Energy Transfer (ET) boasts an enticing yield of 7.5%. The numbers, as always, are alluring: The S&P 500 index (^GSPC) stands at a meager 1.2%, while the average energy company offers a modest 3.2%. At first glance, it seems a wise decision to place one’s faith in this towering dividend. Yet, in the murky depths of investment choices, one must ask: is it truly a choice driven by wisdom, or the transient whims of greed and self-interest?

The Temptation of Yield: A Mirage in the Desert

And so, we are drawn to the gleaming 7.5% yield of Energy Transfer, like moths to a flame. This yield is supported by the company’s status as a master limited partnership (MLP), and the lucrative tolling model of its vast energy infrastructure. The midstream sector, the domain in which Energy Transfer operates, has long been regarded as a steady and reliable haven amidst the volatility of the broader energy sector. Yet, herein lies a troubling question: Does mere yield-like a distant mirage on a desert horizon-suffice to guide the wise investor?

Energy Transfer is not alone in this pursuit. Its peers, such as Enterprise Products Partners (EPD) and Canada’s Enbridge (ENB), also boast their own vast networks of revenue-generating pipelines, storage, and transportation assets. Enterprise’s yield, standing at 6.8%, and Enbridge’s more conservative 5.6%, call to mind a troubling thought: Could the pursuit of the highest yield be, in fact, a folly? A race where the winner may not be the one who endures, but the one who burns brightest and fades fastest?

The Critical Comparison: Energy Transfer vs. Enterprise

In the land of midstream MLPs, Energy Transfer and Enterprise Products Partners are, perhaps, the closest competitors. Both are bound by the same nation, and both are subject to the same imperatives of the market. Yet, as in all matters of business and society, it is not the mere surface that defines the true character of the player, but the depths of their resolve. It is here, in the matter of trust, that the critical distinction lies.

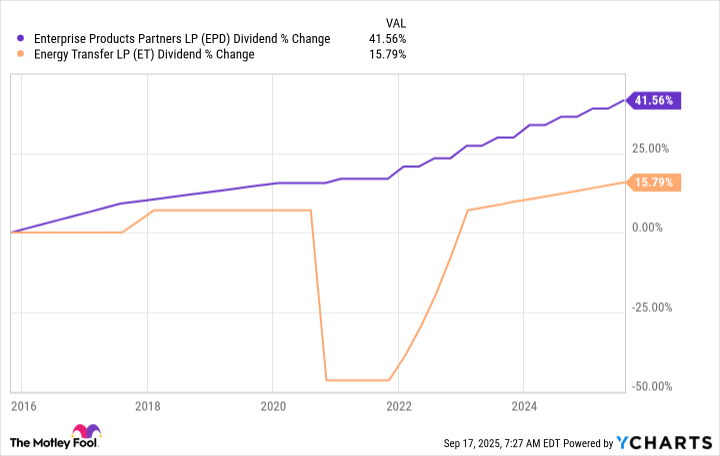

Energy Transfer, during the grim period of 2020, chose to reduce its distribution-a decision made in the midst of the global pandemic, a time when the world seemed to falter. Yet, for the long-term investor, this cut remains a bitter pill-one that even the company’s recovery has failed to sweeten entirely. In contrast, Enterprise, that paragon of consistency, has raised its distribution for twenty-seven uninterrupted years. The steadfast reliability of Enterprise provides something much more valuable than a momentary yield-it offers the comfort of certainty, a foundation upon which an investor can rest their weary head at night. And in that certainty, there is the greatest wealth.

Should one, then, choose Energy Transfer, knowing that its history is fraught with such tempestuous decisions? Or should one entrust their resources to the patient and reliable hands of Enterprise, who has proven, time and again, that the passage of time does not erode trust, but builds it? The answer lies not in the immediate yield, but in the wisdom of the long-term perspective.

The Winds of Change: Energy’s Uncertain Future

We must, however, consider a more profound and existential question. What of the future? The great shift in energy sources from the polluting dregs of oil and coal to the more sustainable, if still imperfect, alternatives is upon us. Energy Transfer, in its own way, seeks to keep pace with this transition, focusing on oil and natural gas-sources cleaner, though not without their own environmental burdens.

Yet, there are those who have already embraced the future with greater urgency. Enbridge, though offering a lower yield at 5.6%, stands as a symbol of foresight. This company has not only ensured the growth of its dividend for three decades, but it has also moved boldly into cleaner energy sectors-investing in renewable power, including offshore wind farms. Its acquisition of regulated natural gas utilities signals a deeper commitment to the energy of tomorrow, rather than clinging to the energy of yesterday.

Thus, one might ask: is Energy Transfer a wise investment? Perhaps-but only in the same way that investing in a dying empire might seem prudent in the short term. The future belongs to those who evolve with it, not those who resist the march of time. And so, while Energy Transfer may satisfy the immediate hunger for income, it is Enbridge who gazes, with clearer eyes, into the uncertain horizon of the future.

The Truth of the Matter

To purchase Energy Transfer, in the end, is not to make some grievous error. One may find solace in the present yield, secure for a time in the fleeting glow of profits. But should an investor truly wish to secure their future, to place their trust in the hands of a company that has withstood the storms of uncertainty, then it is perhaps Enterprise that will provide peace. And for those who seek the promise of cleaner energy, Enbridge, with its quieter, yet steadfast progress, offers the clearest path.

And so, as we stand at the crossroads of investment decisions, let us not be beguiled by fleeting yields, but be guided by the steady hand of prudence and foresight. 🌱

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-21 21:54