Lo! The realm of consumer staples, where even the humblest grocer may yet rise to grandeur. Consider Walmart (WMT), that paragon of frugality, whose shares multiplied a hundredfold betwixt 1972 and 2012. Yet who, in their youth, would have deemed a rural Arkansas general store destined to conquer the globe? A jest, perhaps, but one with dividends. 🎭

Now, a new player enters the stage: a convenience store company, cloaked in modesty, yet brimming with the ambition of a Molièrian farce. Let us dissect its tale with the precision of a shareholder and the wit of a playwright.

Act I: The Humble Beginnings of Casey’s General Stores

In 1959, amidst the cornfields of Ankeny, Iowa, Casey’s General Stores (CASY) took its first bow. A public offering in 1983 did little to rouse the world, for its stores clung to small towns, where fewer than 20,000 souls dwelled. Yet, like a miser counting coins, Casey’s multiplied its stores to 2,895 by July’s end-each a modest stage for its grand design.

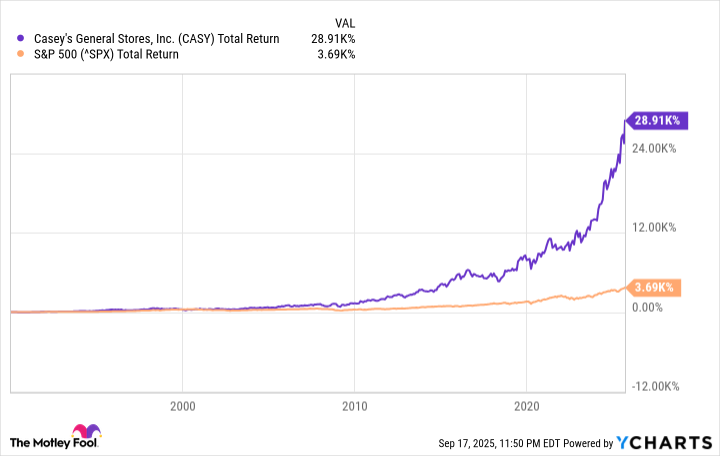

Though the numbers may seem meager, the returns have been nothing short of a farce of fortune. Since 1990, Casey’s shares have swollen 289-fold, outpacing the S&P 500 by a factor of eight. A dividend hunter, ever the pragmatist, might ask: What alchemy transforms gas pumps and gum into such golden gains?

Act II: The Ingenious Scheme of Fresh Food

Casey’s did not invent the gas station or the quick meal. No, its genius lay in knitting these elements into a tapestry of convenience-and profit. The pièce de résistance? Fresh pizza, served with the flair of a bourgeois gentleman’s feast. By 1984, Casey’s had crowned itself the fifth-largest pizza purveyor in the land, a title most would have dismissed as folly.

Yet here lies the rub: While gasoline fumes may cloud the mind, the inside sales-groceries, snacks, and that sacred pie-bring clarity. These high-margin offerings offset the lowly gas profits, creating a balance as elegant as a well-timed jest. In the last quarter, 27% of revenues and 63% of gross profits stemmed from these “inside” sales. A miser might weep at such efficiency.

Casey’s further streamlined its operations, owning distribution centers and fuel tankers as if they were heirlooms. The savings? Invested in technology and rewards, luring customers like moths to a flame. Thus, the margins-6.7%-and return on equity-17.1%-gleam brighter than the neon signs of its rivals.

Act III: The Dividend Dilemma

Some, like the Imaginary Invalid of the stock market, cry, “Too late! The best days are gone!” Yet even a dividend hunter knows patience is the currency of compound interest. In 1994, Peter Lynch mused that buying Walmart a decade post-IPO still yielded 35 times the initial stake. Casey’s, though not a 290-bagger, offers a similar promise: a 36-times-earnings price may seem steep, but for a company with a $20 billion market cap and a fragmented industry to conquer, it is but a modest wager.

Within 500 miles of Casey’s distribution hubs, 75% of towns with 500-20,000 souls lack a Casey’s. Acquisition, like a well-timed punchline, allows the company to expand without reinventing the wheel. For the dividend hunter, this is a farce of opportunity: a company that knows its trade, with a dividend yield as reliable as the rising sun.

Curtain Call: Time, the Friend of the Wise

Warren Buffett’s adage-“Time is the friend of the wonderful company”-resounds in Casey’s tale. Though its stock is not a pittance, its moats-fresh food, vertical integration, and a fragmented market-suggest a long innings. For those who scorn the glitter of tech darlings, Casey’s offers a steadier, if less glamorous, path. And in the end, what is a dividend but the sweetest of comedies? 🎭

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Silver Rate Forecast

- Why Nio Stock Skyrocketed Today

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-21 15:45