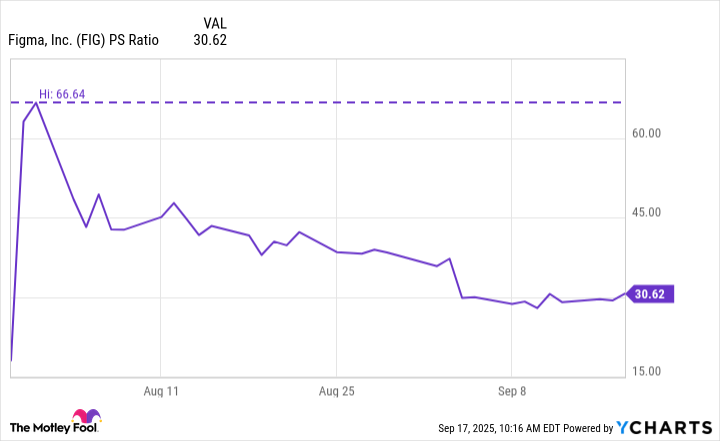

At its zenith, Figma traded at 66x sales – a valuation that would make even a seasoned bookmaker raise an eyebrow. Some might call it confidence; others, hubris masquerading as optimism. The market, ever the realist, has begun adjusting its monocle.

Prognostications & Other Tiresome Necessities

Figma’s customer base reads like a who’s who of the Forbes 2000 – 78% are clients, with two-thirds using three or more products. It’s the sort of adoption rate that would make a Silicon Valley founder weep into their kombucha. Yet herein lies the rub: when you’ve already conquered Everest, where’s left to climb?

Raising prices 20% earlier this year was a masterstroke – until it wasn’t. Charging customers more works until they develop a taste for frugality. Squeezing blood from a stone, darling, requires more than just a firm grip.

The company sits on $1.6 billion in cash – a war chest that could fund acquisitions or R&D. But without a deus ex machina, growth will keep limping. At 30x sales, this stock remains priced for perfection. And given the current trajectory, perfection seems as likely as a sober Mary Poppins sequel 🎩.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-24 03:35