One might be forgiven for thinking the financial world had collectively misplaced its spectacles, what with all the breathless chatter about artificial intelligence and its supposed alchemy of turning silicon into gold. Nvidia’s chaps are busy crafting microchips of such complexity they might double as modern art, while power companies hum a merry tune as the grid wheezes under the weight of AI’s insatiable thirst for electrons. And yet, while the crowd gawks at this technological sideshow, a certain purveyor of stuffed ursines has been quietly stitching together a tapestry of profit so vibrant it would make a Renaissance tapestry artist weep with envy.

Consider, if you will, the case of Build-A-Bear Workshop-a concern that, five years ago, seemed about as likely to conquer Wall Street as a goose is to win the Kentucky Derby. Yet here we are: a 2,150% return on investment, which for those keeping score at home, is the sort of figure that makes even the most stoic of accountants raise an eyebrow and mutter, “Well, I never!” To put this in perspective, a $10,000 wager on this sprightly upstart would now buy you a small island in the Caribbean, whereas the same sum invested in Nvidia would leave you with merely a yacht and a modest villa.

A Comeback More Unlikely Than a Sober Baboon at a Banana Festival

Now, to be perfectly fair, the timing of this meteoric rise does bear the faint whiff of cherry-picking. The pandemic’s early days had left Build-A-Bear’s stock floundering like a fish out of water, so measuring its resurgence from that nadir feels ever so slightly like comparing a toddler’s first steps to an Olympic sprinter’s stride. And yet-one must tip one’s hat where due-the company’s subsequent pirouette from near-oblivion to profitability is the sort of redemption arc that would make Dickens blush with inadequacy.

Revenue, which stood at $339 million in the halcyon days of early 2020, has ballooned to $496 million by early 2025-a 47% swell that translates to a tidy 8% compound annual growth rate. One might call it a quiet triumph of commerce over chaos, though it’s difficult to imagine anything particularly quiet about a global chain of 600 stores where customers stuff their own plush companions with the fervor of Michelangelo sculpting David.

The secret to this resurgence? A dash of nostalgia, a sprinkle of savvy licensing deals with modern television’s glitterati, and an e-commerce strategy so deft it would make a Silicon Valley entrepreneur blush with envy. Parents who once selected plush companions in their youth now drag their offspring to Build-A-Bear stores with the reverence of pilgrims visiting a shrine, while the company’s embrace of collectible trends has transformed it into the Wall Street Journal’s crossword puzzle-consistently vexing, yet oddly addictive.

The Nifty Gritty: Profits, Dividends, and a Lack of Debt

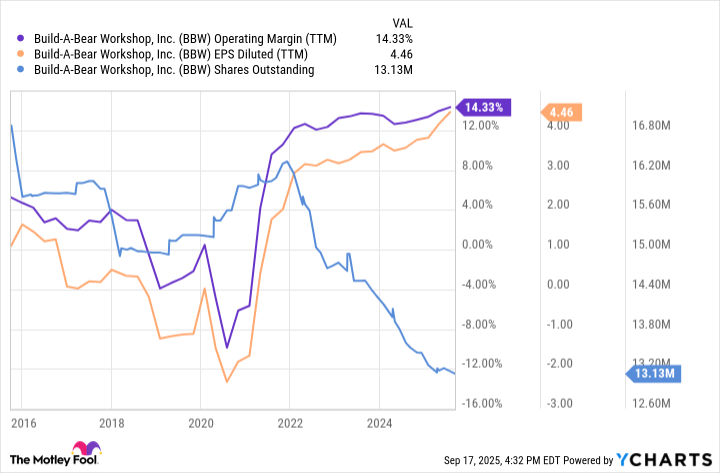

But let us not dwell solely on the romance of plush toys. The numbers, my dear reader, are the real star of this show. An operating margin of 14%-an all-time high-suggests the company’s bean counters have been busy with their abacuses, while earnings per share have scaled similar heights thanks to a shrinking share count that would make a magician blush. With no debt to speak of and capital expenditures as modest as a librarian’s whisper, management has treated shareholders to a veritable feast of buybacks and dividends, including the occasional special payout that arrives like an unexpected Christmas bonus.

At a price-to-earnings ratio of 16, the stock trades at what one might charitably call a “discount” to the market’s lofty standards. True, it once flirted with even cheaper valuations, but in an era where investors pay fortunes for the faintest whiff of disruption, a company that simply sells customizable stuffed animals feels like discovering a pound note in an old pair of trousers.

Can the Bear Keep Dancing?

Two factors suggest the jig may continue. First, despite an economy that resembles a wobbly pogo stick, store traffic rose 3% in Q2 2025, while e-commerce sales galloped ahead by 15%-a testament to the enduring allure of plush collectibles. Second, international expansion proceeds apace, with franchised locations sprouting like daisies in spring. These ventures, requiring minimal capital and yielding maximum profit, ensure that every new store is less a drain on resources and more a golden goose in disguise.

Will Build-A-Bear replicate its 2,150% feat in the coming half-decade? One suspects not-such growth rates are as rare as a polite taxi driver. But with margins robust, debt nonexistent, and a business model as simple as it is resilient, the bear’s handlers seem well-positioned to keep the party going. Shareholders might do worse than to lean back, sip their gin-and-tonics, and let the dividends roll in. 🧸

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-21 22:05