Wall Street’s three major stock indexes have been on quite the roller coaster since 2025 began. A tale of two weeks, if you will-first a clatter of hammers, then a symphony of gavels. The S&P 500, Nasdaq, and Dow Jones all took a tumble when Mr. Trump, that shrewd operator, unveiled his tariff plans. It was like watching a man try to balance a broomstick on his nose-wobbly, precarious, and liable to topple at any moment.

But then, as if by magic, the script flipped. A 90-day pause on tariffs, and the markets danced with glee. The S&P 500, Dow, and Nasdaq all hit record highs, their joyous leaps rivaling the acrobatics of a circus bear on a tightrope. Yet, as the old adage goes, “All that glitters is not gold.” For every silver lining, there’s a shadow lurking, and this one bears a peculiar name: Moody’s Analytics.

This predictive algorithm has a flawless track record of forecasting U.S. recessions

There’s always some metric or historical event threatening to drag Wall Street’s major indexes lower. The Shiller P/E ratio, for instance, is flirting with its second-priciest valuation in 150 years-a sign as clear as a bell at a funeral. But here’s the kicker: Moody’s Analytics has a machine learning model that’s been right for 65 years, and it’s currently whispering, “Trouble’s coming.”

Imagine a fortune-teller with a 100% success rate. That’s Moody’s model, which spits out a 48% chance of a U.S. recession. Close to the 50% threshold, but not quite there. Yet, as the old saying goes, “A watched pot never boils,” and a 40% chance is like a man with a 50% chance of falling off a ladder-he’s already halfway there.

Loading…

–

Mark Zandi, the economist behind this model, points to building permits as the key indicator. “When permits drop, it’s like a canary in a coal mine,” he says. “And right now, that canary’s singing a tune of doom.” With unsold homes piling up like old newspapers, the market’s in a precarious spot-like a man balancing on a tightrope while juggling flaming torches.

Wall Street’s newest algorithm has nothing on historical precedent

While Moody’s model is impressive, it’s no match for the wisdom of history. Recessions are as inevitable as gravity, and while they may seem like a dark cloud, they’re often followed by a rainbow. Since WWII, the average recession has lasted 10 months-shorter than a toddler’s attention span.

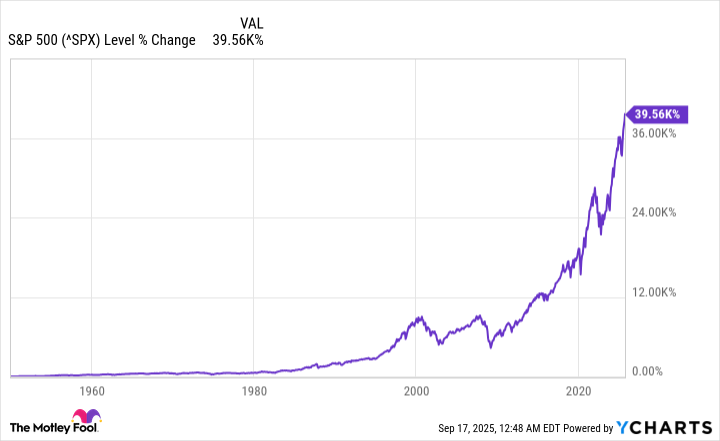

And let’s not forget the stock market’s resilience. The S&P 500 has been a steadfast companion, rising even in the face of wars, pandemics, and the occasional presidential tantrum. A 20-year hold on the S&P 500? You’d have made money, no matter the chaos. It’s like a dog that’s always happy-no matter how many times you drop a bone on its tail.

The data from Bespoke Investment Group and Crestmont Research paints a clear picture: the market’s a survivor. Even if Moody’s model is right, it’s no reason to panic. After all, the stock market is like a stubborn mule-it’ll keep plodding along, no matter how many rocks you throw at it.

So, while the algorithm’s warning is worth heeding, it’s also a reminder that the market’s a fickle friend. And as for Wall Street? Well, it’s a game of chance, and the house always wins-eventually.

🧠

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-20 10:35