Beth Kindig, helmswoman of the I/O Fund, has carved her name in the annals of tech speculation with a fervor that borders on the prophetic. Her unwavering devotion to Nvidia (NVDA) mirrors the zeal of a medieval monk transcribing scripture-though her scrolls are scribbled with earnings calls and capex forecasts. In a Bloomberg interview, she conjured a vision: a $6 trillion colossus by 2025, a sum that would make even the most jaded Wall Street quant clutch their chests in disbelief.

What follows is not mere number-crunching but a dissection of the machinery that might elevate this semiconductor titan to such heights. Let us examine the gears, the levers, and the shadows cast by this prophecy.

The Arithmetic of Empire

Nvidia’s data center segment, a beast of $41.1 billion in Q2, roars with annualized ferocity toward $160 billion. Kindig’s calculus is stark: scale the next-gen Blackwell GPUs, and by year’s end, $50 billion quarterly sales become not a dream but a fait accompli. By 2025, she imagines $75 billion quarterly-a $300 billion annual tempest. The question is not whether the math is sound, but whether the world can bear such a titan.

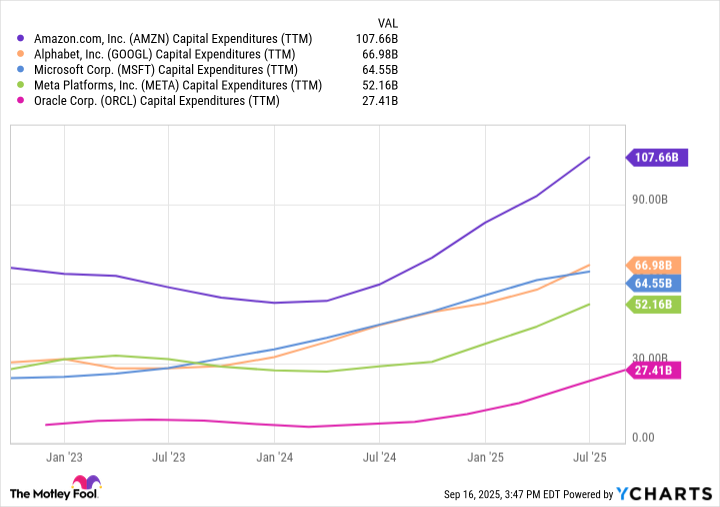

Capital expenditure trends, she argues, are the unsung architects of this ascent. Analysts, she suggests, are blind to the true scale of demand, their models as quaint as a scribe’s quill in an age of laser printers. The hyperscalers-Amazon, Microsoft, Alphabet-are not merely building servers; they are forging the scaffolding of a new civilization, one that demands GPUs in quantities that defy precedent.

The Pillars of GPU Hegemony

At the core of this edifice lies the relentless tide of AI workloads. Training models to navigate warehouses or autonomous vehicles is not a matter of refining chatbots-it is the alchemy of turning silicon into sentience. Nvidia’s GPUs, with their Blackwell architecture, are the crucibles of this transformation. They are not tools; they are the very sinews of a machine that learns, adapts, and consumes.

Consider the GPU-as-a-Service model, a Frankensteinian fusion of capitalism and computation. Oracle, CoreWeave, Nebius Group-these modern-day guilds rent Nvidia’s silicon to the masses, creating a hydra-headed empire. Each cloud provider is a node in a network that ensures Nvidia’s dominance is not a fleeting storm but a geological epoch.

The Moral Calculus of Markets

Is Nvidia a buy? The question is as quaint as asking whether the sun will rise. The $6 trillion valuation is not a target but an inevitability-a given in a world where AI’s hunger for compute is bottomless. Yet herein lies the rub: such power concentrates in the hands of a few, and with it, the moral weight of deciding which industries thrive and which wither. Nvidia is not merely a company; it is a gatekeeper of the digital age, its GPUs the keys to the kingdom.

To invest in Nvidia is to wager on the future’s fidelity to this paradigm. It is to accept that the next decade will be defined by a relentless march toward AI-driven ubiquity, where the line between human and machine blurs. The risks are not in the numbers but in the silence of those who dare to question whether this is progress-or a new kind of tyranny.

🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-20 02:53