In the realm of modern investment, where the winds of change sweep through the verdant fields of renewable energy, one stumbles upon a curious figure: Constellation Energy (CEG), the paragon of competitive nuclear power in America. With generous intentions and a nimble demeanor, this utility company presents a bright but complicated tableau, beckoning investors to consider its fate with measured contemplation.

The Indispensable Nature of Power

Should one willingly forsake the comforts of electricity-even for a fleeting hour-the absence will strike a discordant note, thrusting one into a semblance of the Dark Ages. Such is the essence of power in contemporary existence, underpinning our every endeavor. It is precisely this unyielding demand that renders the utility sector an inherently stable sanctuary, lest the world should grind to an unceremonious halt.

Yet, amid this steadfast tableau, a noteworthy evolution is afoot. The renewable crusade unfurls before us, celebrated by solar and wind energy, which, alas, faces the inherent caprices of intermittency. These fitful sources demand the steadfast embrace of baseload power to avert the chaotic fluctuations that can mar the delicate fabric of the grid.

Here, Constellation Energy emerges with a solemn purpose, wielding its extensive fleet of nuclear power stations like a knight of yore, prepared to provide indispensable baseload power. Though the path to erecting a nuclear reactor is fraught with expense, the resultant decades of stable energy generation offers an affordable boon unmatched by lesser lights.

As our contemporary grid welcomes more intermittent power, the significance of Constellation’s offerings magnifies, underscoring its ambition to pivot toward market-driven pricing, an evolution that opens promising avenues for growth. Moreover, the company sets its sights on diversification, eyeing the acquisition of Calpine to weave natural gas into its narrative-a cleaner alternative bridging the chasm between traditional fuels and burgeoning renewables.

Constellation’s Quandary

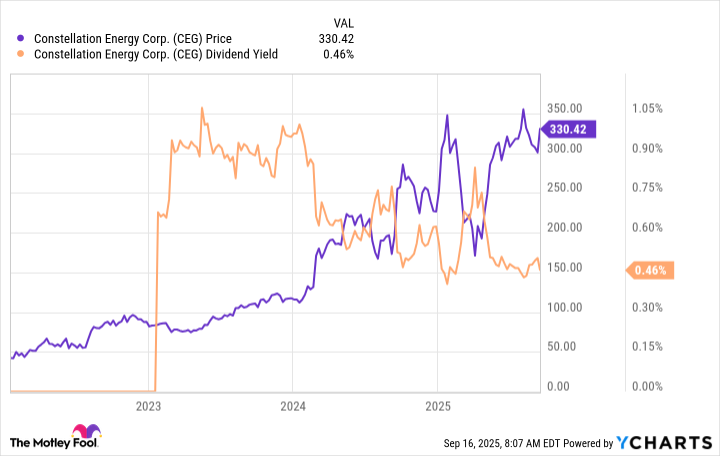

Despite the harmonious symphony played by Constellation’s operational tune, one must heed the common wisdom that even the finest composition can falter when burdened by excessive valuation-a lesson imparted by the venerable Benjamin Graham. Alas, this is the conundrum that now ensnares Constellation Energy; one finds its stock basking under an imposing premium.

The company’s dividend yield languishes at a modest 0.5%, a paltry reflection that pales against the 1.2% yield of the esteemed S&P 500 and substantially falls short of the 2.7% average yield found amongst its utility peers. Strikingly, this yield, one of the lowest in recent memory, suggests that the stock is not precisely a bargain at present, particularly as it hovers near historical zeniths.

Delving deeper into conventional valuation measures-such as price-to-earnings and price-to-book ratios-one notes that Constellation’s P/E hovers around 34, a stark contrast to the industry average of approximately 21. The price-to-book ratio, too, revels in a similar fate as it flouts expectations with a ratio near 7.7 against a humbling average of 2.3.

The evidence unfolds before our discerning eyes: Constellation Energy, cloaked in the fine threads of high valuation, offers perilous terrain where even minor setbacks-a reactor’s unforeseen hiccup, for instance-could provoke a palpable flight of investors from its embrace. This notion feels particularly resonant given the historical specters of nuclear mishaps, which, though rare, sway public sentiment with disquieting agility.

A Word of Caution

In conclusion, Constellation Energy may indeed be a commendable enterprise, yet it bears the weight of being perceived as extravagantly priced. Unless one nurtures grand aspirations for the future of nuclear energy and places firm faith in Constellation’s potential, it may be advantageous to adopt a more observant stance, watching this high-flying bird from the comforting shadows of the sidelines for the time being.

😌

Read More

- 21 Movies Filmed in Real Abandoned Locations

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 39th Developer Notes: 2.5th Anniversary Update

- Gold Rate Forecast

- Rewriting the Future: Removing Unwanted Knowledge from AI Models

- PLURIBUS’ Best Moments Are Also Its Smallest

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Doom creator John Romero’s canceled game is now a “much smaller game,” but it “will be new to people, the way that going through Elden Ring was a really new experience”

2025-09-20 14:49