Many years later, when the dust of the AI boom had settled and the algorithms lay dormant beneath the desert sun, the analysts would recall the day they mistook BigBear.ai’s stock for a mirage – that shimmering illusion where parched investors imagine water where only silicon lies. The market, that grand carnival of perpetual optimism, had spun its usual enchantments: Nasdaq’s vertiginous peaks, S&P’s golden plateaus, and the sweet perfume of progress wafting through cubicles where spreadsheets bloomed like desert flowers.

Yet amidst this carnival stood BigBear.ai, a $5 ticket promising entry to a kingdom it could never build. Palantir, the colossus forged from Pentagon’s own thunder, already walked the earth like a god in exile, its contracts stretching longer than the shadows cast by Babel’s ruins.

The Alchemy of Multiples and Myths

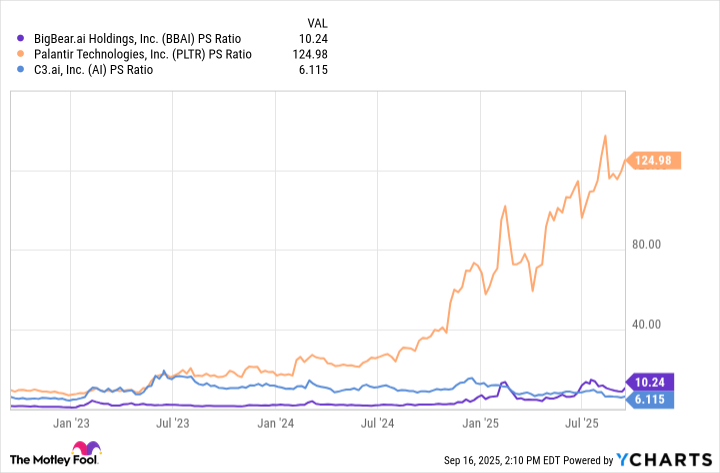

Novices in the temple of finance still cling to the child’s arithmetic of share prices, as if counting coins beneath a banker’s lamp. But valuation is a darker art, requiring one to divine future kingdoms from present entrails. The price-to-sales ratio, that oracle of modern seers, reveals BigBear.ai’s bones gleaming under Wall Street’s fluorescent lights – a multiple of 10.2, modest as a nun’s veil.

But what is a multiple if not the market’s fever dream? Palantir’s valuation had swollen like a monsoon river, carving canyons through defense contracts with the inevitability of tectonic fate. Its engineers, architects of a digital Pantheon, inscribed their runes into the very marrow of NATO’s bones and the Department of Defense’s spinal code.

The Prophecy of Palantir

When Palantir first emerged from Silicon Valley’s primordial ooze, prophets whispered it would become the Oracle of Delphi for the Pentagon. And indeed, their data pyramids now rise from the ashes of forgotten wars, their contracts stretching across decades like the roots of ancient olive trees. The U.S. Army’s digital heart beats in sync with their algorithms; ICE’s labyrinthine corridors echo with their analytics.

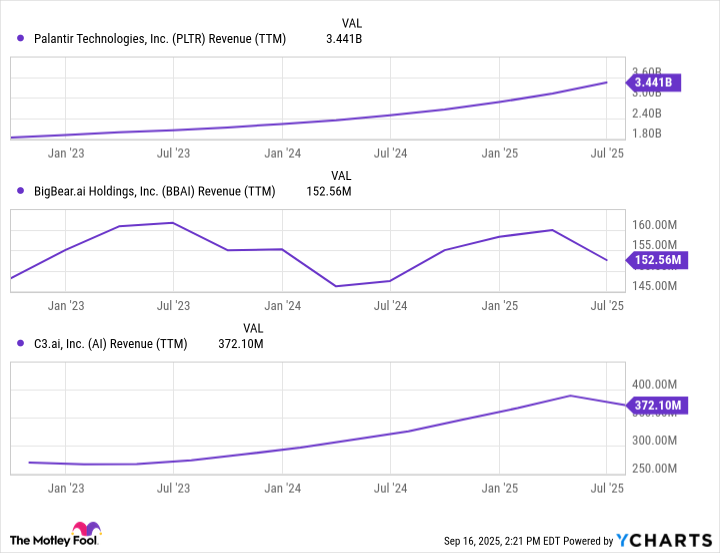

BigBear.ai, meanwhile, scrounges for crumbs in the data desert. Its contracts, fragile as moth-winged prophecies, flutter and fade. Where Palantir builds fortresses from data and steel, BigBear.ai scribbles in the margins of obsolete punch cards. The structural moat around Palantir’s castle, dug with the spoons of 20-year defense budgets, proves impervious to the company’s puny siege engines.

The Melancholy of Discounted Futures

There’s a particular sadness in stocks that wear their low prices like widow’s veils. BigBear.ai’s valuation, compressed tighter than a coal’s memory of sunlight, isn’t a bargain but a requiem. The market, that ancient augur, reads its entrails with clinical detachment: declining growth rates whispering of terminal atrophy, balance sheets heavy with the sediment of forgotten promises.

To call this a “buy” would require suspending disbelief more profound than any magical realism. The company’s contracts, ephemeral as desert rain, cannot nourish a moat when Palantir’s reservoirs run deep with the blood of imperial contracts. Here lies no sleeping giant, only a stone that won’t bloom.

In this dance of digits and delusions, BigBear.ai remains a ghost haunting the periphery of a kingdom it will never inherit. 📉

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-23 04:14