In the grand tradition of Discworld’s Guild of Alchemists and Venture Capitalists, where hope and hype often outpace reality, we find ourselves in a curious paradox: a stock that has ballooned 1,000% in a matter of months. Opendoor Technologies (OPEN), once a cautionary tale of digital real estate alchemy, now flutters like a dragon’s coin in the pocket of every self-styled “market savant.” But let us not confuse the gilded balloon for the air that fills it.

The current meme-stock circus-where investors juggle low-price shares like fire-breathing squirrels-has anointed Opendoor as its latest ringmaster. Its digital home-flipping model, a blend of cash offers, debt-fueled ambition, and margins thinner than a Luggage’s patience, has somehow become the toast of the town. Yet, as the wizards of the Unseen University of Coders would whisper: “Just because it’s popular doesn’t mean it’s profitable.” 1

The Alchemy of Unprofitability

Opendoor’s stock wasn’t always a party favor. It languished in the gutter, much like a wizard’s apprentice who forgot to add “a dash of unicorn tears” to the profit elixir. Its business model-a digital platform to buy and flip homes at scale-is the financial equivalent of trying to bake a soufflé with a dragon’s breath as the main ingredient. Last quarter’s 8.2% gross margin? A rounding error in the ledger of legends.

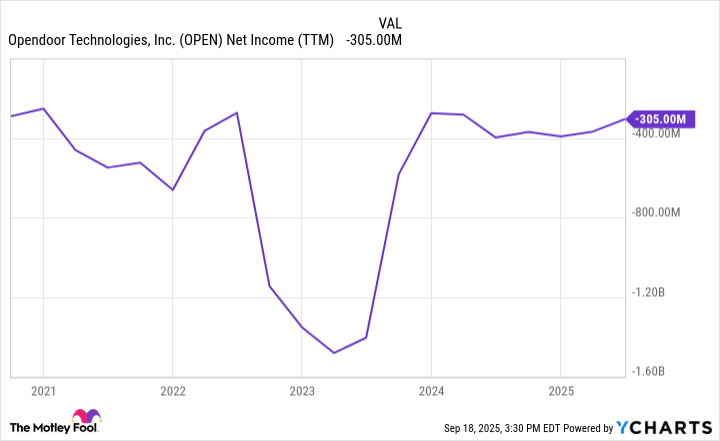

During the 2020-2021 real estate boom, Opendoor’s transactions flowed like a wizards’ feast-until the housing market froze, and the gravy turned to sludge. Revenue and gross profit plummeted 70% from their peaks, leaving the company with $417 million in gross profit and a $305 million net loss over 12 months. Investors, ever the optimists, bet on bankruptcy. Then came the activists, like a pack of badgers in pinstripes, and began shaking the tree.

The Wizard’s New Robes and the Great Shake-Up

This summer, professional investors bought in, and the meme-stock mob followed, turning Opendoor into a digital campfire story. The company, now inspired by its newfound “enthusiastic shareholders,” summoned Kaz Nejatian, a Shopify alumnus, to don the CEO’s hat. Imagine, if you will, a wizard from the University of E-Commerce arriving to fix the Guild of Home Flippers-a tale as old as time, or at least as old as the last failed SPAC.

Nejatian’s arrival coincided with the return of two founders to the board and whispers of “massive layoffs.” Let us hope these cuts are less like chopping off limbs and more like pruning a bonsai tree. The new CEO has also hinted at AI-driven “innovations,” though details are as clear as a wizard’s prophecy. Investors, dear reader, must now watch Opendoor’s next moves like a dragon guards its hoard.

The Great Balloon Debate

At $10 a share, Opendoor’s market cap is a bloated $7.5 billion. That’s a 20x rebound from June’s lows-a feat that would make even the most jaded investor raise an eyebrow. But let us not mistake velocity for value. Valuing Opendoor is like trying to weigh a dream: it requires either a leap of faith or a subscription to the Journal of Speculative Alchemy.

On one hand, the company has never generated a profit. It has burned cash like a dragon in a bakery. On the other, its new CEO and AI-driven ambitions might yet weave a profit spell. But here’s the rub: a $7.5 billion valuation implies 20x trailing gross profit. For this to work, Opendoor must conjure significant growth-a feat that requires more than a new hat and a PowerPoint. 2

Opendoor’s stock, at $10, smells of overvaluation. It’s the financial equivalent of buying a bridge in a village where the foundation is made of whispers and hope. As the Discworld’s most famous proverb goes: “There’s nothing wrong with a little greed. The problem comes when you get so greedy that you miss the trapdoor.” 3

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-09-22 10:20