There exists a creature on Wall Street, my friends, a lumbering beast whose antlers once scraped the heavens but now wallows in the mire of 32% depreciation. I speak, of course, of UnitedHealth Group (UNH) – a stock so paradoxical it might have been birthed by the fevered imagination of some financial Dostoevsky. In August of 2025, this colossus performed a feat worthy of circus spectacle: rising 24% while the S&P 500 spun like a drunken carousel operator. Yet still it crawls, serpent-like, beneath its former self, trailing the market like a melancholic snail trailing its slime.

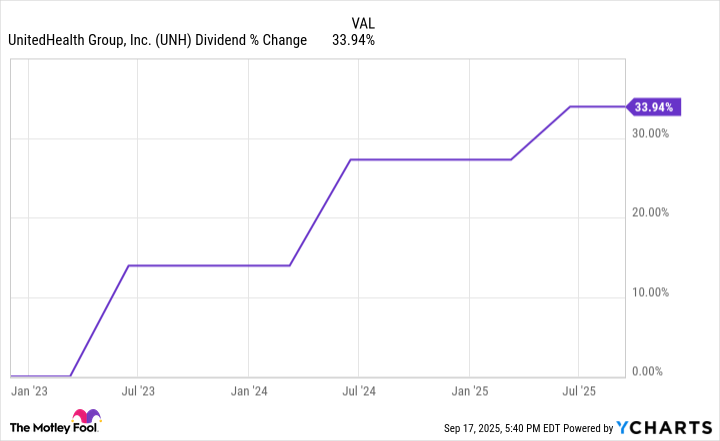

But ah! This wounded beast bleeds dividends – golden, 2.5% yielding ichor that grows richer each year. Thirty-four percent increase over three years? Why, that’s practically a love letter to income-seekers penned in cursive ink! Here we have a stock that combines the allure of a damsel in distress with the dependability of a Swiss clock, albeit one recently dented by market hammers.

The Great Unraveling: A Tale of Three Calamities

Let us now descend into the grotesque opera of 2025. Act I: UnitedHealth, that noble physician of premiums, welcomed new Medicare Advantage patients – a horde of hypochondriacs who visited physicians with the fervor of pilgrims at Lourdes. Costs ballooned like a glutton’s waistline, profits shrank accordingly, and the company missed earnings for the first time since the 2008 apocalypse. The market responded with biblical wrath.

Act II: CEO Andrew Witty, that grand maestro of managed care, exited stage left with all the drama of Raskolnikov fleeing the scene of his crime. Chairman Stephen Hemley returned from retirement like Banquo’s ghost, only to witness shares plummet further. One might mistake this for Shakespearean tragedy, were it not so absurdly modern.

Act III: The Department of Justice, that eternal seeker of sinners, launched a criminal probe into Medicare billing practices. Picture bureaucrats with magnifying glasses, hunting for decimal point heresies in a ledger the size of the Domesday Book. And lest we forget the antitrust review of Amedisys acquisition – a subplot so Byzantine it would make a Venetian conspirator blush.

August: The Month of Whispers and Wagering

But lo! The winds shifted in August, carrying the scent of redemption. On August 6th, Hensley took the stage at the earnings call like a surgeon announcing a risky but necessary operation: premium hikes, network narrowing, and AI deployment to battle costs. The market, ever the credulous patient, nodded sagely.

Then came the Berkshire Hathaway gambit – Warren Buffett’s conglomerate purchasing 5 million shares with the quiet confidence of a cardsharp acquiring the final ace. Was this Buffett’s Midas touch or merely the arithmetic of a man who understands that even turkeys can fly when the wind blows right? The stock, naturally, ascended 24% – a resurrection performed with carnival barker flair.

The Dividend Siren: A Trader’s Lament

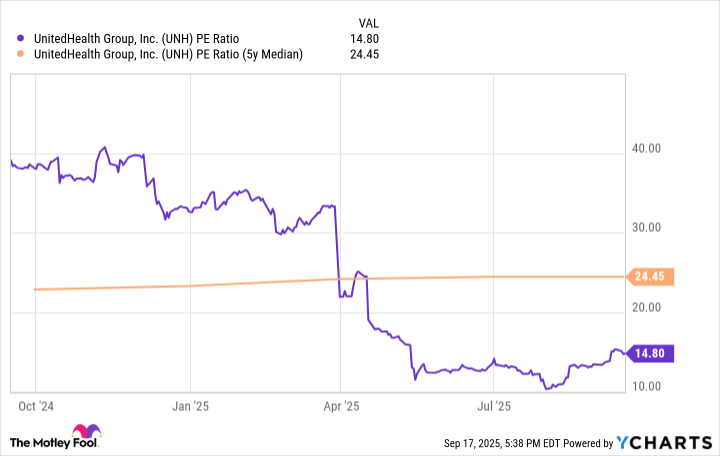

Yet beneath these machinations pulses the true heart of this beast: its dividend. Reaffirmed at $2.21 per share despite the carnage, growing like ivy on a tombstone. Twenty-two cents annual increase last year alone! A yield of 2.5% that sings sweeter with each market tremor. The P/E ratio? Cowering below its five-year median like a whipped cur.

Consider this: 78% of Medicare Advantage plans will sport four-star ratings in 2026. The former CEO’s ghost must be clapping its spectral hands in approval. Buffett, that oracle of Omaha, sees value in wounded stocks – and UnitedHealth now wears its scars like medals in a military parade.

Epilogue: The Dance of Numbers

Berkshire Hathaway’s acumen is no divine right, but their record shines brighter than a newly minted kopeck. UnitedHealth’s plan to conquer costs and expand profits is as precise as a watchmaker’s blueprint – though whether it will survive the market’s capricious temperament remains a question for the ages.

As a trader, I see opportunity dressed in the rags of misfortune. As a disciple of Gogol, I see a grotesque ballet of numbers and human folly. Buy this dip, dear speculator, before the market remembers its own madness. 🕯️

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-21 11:47