It is a tumultuous journey indeed, for the stalwarts of the financial realm-the enduring S&P 500 (^GSPC), the venerable Dow Jones Industrial Average (^DJI), and the visionary Nasdaq Composite (^IXIC)-as they traverse the landscape of 2025.

From the ashes of a fleeting stock market crash in the dawn of April, ignited by President Donald Trump’s declaration of a tariff and trade affair on the 2nd, the titans of Wall Street sprang forth with vigor. The dawn of April 9 saw Trump issue a temporary reprieve on heightened “reciprocal tariffs.” In that moment, the markets bloomed, recording their most monumental one-day gains in the annals of history.

However, the gains over the past months, like dazzling mirages, merit scrutinization beyond the glittering surface. Since the fateful closing on April 8, the Dow, S&P 500, and Nasdaq have soared by 22%, 33%, and 46%, respectively, with each embracing new heights never witnessed before.

But, dear reader, as we glean insight from history, one cannot help but wonder if this prosperity is but a fleeting jest.

A Market Teetering on the Edge of Unwritten History (and the news, alas, is not bright)

Excepting the brief commotion of February to March 2020’s COVID-19 crash and the bear market of 2022, the bulls have galloped unabated across landscapes for 15 out of the last 16 years. While it soothes the weary investor’s heart to witness the grand ascent of Wall Street’s chief indices, a troubling specter looms when laboring earnings lag far behind.

Most investors undoubtedly dance with the concept of price-to-earnings (P/E) ratios-a metric to reflect the worth of a business in relation to its counterparts or the wider economy. This mathematical conjuration divides a company’s market price by its trailing twelve-month earnings per share (EPS).

Yet, the P/E ratio is hardly infallible. It flounders during economic downturns and ignores the winds of corporate growth.

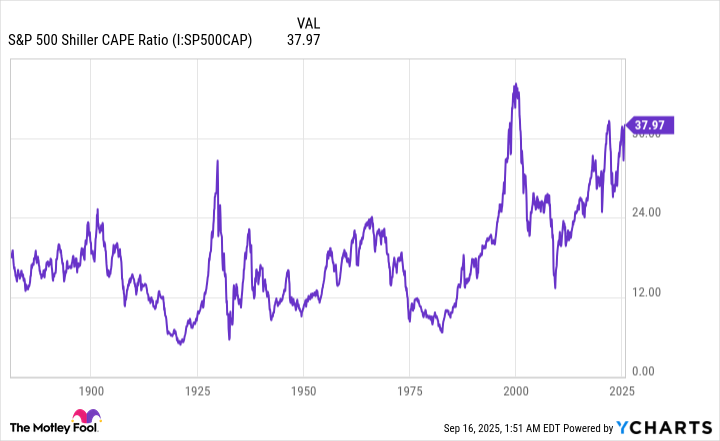

In a more astute comparison, the S&P 500’s Shiller P/E ratio-revered as the cyclically adjusted P/E or CAPE ratio-serves as a far more judicious measure of value. Crafted from a decade’s worth of inflation-adjusted EPS averages, it sheds light upon the health of the S&P 500, that barometer of the market’s pulse.

As the sun set on September 15, the Shiller P/E painted a picture brimming with foreboding-a staggering multiple of 39.78. This figure stands as the third-most inflated measurement recorded in an unbroken bull market, overshadowing a historical average of 17.28 over 154 years as though it were a fading whisper.

To exemplify the starkness of the current valuation, let us reflect upon the Shiller P/E’s odyssey above 40, a summit reached on only two poignant occasions:

- In the first week of January 2022, just before the onset of the bear market’s icy grip, it approached the fateful number.

- In December 1999, mere moments before the cataclysm of the dot-com implosion, this ratio reached an all-time zenith of 44.19.

Today, the market flirts with a perilous historical mark; the Shiller P/E stands on the precipice of breach, tantalizingly close, with the twilight of September 15 revealing it could soon surpass 40, marking only the third instance since the dawn of 1871.

Why does this matter? History has taught us that when the Shiller P/E ascends beyond 40, the inevitable response has been the loss of 25% (the 2022 bear market) or 49% (the dot-com catastrophe) of the benchmark’s worth. The Nasdaq, that other vibrant entity, faced an even harsher fate-a staggering 78% drop from its lofty perch between 2000 and 2002.

If we widen our lens yet further, we uncover that in each of the five prior episodes where the Shiller P/E broke through 30 and lingered for a minimum of two months, the S&P 500 ultimately faced declines of 20% or greater.

Suffice it to say, although nothing on Wall Street is ever set in stone, repeated historical patterns seem to whisper agonizing truths: extended valuations tied to the Shiller P/E have long served as heralds of impending bear markets, a fate known for over a century and a half.

Yet, Among Shadows, a Lingering Thread of Hope

While the Shiller P/E does not carry the weight of a timing tool-valuations may linger in their inflated state for moments stretching into weeks or years, as witnessed before the dot-com demise-it indeed hints at an eventual downturn. Though this historical reflection may taint what has been a euphoric rally upon Wall Street, a silver lining remains.

History sways like a pendulum-swinging not in vain, but favoring those who embrace a vision that stretches beyond the immediate in pursuit of resilience.

In June of 2023, the keen minds at Bespoke Investment Group unveiled a profound study on social media, tracing the calendar lengths of bull and bear markets within the S&P 500, extending back to the Great Depression’s somber inception in September 1929. The examination entailed the scrutiny of 27 separate events, for history bears witness to both the bitter and the sweet.

On one side, the average S&P 500 bear market endured a mere 286 calendar days, cutting just short of nine and a half months. Only eight out of those 27 bear markets exceeded a year, with none surpassing 630 days.

Loading…

–

Compare this with the fact that the average S&P 500 bull market perseveres for 1,011 calendar days, a journey approximately three and a half times as lengthy. Should the present bull market continue on its course, it may well eclipse the span of the most enduring bear market (630 calendar days), joining the ranks of a mere fourteen out of twenty-seven.

Should investors broaden their gaze, the marvel of patience upon Wall Street unfolds. Every year, the diligent analysts at Crestmont Research refresh a captivating dataset detailing the rolling 20-year total returns of the S&P 500, including dividends, prepared since the turn of the 20th century. This endeavor, starting from 1900 to 2005, scrutinizes 106 rolling periods.

What this analysis reveals is a testament to endurance: every single one of those 106 rolling time frames netted positive annualized returns. In essence, had a soul, hypothetically, invested their fortunes in an index fund tracking the S&P from 1900 to 2005, with a steadfast heart for 20 years, they would emerge victorious.

Moreover, these rewards were hardly trifling. Half of the scrutinized 106 periods boasted annualized gains ranging from 9.3% to 17.1%, while even the less fortunate decile garnered a commendable 5.1% annual return.

So, even if history proves itself once more, suggesting a retreat in the S&P 500, Dow Jones, and Nasdaq Composite, let it be known that all signs, when gazed upon through the lens of two decades or more, still point toward ascendant horizons.

📈

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-21 10:18