Let’s not pretend this is a love story. It’s a business analysis. But if you squint, the plot twists are eerily similar. Uber’s the prom king. Lyft’s the kid who shows up late, eats all the dip, and somehow still gets a round of applause. If you’ve got $1,000 and a craving for growth, the latter might be your best shot. Here’s why.

The second-banana fallacy

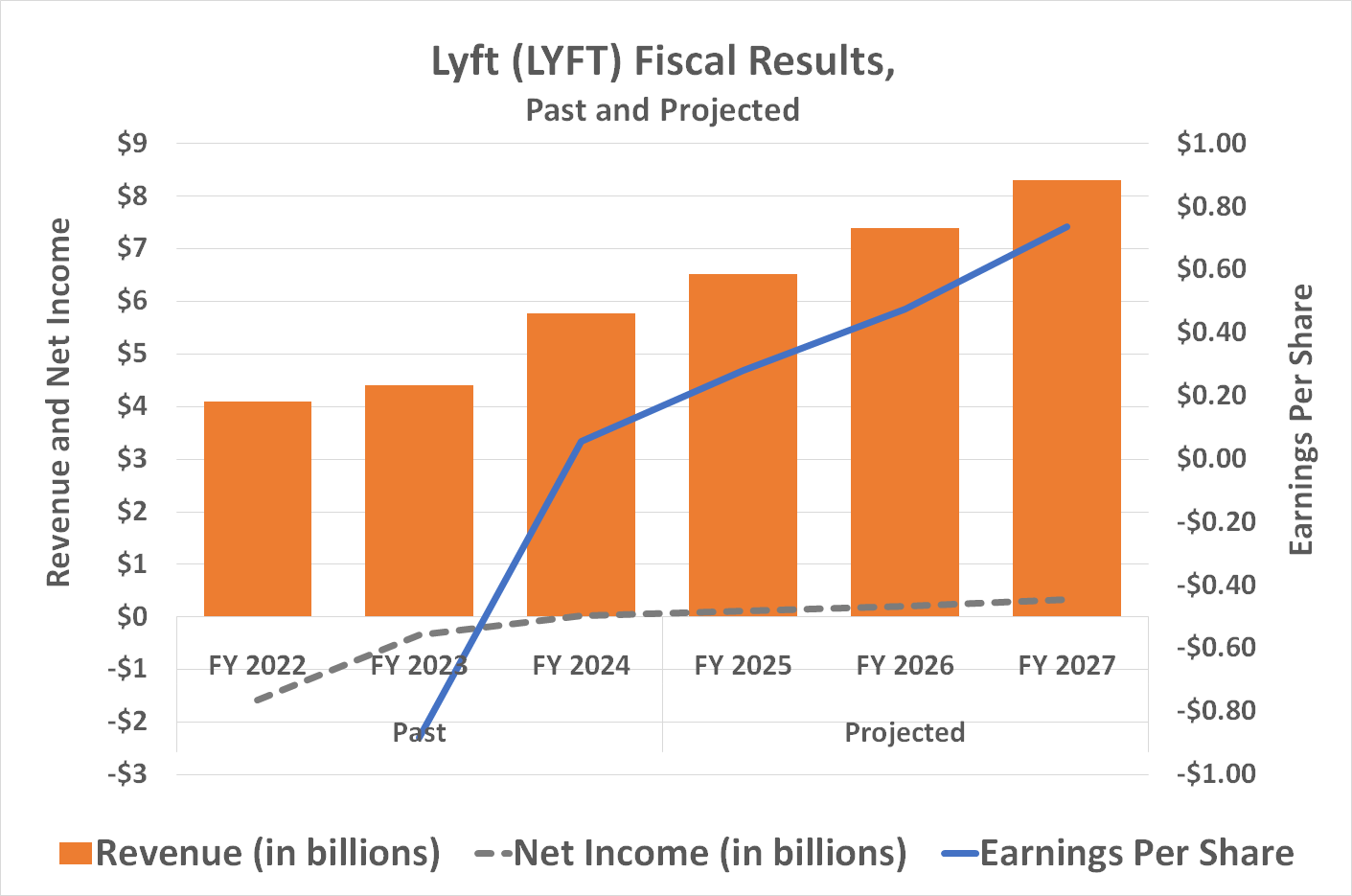

Biggest isn’t always best. Sometimes the sidekick steals the show. Uber’s got $44 billion in revenue. Lyft? $5.8 billion. A David-and-Goliath ratio so lopsided it makes the tech bros blush. But David had a slingshot. Lyft’s got something sharper: profitability. It turned its first annual profit last year. A minor miracle in an industry where “scale” is just Silicon Valley for “losing money spectacularly.”

So it goes.

Europe‘s next. Lyft bought Freenow for $200 million-a rounding error for Uber, a lifeline for Lyft. The continent’s mobility market is 99% untapped. A statistic so ripe it’s practically begging for disruption. Uber’s too busy dodging regulators. Lyft’s rolling up its sleeves.

Growth? Let’s talk chess moves

Autonomous cars with Baidu. Credit-card deals with Mastercard. A United Airlines tie-in that’ll either soar or crash. Lyft’s playing 4D chess while Uber’s stuck in checkers. Partnerships pile up like unread Slack messages. None of them pay dividends yet. But investors aren’t paid dividends. They’re paid hope. And Lyft’s serving it piping hot.

Small markets? Indianapolis. Nashville. Cities Uber ignores like yesterday’s news. Lyft’s calling them “underserved.” Analysts call it “desperation.” Both might be right.

Reality checks and analyst shrugs

Lyft’s stock trades above its target price. A disconnect so glaring it’d make a math teacher weep. Two-thirds of analysts say “hold.” Which is finance-speak for “go ahead and buy it if you’ve got a strong stomach and a weak grasp of risk.”

But here’s the kicker: The ride-hailing industry’s growing 16.6% annually. A comet streaking across the sky. Uber’s riding it like a surfboard. Lyft’s clinging to the comet’s tail. Both will get scorched. But sometimes the best view’s from the flames.

So it goes.

Investors crave timelines Uber can’t offer. Five years. Ten. A blink in cosmic terms. Lyft’s not winning the war. But it might win your portfolio. Buy the dip? Sure. But don’t wait forever. The future’s a cab with a broken meter. It arrives when it wants. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-09-20 21:44