Investors today resemble a group of overly confident tourists who’ve just discovered the “AI Express” and are now sprinting to board it-except some have forgotten their tickets. Among the stranded is AST SpaceMobile (ASTS), a satellite internet pioneer whose stock has plummeted 30% amid whispers of a certain SpaceX’s looming shadow. The situation feels like a Victorian melodrama: a plucky inventor (AST) racing against a brash industrialist (Elon Musk) to see who can beam the internet into our pockets first.

The drama hinges on a simple question: Is AST SpaceMobile’s 30% decline a golden opportunity or a cosmic trap? Let’s peer through the telescope and see.

Innovation in satellite internet

Currently, satellite internet requires a user to own a terminal, antenna, or satellite dish-devices that resemble “a cross between a giant soup can and a parrot’s nest.” AST SpaceMobile, however, has taken a different approach: instead of asking users to change their habits, it’s asking satellites to change their behavior. By launching barn-sized satellites and partnering with telecom giants, the company aims to deliver internet directly to smartphones. It’s like replacing your home’s plumbing with a teleportation device-except the teleportation happens 22,000 miles up.

If successful, this could be a game-changer. Imagine a world where your phone’s signal strength depends not on a cell tower but on a satellite zipping past at 17,500 mph. The company projects speeds capable of streaming cat videos in 4K, a feat that would make even the most ardent cat lover weep with joy. And with telecom partners, AST SpaceMobile could target 1 billion potential customers-a number so vast it makes the population of Earth seem cozy by comparison.

SpaceX, of course, is watching this unfold like a dragon eyeing a nearby gold mine. Elon Musk, that modern-day Barnum, recently spent $19 billion on spectrum from EchoStar to launch its own direct-to-device service. It’s a move that smells of both ambition and panic, like a chef buying out the entire spice market to protect their secret recipe.

What does the future look like for AST SpaceMobile?

Here’s where the plot thickens. AST SpaceMobile claims it can launch its satellite constellation in the U.S. by year’s end and expand globally by 2026. If it sticks to this timeline, it could enjoy a few years of uncontested dominance in the direct-to-device market. SpaceX, meanwhile, insists its service will take at least two years to launch-a timeline Musk has been known to treat like a gentle suggestion rather than a hard deadline. If history is any guide, AST SpaceMobile might have a window of opportunity as wide as the Grand Canyon.

The revenue projections are equally audacious. The company aims for $50 million in 2025 and hints that 1% of its 1-billion-customer target (10 million users) could generate $1.2 billion annually. That’s the financial equivalent of turning pennies into gold-though, as with all alchemy, the trick lies in believing the process works.

Still, the future remains as murky as a satellite signal during a solar flare. But for shareholders, the potential is as tantalizing as it is terrifying.

Valuing AST SpaceMobile stock

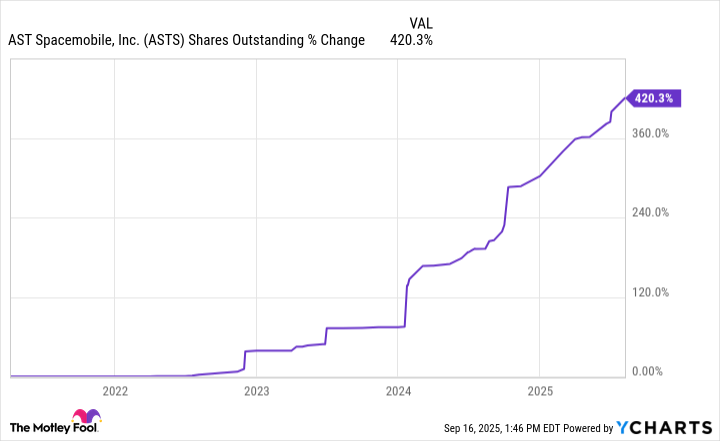

At a $15 billion market cap, AST SpaceMobile’s valuation feels like a house built on sand and optimism. The company burned through $676 million in free cash flow last year and has resorted to convertible bonds and stock offerings to fund its ambitions. This has inflated the share count by 420% over five years-a financial soufflé that risks collapsing under its own weight.

Even if the $1.2 billion revenue target is achieved, the stock’s current valuation may still be a stretch. After all, a company with no current revenue and a balance sheet heavy with debt and dilution is like a magician who’s borrowed all their props from a skeptical lender. It’s a spectacle, but one that leaves you wondering if the rabbit is still in the hat.

So, is AST SpaceMobile a can’t-miss opportunity? Not quite. This isn’t the time to buy the dip-it’s the time to buy a magnifying glass and scrutinize the fine print. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-20 11:30