Ah, Bitcoin. The darling of digital currencies, forever winking at us from behind a veil of mystery and fortune. Once relegated to the obscure corners of cyberspace, it has, in no uncertain terms, sauntered onto the main stage. More investors are now treating it like an asset class in its own right, rather than the fleeting fancy of a few eccentric tech aficionados.

Bitcoin, the original cryptocurrency, is, as they say, the gift that keeps on giving. Despite its well-publicized fits of volatility, it still holds the crown as the largest digital currency by market value. Over the last decade, it has delivered a performance that most hedge funds can only dream of-over 50,000%. Enough to make even the most seasoned investor blush with envy. But the real question is, can this modern-day gold rush continue to deliver for those hoping to be set up for life?

While it’s unlikely that Bitcoin will replicate the frenzied, exponential growth of yesteryear (not without a good deal of luck and timing), there remains a tantalizing possibility that it might still offer enough upside to justify its place in a diversified portfolio. In a world increasingly desperate for financial alternatives, Bitcoin just might be the answer. If you’re still with me, let me explain.

Bitcoin: Small But Full of Potential

Bitcoin’s market value is undeniably substantial, yet it still has the aura of a “young upstart” in the grand scheme of global assets. As of September 19, its fully diluted market cap sits around a rather tidy $2.3 trillion. Yet, when compared to other assets such as gold-currently valued at $25 trillion-or the vast oceans of fiat currency circulating in the global economy, Bitcoin’s growth potential seems positively pedestrian by comparison. But don’t be fooled by its size; Bitcoin still has plenty of room to run.

The long-term trajectory of Bitcoin, as always, depends on numerous variables. Most prominently: will the global economy finally embrace digital currencies in a meaningful way? Will Bitcoin retain its position as the leader in this space? It’s far too early to say, but should the stars align, Bitcoin could very well see valuations far beyond its current standing.

The Ever-Eroding Value of Fiat

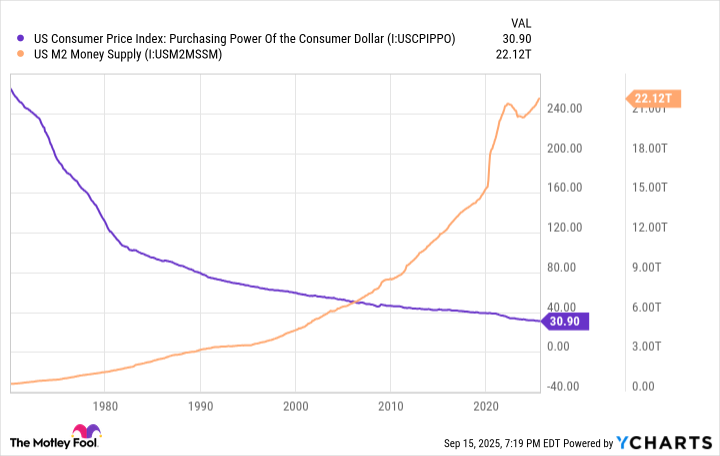

And then, of course, there’s the matter of fiat currencies. Poor, devalued, untrustworthy fiat currencies. Particularly the U.S. dollar, which has been suffering from years of fiscal profligacy. Governments have continued to push the money supply higher, far outpacing the economy’s ability to produce real, tangible goods. Inflation, that oh-so-ubiquitous beast, raises its ugly head. And as prices rise, the purchasing power of the dollar continues to slide.

Enter Bitcoin. Priced in U.S. dollars, Bitcoin stands as a hedge against inflation. With the U.S. government’s ongoing penchant for overspending-despite, or perhaps because of, its newfound tariffs-one could surmise that the dollar will continue its gradual erosion. And in this ever-charming, slightly tragic economic dance, Bitcoin might just rise as the anti-inflationary asset du jour, nudging its price higher in the process.

So, Can Bitcoin Really Set You Up for Life? Yes, But Don’t Rush Into It

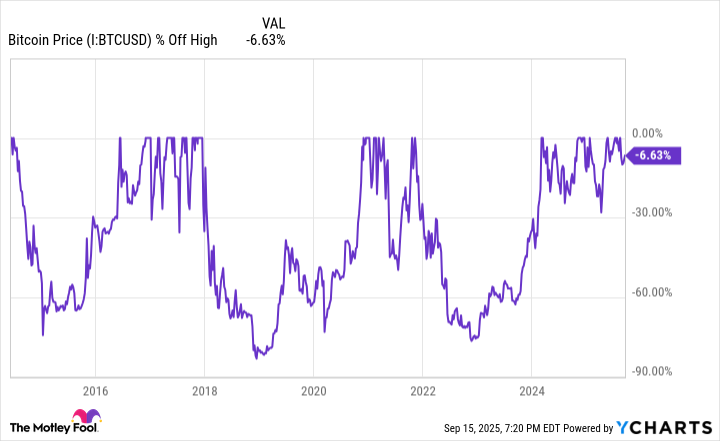

The short answer: Yes, Bitcoin can still set you up for life. That is, assuming inflationary pressures persist and society continues to view Bitcoin as a viable alternative to traditional currencies. But, my dear reader, this is no simple “buy and forget” situation. There are, as always, caveats. It is important to remember that Bitcoin, despite its rather impressive performance thus far, remains a speculative investment.

Real estate is a tangible asset. Stocks are linked to actual companies that sell goods and services, generate profits, and provide value. Bitcoin, on the other hand, is something of a digital enigma. It doesn’t generate profits or produce goods. It exists because people choose to believe it has value. It’s a confidence game. If society were to lose faith in Bitcoin-however unlikely that may seem-its value could theoretically evaporate, and the price could plummet faster than you can say “volatility.”

Indeed, Bitcoin has a somewhat colourful history of price drops and fluctuations. So, if you do decide to invest in this rather exciting (and occasionally terrifying) asset, do so with a full understanding of the risks involved. Past performance, as they say, is no guarantee of future returns. But with a bit of fortune and a long enough horizon, Bitcoin may very well deliver returns that no stock or piece of real estate could hope to match.

In conclusion, Bitcoin might just set you up for life-but only if you’re prepared to weather the inevitable storms. Choose wisely, and remember, the road to riches is often paved with a bit of chaos.

💸

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Exit Strategy: A Biotech Farce

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- QuantumScape: A Speculative Venture

2025-09-22 12:07