Out on the plains of the stock market, where fortunes are sown and reaped like wheat, Lululemon (LULU) has carved a legend. Since its birth in 2007, the stock has climbed a thousand feet, a vertical ascent that left many breathless. Yet here in 2025, the land lies fallow. Shares, once crowned with golden sheaves, now lie in a dustbowl of 70% from their peak. The air hums with questions: What storm has blown this way? And where does the road lead from here?

The athleisure titan, so proud in its stretchy armor, stumbles now in the shadow of its own success. The American market, its original frontier, has turned thorny. Investors, like wary pioneers, eye the horizon for signs of competition in leggings, sportswear, and the broader cloth trade. Yet in this drought, the stock’s price has sunk to a level not seen since the early days of its journey-a parched field waiting for rain.

The Furrows of History

To plant in this soil, one must look back. Lululemon’s story is not new; it is the tale of a brand that wore its craft like a second skin. From a fledgling $1 billion in revenue at its birth to $10.9 billion in recent years, its growth is a testament to the alchemy of design and desire. The United States, its first territory, became a patchwork of stores where the faithful traded in comfort and confidence.

But the horizon stretches wider. China, that vast and hungry market, now claims 16% of Lululemon’s harvest. Last quarter, its Mainland fields yielded 24% more grain than before. Yet the land is vast, and the plow has only just begun to turn the earth. Online markets lie untapped, and new towns await their first Lululemon storefront. The brand’s reach, like the prairie, is still a frontier.

Europe, Latin America, and the islands of Asia remain untouched by the brand’s loom. Revenue beyond North America and China? A mere 15%. But the athleisure trade, like the wind, moves where it will. Nike and Adidas, titans of the cloth, built their empires on this truth. Lululemon, if it stays true to its thread, may yet weave a similar tapestry.

The Price of the Land

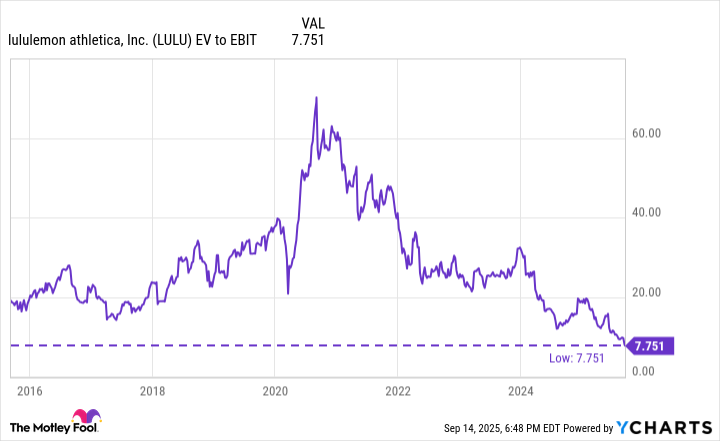

Here lies the first seed of hope: the price. As of Sept. 14, Lululemon’s shares trade at an EV/EBIT of 7.75-a number that whispers of bargains. For ten years, this field has been tilled at higher rates, the soil richer but the harvest uncertain. Now, management scatters buybacks like seeds in autumn, reducing shares by 15% over the decade. A leaner stock, a fatter yield for those who dare to plant.

Yet the land is not without its curses. Why has the market turned its back? The answer lies in the cycles of cloth. For fifteen years, athleisure wore the crown of immortality. Pandemic winds inflated its sails, and Wall Street’s galleons followed. But tides shift. Last quarter, North America’s revenue crept forward by 1%-a pace slower than the crawl of a beetle. Tariffs loom like thunderheads, threatening to dim profit’s light.

The Seasons of Cloth

The apparel trade is a fickle mistress. Trends bloom and wither like wildflowers. Lululemon’s stretchy dominion now faces the cold breath of change-other fashions rising, other needs pressing. Yet even in this chill, the brand holds its ground. Last quarter, it claimed more of the athleisure market despite its North American stall. The cloth may shift, but the loom remains strong.

For the small investor, the question is not just numbers but justice. Is this a field worth tilling? Lululemon’s history is a ledger of grit and growth. Its current price, though bruised, may yet be a door. But the cycle’s shadow lingers-a reminder that no empire, not even in spandex, is immune to the seasons.

So here we stand, at the crossroads of thread and time. The land is cheap, the harvest uncertain, but the brand’s hands are steady. For those who remember the long march of cloth and commerce, the answer may lie not in the present’s storm, but in the soil of what might be. 🌾

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-09-18 11:23