Dividend-paying equities remain a cornerstone for income-focused portfolios, particularly amid persistent inflationary pressures. While quarterly distributions dominate the equity landscape, monthly dividend structures offer tactical advantages for investors requiring regular cash flows. This analysis examines three securities with distinct monthly payout mechanisms, evaluating their operational resilience, sectoral dynamics, and dividend sustainability.

Realty Income: Retail Infrastructure Monetization

Realty Income Corporation (NYSE: O) operates as a net-lease REIT specializing in single-tenant retail properties. Its portfolio comprises 11,300+ assets leased to 250+ tenants, with diversified exposure across convenience stores (12%), discount retailers (11%), and agricultural supply chains (9%). Occupancy rates exceeding 98% for six consecutive quarters demonstrate operational stability amid broader retail sectoral headwinds.

The firm’s dividend track record – 30 consecutive years of increases with current yield at 5.3% – reflects disciplined capital recycling and lease escalations. Notable tenant concentration risks remain mitigated through contractual rent increases (typically 1-2% annually) and geographic dispersion across 49 U.S. states.

EPR Properties: Experiential Real Estate Capitalization

EPR Properties (NYSE: EPR) maintains a specialized portfolio of experiential assets, including 89 entertainment venues (18% of AUM), 74 education facilities (15%), and 35 recreation properties (7%). The REIT’s unique positioning in high-barrier-to-entry assets generates 99% occupancy rates with weighted average lease terms of 12 years.

Dividend sustainability – currently yielding 6.1% – depends on cyclical consumer discretionary spending patterns. However, triple-net lease structures (tenant responsibility for 82% of operating expenses) provide margin insulation. Historical dividend growth (18 of last 20 years) demonstrates management’s commitment despite pandemic-era disruptions.

Global X Nasdaq 100 Covered Call ETF: Options-Based Income Strategy

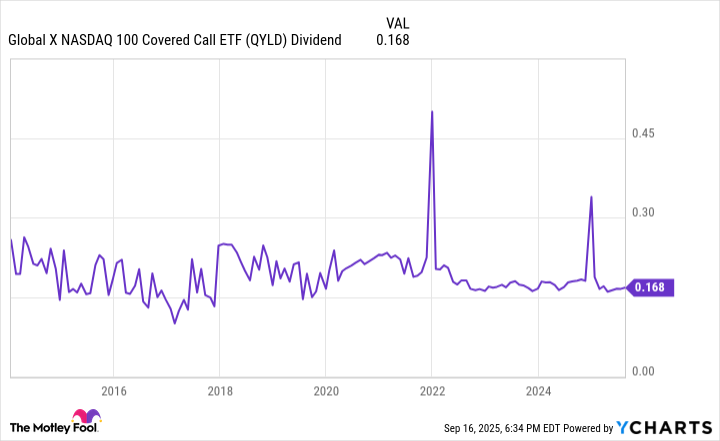

Global X Nasdaq 100 Covered Call ETF (NASDAQ: QYLD) employs a systematic options overlay on Nasdaq-100 constituents, generating income through monthly covered call premiums. This strategy captures volatility premiums while maintaining equity exposure to top-tier technology firms (NVIDIA, Microsoft, Apple collectively 40% of holdings).

The ETF’s 13.6% trailing yield reflects elevated options premiums in high-volatility environments. However, structural underperformance during bull markets (-18% cumulative vs Nasdaq-100 since 2013) warrants caution. Portfolio turnover (400-500% annually) creates tax inefficiencies, making this instrument better suited for tax-advantaged accounts.

Investment considerations: While monthly dividend structures enhance cash-flow predictability, these instruments require rigorous due diligence. Realty Income’s retail exposure demands continuous tenant credit monitoring. EPR Properties’ cyclical sensitivity necessitates prudent portfolio allocation. QYLD’s options strategy mandates active risk management in rising markets. Diversification across these vehicles may mitigate individual security risks while maintaining income objectives. 📊

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-21 10:52