In the shadow of towering banks and the clatter of cash registers, there exists a quiet revolution. The kind that does not announce itself with parades or fanfare, but creeps forward like ivy on a factory wall-relentless, unseen, until one day it cracks the stone. For those worn down by the grinding wheels of traditional credit, a machine stirs in the dark: Upstart Holdings (UPST).

Let us speak plainly. The old gods of credit-Equifax, TransUnion, Experian-are relics of a pre-digital age. They were forged when men still wrote ledgers by hand, when a delayed paycheck meant ruin, and a missed payment became a scar etched into one’s soul. These institutions, born of ink and paper, still weigh borrowers down with the same crude calculus: payment history, debt levels, the age of one’s credit scars. But what of the gig worker with no fixed hours? The immigrant stitching a new life with borrowed dollars? The modern soul adrift in an outdated system?

The Algorithm That Sees

Upstart’s algorithm devours 1,600 data points. It does not judge by the sins of the past, but by the patterns of the present. It sees the single mother working double shifts, the truck driver with a spotless record but no FICO score, the small business owner clinging to a dream. This machine, cold in logic yet humane in outcome, approves 43% more loans than its predecessors. One-third of these loans carry lower rates-a rare mercy in a world built on interest.

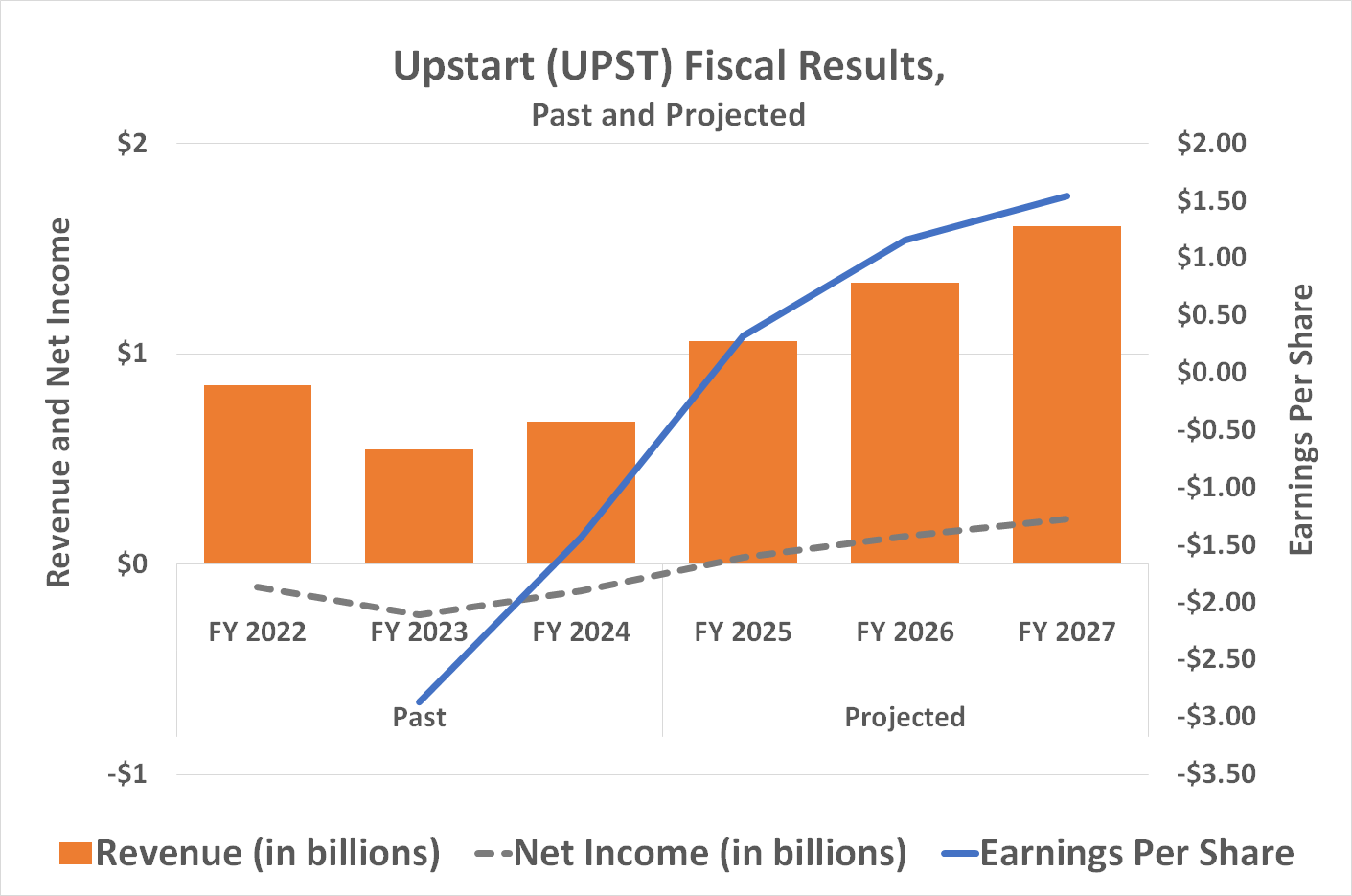

Yet even here, the gears do not turn freely. Lenders, creatures of habit and fear, dragged their feet for years. By 2021, only $4.1 billion in loans flowed through Upstart’s veins. But last year, that figure swelled to $6 billion-a whisper of things to come. The company now forecasts $1 billion in 2024 revenue, with profits of $216 million by 2027. Progress, yes, but progress measured in blood.

Three Truths in the Mud

- The Machine Works. It does not promise utopia, only better odds. For lenders, it means fewer defaults. For borrowers, a sliver of dignity. For investors? A glimpse of margins yet to bloom.

- Adoption Crawls Forward. Over 100 lenders now use Upstart-a victory, but a pyrrhic one. The industry resists change like a drunkard resists sobriety. Yet inertia is a moat. The old guard cannot pivot; their systems are too brittle, their habits too deep.

- The Price Bends. Shares linger where they did in November, discounted by fear of inflation’s shadow. Analysts shrug, tossing a $78.79 target into the ring-a 15% wager against despair. The market, ever myopic, prices in ruin. But ruin is not the same as certainty.

Beware the Fragility

Upstart is no fortress. Its profits are paper-thin, its margins a tightrope walk. A single misstep-a credit crunch, a regulatory crackdown-could send it reeling. And the moat? It is not stone, but the sheer exhaustion of the herd. Lenders will not flee to new platforms unless forced. For now, that is enough.

Five years hence, the dust may settle. The machine will endure if it must, not because it is perfect, but because it works. The common borrower will not care who owns the code, only that the loan is approved. Growth investors, those hardened gamblers, will find their reward in the gap between struggle and progress 🚀.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-21 17:28