By now, Nvidia has ascended to the throne of global capitalism, its GPUs the gilded scepter of the AI age. The company’s market cap, a gaudy bauble of $1.5 trillion, glitters like a mirage in the desert of speculative investing. Yet, as the old proverb whispers-though not in Nabokov’s lexicon-“The butterfly of disruption flutters even in the shadow of empires.”

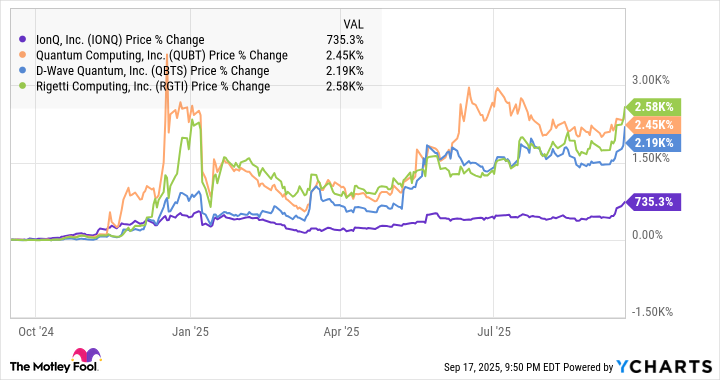

Enter quantum computing, that sly alchemist of bits and qubits, which promises to recast the very architecture of computation. Where Nvidia’s silicon monarchs rule with brute-force arithmetic, quantum pioneers like IonQ (IONQ) dabble in the esoteric, their qubits waltzing through superposition like lovers in a dream. The market, ever a fickle muse, has anointed these quantum quixotics with a 200% surge this year, a crescendo ignited by Alphabet’s Willow chip-a breakthrough as dramatic as a chess master’s sudden, sacrificial queen.

IonQ, the largest of the quantum quartet, now trades at a market cap of $19.4 billion, a figure that dances perilously close to parody given its $20.7 million quarterly revenue. Yet here lies the paradox: a company whose financials resemble a haiku of underperformance, yet whose ambitions are etched in the stars. In Q2, the firm’s collaboration with AstraZeneca and AWS produced a 20-fold acceleration in drug discovery-a feat that smells of both serendipity and calculated genius, as if the universe itself conspired to validate the quantum gospel.

Geographically, IonQ has been stitching its name into the fabric of global innovation, from the cherry blossoms of Japan to the fjords of Sweden. Its acquisitions-Lightsynq, Capella, Oxford Ionics-read like a Borgesian catalog of quantum subsidiaries, each a fragment of a larger, half-imagined puzzle. And then, with a flourish, it signed a memorandum with the U.S. Department of Energy to explore quantum technologies in space, a venture as whimsical as it is audacious, as if the company were already drafting the obituary of classical computation.

Now, the question that lingers like a ghost in the machine: Can IonQ outpace Nvidia over the next decade? The answer, of course, is a sly game of chess. Nvidia, at its zenith, is a fortress of scale, its P/E ratio of 40 a mere shadow of its former self. To achieve a 10x return would require it to breach the $40 trillion market cap threshold-a feat akin to a snail racing a cheetah, its trajectory as plausible as a snowstorm in the Sahara. IonQ, meanwhile, is a gambler with a loaded die, its potential as boundless as the quantum vacuum, its risks as sharp as a blade of light.

For the seasoned investor, the choice is not binary but a matter of portfolio choreography. To own both is to dance between the known and the unknowable, to hedge against the entropy of time. After all, as Nabokov might quip, “The future is a palimpsest; we scribble on its pages with ink made of hope and despair.” And in that ink, perhaps, lies the answer. 🏰

Read More

- 21 Movies Filmed in Real Abandoned Locations

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 39th Developer Notes: 2.5th Anniversary Update

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Leaked Set Footage Offers First Look at “Legend of Zelda” Live-Action Film

- Top Actors Of Color Who Were Snubbed At The Oscars

- TON PREDICTION. TON cryptocurrency

2025-09-22 04:07