In the bureaucratic realm of dividend investing, one is tempted to chase the highest yields, as though they were bureaucratic decrees etched in gold. Yet, such pursuit often leads to an inescapable paradox: the very yields that promise sustenance may crumble under the weight of unseen regulations, leaving investors stranded in a labyrinth of their own making.

This is the existential crisis of dividend lovers: to navigate the arcane rituals of corporate finance, where companies like Pfizer (PFE), with its 7.2% yield, appear as beguiling specters, while Johnson & Johnson (JNJ), Omega Healthcare (OHI), and Merck (MRK) loom as shadowy custodians of a more elusive order. The question is not merely which stock to choose, but whether the system itself permits such a choice.

Here, then, is a dissection of three healthcare dividend stocks, each a chapter in the absurd manual of capital allocation.

1. The Paradox of Pfizer’s Yield

Pfizer is a company that understands the art of bureaucratic survival. It has weathered the patent cliffs that rise like Kafkaesque walls, each expiration a bureaucratic hurdle requiring new drugs to be summoned from the void. Investors, of course, are expected to accept these transitions with quiet resignation, as though the pharmaceutical industry were a department of perpetual reinvention. Yet, the 7.2% yield it offers is less a reward and more a cipher-a number that whispers of vaccines and regulatory scrutiny, of a world where public trust is a currency more volatile than shares.

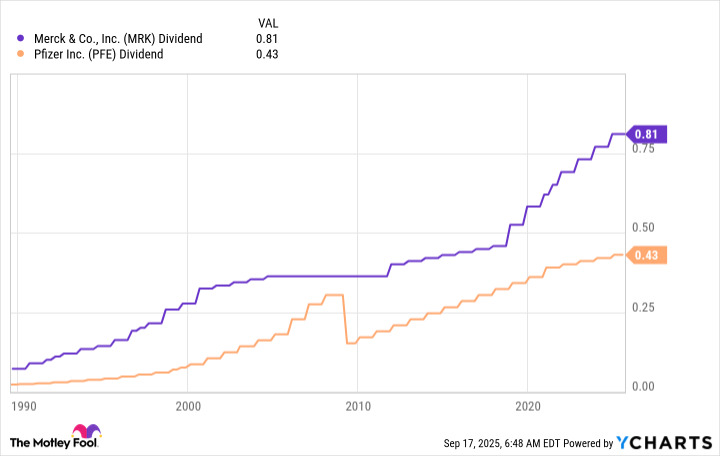

Consider Merck, its competitor, which offers a more modest 4% yield. Why choose one over the other? The answer lies in the bureaucratic archives of dividend history. Merck, it seems, has mastered the ritual of continuity, a survivor in a system where cuts are punished with existential dread. In 2009, Pfizer faltered-a single misstep in an otherwise orderly process-proving that even the most formidable institutions are subject to the whims of acquisition and debt. For the dividend purist, Merck’s unbroken record is not a virtue, but a necessity.

2. Omega Healthcare’s Pandemic Ordeal

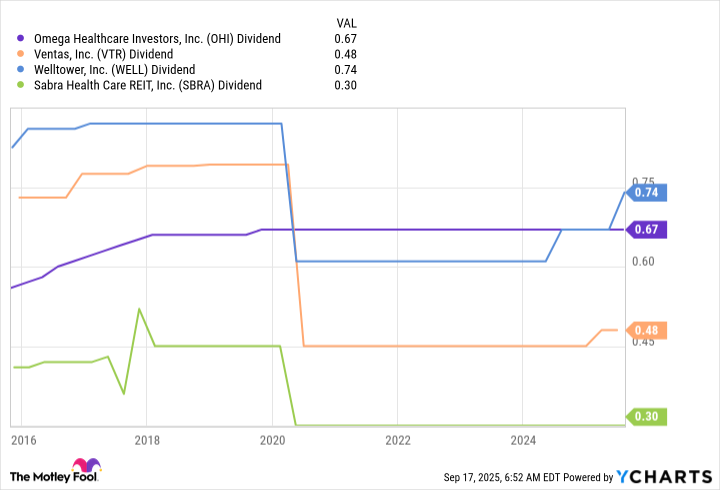

Omega Healthcare, a real estate investment trust (REIT) specializing in senior housing, endured the pandemic as one might endure a bureaucratic audit: with quiet despair and the faint hope of eventual clearance. The virus, that invisible bureaucrat, reduced its facilities to zones of quarantine, where residents were both subjects and prisoners. Yet Omega, unlike many of its peers, refused to sever the dividend-a ritual payment that, in the eyes of investors, transcends mere finance and enters the realm of existential obligation.

The yield of 6.4% it now offers is not a triumph, but a relic of endurance. The pandemic, now relegated to the archives, has left behind a trail of paperwork and capital expenditures. In Q2 2025, Omega’s investments in new assets-a bureaucratic act of renewal-suggest the system may yet grant it a reprieve. But such optimism is fragile, a ledger entry in a world where growth is a conditional promise.

3. The Dividend King’s Burden

For those who demand the ultimate in bureaucratic reliability, Johnson & Johnson (JNJ) stands as a monarch in a crumbling castle. Its 60-year streak of dividend increases is a document of near-mythic status, a parchment signed in ink and reinforced by decades of compliance. Yet, even kings are not immune to the system’s contradictions: lawsuits over talcum powder linger like unresolved case files, and the pharma industry’s patent cliffs loom as they do for all. The 3% yield it offers is not a bounty, but a fee for the privilege of stability.

J&J’s dividend is a bureaucratic artifact, its continuity a product of relentless procedural adherence. Yet, in a world governed by absurdity, even the most meticulous records cannot shield against the unpredictable. The dividend, like all such promises, is a fragile thing-dependent on a system that values form over function, and consistency over clarity.

The Absurdity of Choice

To chase the highest yield is to accept a bureaucratic lottery, where the rules are written in a language no one understands. Pfizer‘s 7.2% may glitter like a golden ticket, but it is a ticket to a maze with no exit. Merck, Omega Healthcare, and Johnson & Johnson offer no such illusions. Their yields are lower, their narratives more muted, but their dividends are rituals performed with the precision of a machine that has learned to function despite the void.

For the dividend investor, the lesson is not in the numbers alone, but in the acceptance of the system’s absurdity. To choose wisely is to navigate the labyrinth not with hope, but with the resignation of one who knows the rules are arbitrary-and yet must be followed. 🌀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-20 12:24