The government’s AI push is a neon sign in a storm, blinking promises of progress while the rain of reality soaks through the cracks. BigBear.ai (BBAI) sits in the crosshairs of that storm, a lean figure with a six-shooter named ambition. But let’s cut through the fog: this ain’t a sure thing.

Palantir’s been dancing on a tightrope, but they’ve got the rhythm down. Their AIP platform? A Swiss Army knife for agencies and corporations alike. Second-quarter government revenue hit $426 million, up 53% from the year before. BigBear? They’re still tying their laces, hoping to sprint after the same gold. Some stock-watchers see potential, but potential’s a ghost that haunts every boardroom.

With a $2 billion market cap, BigBear’s a flyweight next to Palantir’s heavyweight. If they could mimic half of Palantir’s success, they’d be sitting pretty. But mimicking isn’t the same as mastering-and the gap between the two is a canyon.

What BigBear.ai does

They’re based in Maryland, a stone’s throw from D.C., where the air smells of bureaucracy and budget approvals. BigBear sells AI, machine learning, cloud analytics, and cyber engineering-tools for the Department of Defense’s Joint Planning and Execution Community. Their Orion platform? A real-time oracle for mission planning, sifting threats like a detective in a den of vipers.

A Pentagon contract will churn out AI models to parse news reports from nations with a history of troublemaking. And their VeriScan biometrics? It’s got eyes at airports, scanning faces faster than a con man can whisper a lie.

Last year’s $165 million Army contract? A headline grabber, sure. But headlines don’t pay the bills when the books are red.

Why BigBear.ai has some red flags

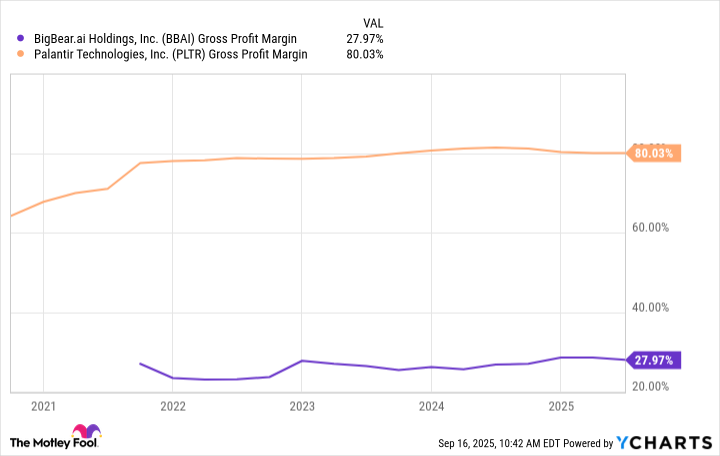

Scalability’s their Waterloo. Palantir sells a platform; BigBear builds custom suits in a world that wants off-the-rack solutions. That’s a recipe for a slow bleed. Palantir’s gross margin? 80%. BigBear’s? 28%. The math doesn’t lie-it just sighs.

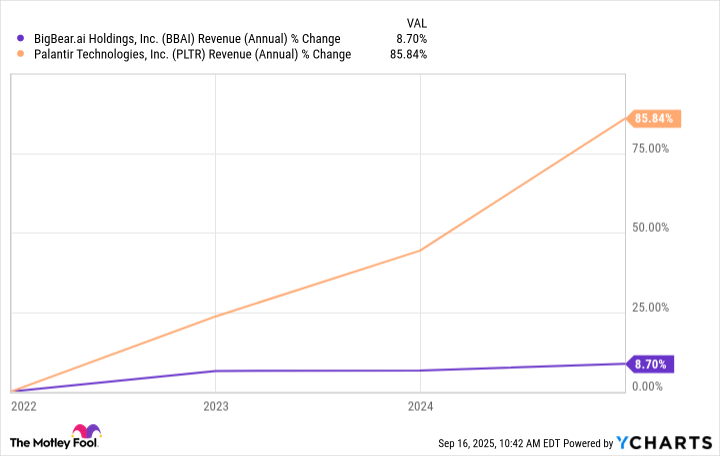

Revenue growth? Palantir’s a rocket ship. BigBear’s a creaky elevator. Since 2022, they’ve limped along with 8.7% annual growth. Q2 revenue? $32.5 million, down 18% from the year before. The net loss? $228 million. Management blames Army program slowdowns, but the writing’s on the wall-next year’s revenue forecast is lower than last year’s corpse.

Analysts whisper $133.5 million for 2024-a 15.6% drop. 2025? $152 million, still short of 2024’s mark. That’s not growth. That’s a holding pattern with a leaky hull.

How to trade BigBear.ai stock now

BBAI’s up 11% this year, but it’s been a rollercoaster. Volatility’s their middle name. Bulls hope they’ll catch Palantir’s lightning in a bottle. But lightning doesn’t strike twice, especially not in a field this crowded.

If BigBear can scale, trim costs, and turn a consistent profit, they might just survive. Until then, this stock’s a poker game played with someone else’s chips. You don’t bet your coffee money here. You bet your confidence-and confidence’s a currency that dries up fast.

Stick to the fundamentals. This ain’t the time for moonshots. Unless you’ve got a taste for speculation and a stomach for losses, keep BBAI in your rearview mirror. The road ahead? Paved with promises and potholes.

Let the dice roll. 🎩

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Silver Rate Forecast

- Why Nio Stock Skyrocketed Today

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-21 11:06