Once upon a time, in a land where dreams are sold in shares, there lived a company named Archer Aviation. Its vision? To stitch the sky with flying taxis, as if the clouds were fabric and the air a loom. To some, this was a tale of madcap whimsy. To others, a recipe for disaster. But let us not judge too soon, for even the strangest of tales can hide a golden egg.

Archer’s aircraft, these so-called “sky-scooters,” are meant to zip between cities like drowsy bees. The notion may seem as sensible as teaching a cat to dance, yet the company claims a market worth a trillion dollars-enough to make even the greediest of goblins weep with delight. But here’s the catch: the price of a share is less than a loaf of bread. A bargain? Or a trap set by a mischievous squirrel?

Now, dear reader, let us ponder: should you toss your hard-earned coins into this airborne riddle? Let us delve deeper, with the caution of a child peering into a dark cupboard.

What Problems Can Archer Solve?

Archer’s grand plan is to untangle the knots of urban chaos. Imagine a world where traffic jams are as rare as a sunny day in a rainforest. The company’s rivals-those grumpy giants of the sky-have tried to tame the skies with their clunky planes and overpriced rides. But Archer? It whispers, “Why not fly?”

Yet the skies are not without their dangers. The fat cats of the air, like United Airlines, have grudgingly agreed to partner with Archer, as one might reluctantly share a biscuit with a beggar. And what of the defense sector? Ah, there lies a secret garden where Archer’s Midnight aircraft could sneak about like a thief in the night, unnoticed and unbothered.

But beware, dear investor. For every dream, there is a shadow. And Archer’s shadow is a towering, money-hungry beast, gnashing its teeth over every dollar spent.

Analyzing Archer’s Financial Profile

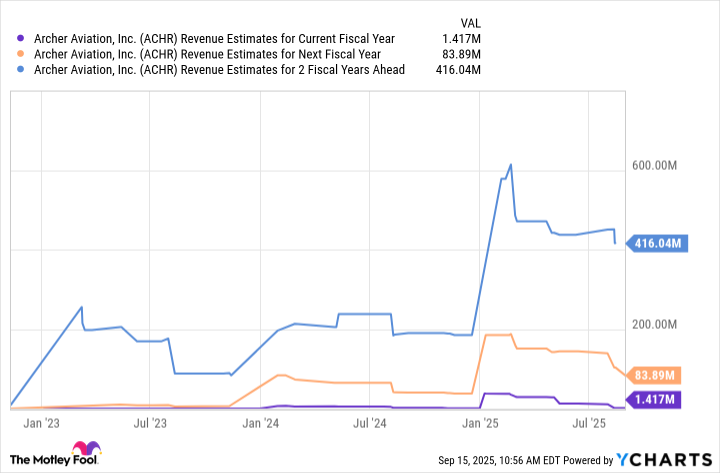

To build a flying taxi, one must first build a cathedral of cash. Archer, like a child with a piggy bank full of dreams, has spent billions on testing and tinkering. Yet, it has not yet sold a single ticket. A pre-revenue kingdom, where the king wears a crown of hope and the subjects are investors with trembling hearts.

Wall Street, that fickle jester, claps its hands and says, “Soon, soon!” But the road to profitability is a maze with no exit. The company’s order book is a treasure map, but the treasure is buried deep, and the path is lined with landmines.

Is Archer Aviation Stock a Good Buy?

To value Archer is to count the stars-futile, yet irresistible. Analysts compare it to airlines and ride-hailing giants, though the match is as odd as a duck in a suit. At 14 times its projected sales, Archer’s stock is a gilded cage, where the key is lost in a labyrinth of uncertainty.

For the dividend hunter, this is no feast. No dividends, no steady income-only the promise of a future where the skies are filled with flying taxis and the pockets of investors grow fat. But such promises are as fleeting as a balloon in a storm.

So, what is an investor to do? To leap is to risk falling into a pit of despair. To wait is to watch others feast while you nibble on crumbs. But remember, dear reader: the greatest treasures are often hidden in the most peculiar of places. And sometimes, the sky is not the limit-it is the beginning.

🚀

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2025-09-19 10:14