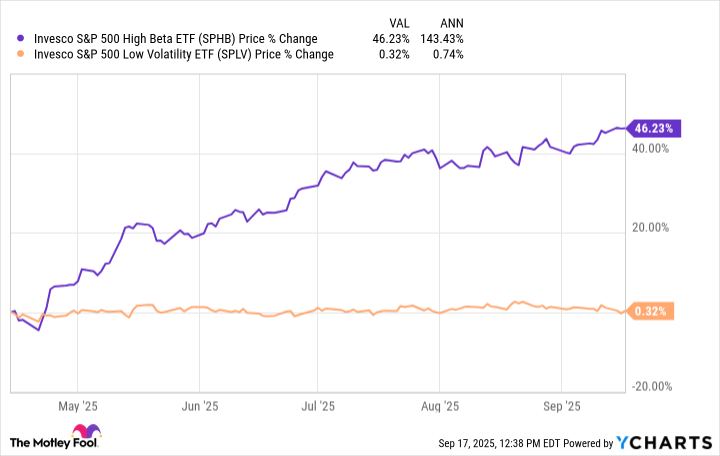

Markets have a peculiar habit of rewarding the obnoxious. Growth stocks, those overpriced attention-seekers, have bounced 46% in five months while Clorox-maker of Brita filters and Glad bags-has languished. It’s like a party where everyone’s dancing to a song they can’t hear, and the host is quietly mopping up spilled wine. Delightful.

Clorox isn’t broken; it’s just misunderstood. A cyberattack in 2023? A new ERP system causing inventory chaos? Consumer confidence? These are not crises-they’re the financial equivalent of a waiter forgetting the menu. The real crime is that investors keep asking, “Why isn’t this stock doing more?” as if Clorox has a *duty* to entertain them.

CEO Linda Rendle’s Q4 call was a masterclass in corporate damage control: “Our brands are healthy, we lost share but gained it back, and our consumer value metric is high.” Translation: “We’re not the ones who bought a $300 blender for ‘self-care.'” Clorox’s brands-Kingsford, Burt’s Bees, Liquid-Plumr-are the Swiss Army knives of consumer staples. You don’t need them to be trendy. You need them to work when your drain clogs at 2 a.m.

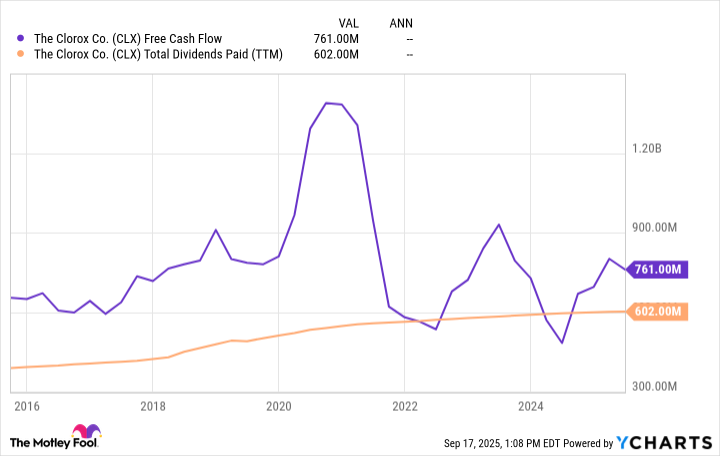

Here’s the rub: Clorox trades at 20x forward earnings, 21x free cash flow. The S&P 500? 30x. Investors are paying a premium for tech stocks that haven’t invented anything since the iPhone. Meanwhile, Clorox is quietly generating 25% ROIC and returning 11% FCF margins. They’ve even managed to hit pre-pandemic levels after a cyberattack and ERP fiasco. If that’s not a moat, it’s at least a sturdy fence.

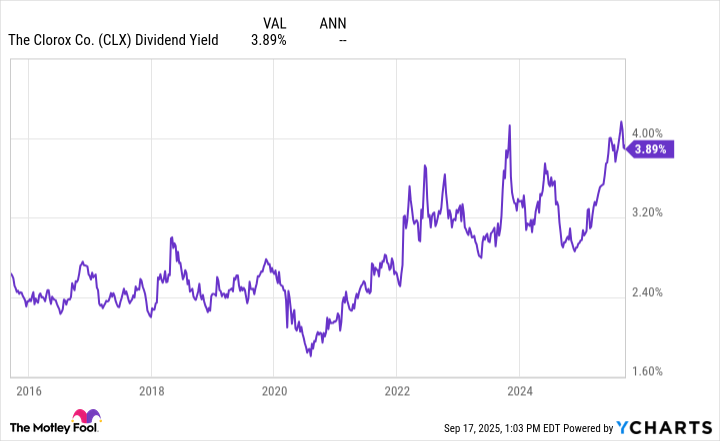

The 3.9% dividend yield isn’t a gimmick-it’s a middle finger to the idea that passive income requires risk. Clorox’s buybacks have shrunk shares outstanding by 1.3% in a year, which is about as aggressive as a librarian adjusting a book’s spine. But at current valuations, it’s a slow drip of compounding. Just don’t expect fireworks. This isn’t a stock for those who think “meh” is a performance review.

Contrarians thrive on discomfort. Clorox’s problems are obvious, but so what? The market’s obsession with short-term drama is the real anomaly. When everyone’s distracted by crypto memes and AI hype, a company selling essential goods at a discount becomes a relic. Not because it’s flawed-but because the world forgot how to appreciate reliability. 🧹

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Why Nio Stock Skyrocketed Today

- Silver Rate Forecast

2025-09-21 11:54