Many years later, as the world would come to understand the weight of the Fed’s decision, the first whispers of the rate cut would be heard in the hush of a quiet afternoon in the heart of Manhattan, where the air was thick with the scent of ambition and the distant hum of stock tickers. In 2022, inflation had clawed its way to the highest peaks in decades, and the Federal Reserve, like a weary farmer tending to a parched field, raised interest rates until they reached 5.5%, a drought that scorched the economy’s soil. Then, on Sept. 17, the Fed’s hand, steady yet uncertain, lowered the rate by 0.25 percentage points to 4% to 4.25%, a gesture as fleeting as a shadow at noon.

The cut, though expected, carried the quiet gravity of a prophecy half-fulfilled. The “dot plot,” that enigmatic chart of policymakers’ hopes, hinted at further reductions, as if the Fed were tracing constellations in the dark. Interest rates, like the tides, ebbed and flowed, shaping the shores of commerce. Higher rates, cold and unyielding, made borrowing a burden, while lower rates, soft and inviting, whispered promises of growth. These shifts, though imperceptible to the untrained ear, echoed through the veins of corporations, their fates intertwined with the rhythm of capital.

Among the many who would feel this pulse, three stocks stood out, not as mere numbers on a screen but as ancient trees rooted in the soil of dividends. Their branches, laden with returns, would sway in the breeze of policy, their leaves rustling with the promise of stability.

1. Realty Income

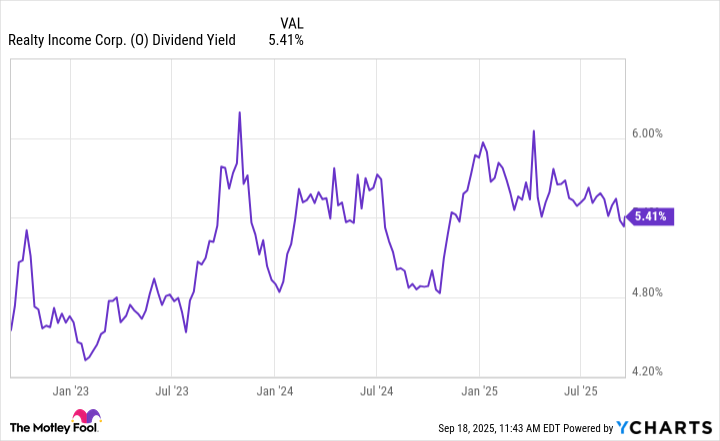

Realty Income, that venerable REIT, with its properties stretching across nine nations, had always been a beacon of dividend stability, its returns as predictable as the tides. It pooled the dreams of investors, buying single-tenant properties and leasing them to tenants who bore the weight of maintenance and taxes, while the trust’s shareholders reveled in the fruits of its labor. Its $61 billion empire, a mosaic of rooftops and concrete, now faced a new chapter. The recent rate cuts, like a gentle rain, would lower its cost of capital, making acquisitions and refinancing as easy as breathing. This would widen the gap between the income from tenants and the cost of financing, a harmony that would delight investors, for in the world of dividends, such balance was a rare and sacred thing.

Realty Income’s dividend, already a lighthouse in the fog of market uncertainty, would gleam brighter still. Lower rates, like a mirror, would make its yield more alluring than bonds, drawing in seekers of steady income, their pockets heavy with the hope of prosperity.

2. Bank of America

Bank of America, that colossus of finance, with its tentacles stretching across 36 countries, had long thrived on the alchemy of interest. Its net interest income, the lifeblood of its operations, was a delicate dance of loans and deposits, each transaction a note in a symphony of profit. Yet the rate cut, like a sudden storm, threatened to unbalance this harmony. The bank would collect less from loans, while still paying interest on deposits, a paradox that could shrink its NII, the very engine of its growth. Still, in its second quarter, the NII had surged to $14.7 billion, a testament to its resilience. The question lingered: would the storm pass, or would it carve new paths in the landscape of finance?

The answer, like the tide, remained uncertain, but one truth endured: in the world of banking, even the smallest shifts could ripple through the depths of capital.

3. Visa

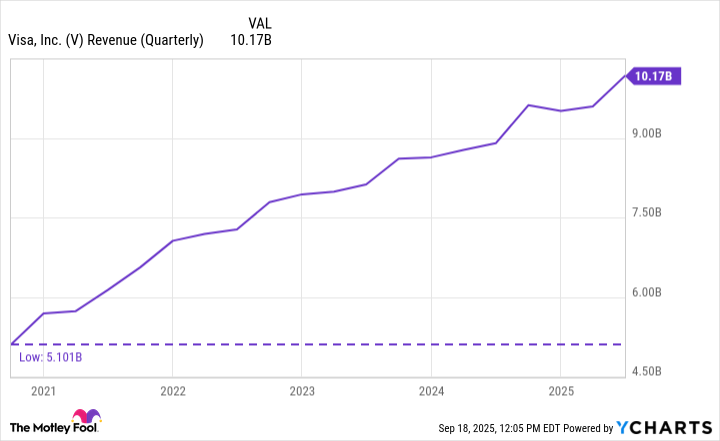

Visa, that silent giant of commerce, with its network stretching across 150 merchants, had always been a marvel of simplicity. It took a percentage of every transaction, a fee so small it was almost imperceptible, yet collectively, it formed a river of revenue that swelled with each passing year. Its business model, unadorned and efficient, was a testament to the power of scale. The rate cut, though indirect, would act as a catalyst. Cheaper borrowing would ignite consumer and business spending, and with it, an increase in transactions. More transactions meant more money, a cycle as inevitable as the rising sun.

In its third quarter, Visa’s payment volume had surged 8%, a testament to its enduring strength. The rate cut, like a seed planted in fertile soil, could yet yield even greater harvests, though the timing remained as elusive as the wind.

And so, the Fed’s decision, a whisper in the grand design of markets, left its mark on these three stocks, each a thread in the tapestry of dividends. Whether their fortunes would rise or fall, only time, that relentless weaver, would reveal.

💰

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-09-21 16:42