The S&P 500, that most reliable of companions, has delivered annualized returns of 10.3% since 1957. A figure that would make even the most stoic investor raise an eyebrow, were it not for the fact that such consistency is as rare as a well-timed pause in a Churchillian speech.

Yet, the S&P 500 rarely graces us with its average 10% return in a single year. Instead, it prefers to dabble in extremes-those few years of splendor offsetting the rest with the kind of mediocrity that would make a Victorian parlour hostess blush. And with its current reliance on mega-cap growth stocks, the index may soon become a veritable carnival of volatility.

Why, you ask, might 2026 be a year of extremes? Let us consider the data with the gravity it deserves.

The Average Isn’t So Average

From 1975 to 2024, the S&P 500 averaged 10.6% annual returns, with a median of 13.1% and a standard deviation that would make a statistician weep. This means a 68% chance of returns between -5.4% and 26.6%, and a 95% chance of between -21.4% and 42.6%. The last decade, of course, was a masterclass in chaos.

| Year | S&P 500 Return |

|---|---|

| 2024 | 23.31% |

| 2023 | 24.23% |

| 2022 | (19.44%) |

| 2021 | 26.89% |

| 2020 | 16.26% |

| 2019 | 28.88% |

| 2018 | (6.24%) |

| 2017 | 19.42% |

| 2016 | 9.54% |

| 2015 | (0.73%) |

As the table reveals, 2016 was the only year that approached the average. The rest? A spectacle of excess, with gains so grand they could make a stockbroker weep and losses so severe they might prompt a rethink of one’s life choices.

A High-Risk, Higher-Potential-Reward Index

The S&P 500’s composition, with 39% in the “Ten Titans,” ensures that its future will be as unpredictable as a well-timed punchline. These titans-Nvidia, Microsoft, Apple, and the rest-control half the index’s influence, a concentration that would make even a monopolist blush.

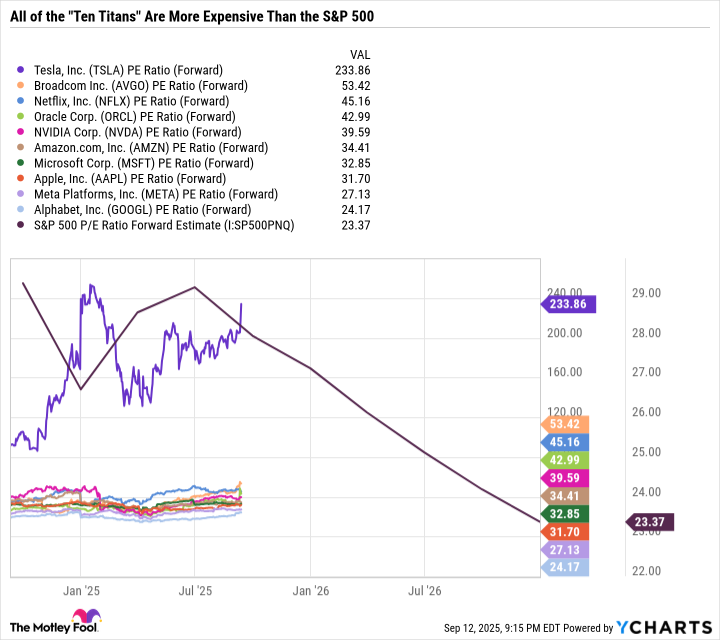

While large companies may seem stable, their valuations often rest on speculative earnings forecasts. Consider the Ten Titans’ forward P/E ratios, which hover above the index’s average like a particularly persistent mosquito.

Investors in these titans are betting on a future that may or may not materialize. Oracle’s five-year cloud revenue forecast, for instance, implies a 14-fold increase-a figure that would make even the most optimistic investor pause. Yet, as the old adage goes, the future is a fickle mistress.

The S&P 500: Still a Long-Term Proposition

Despite the chaos, the S&P 500 remains a tempting proposition for the long-term investor. A surge in AI spending or a drop in interest rates could spark a rally that would make even the most jaded investor smile. Yet, the specter of a downturn looms, particularly if growth slows or geopolitical tensions escalate.

The solution? Avoid the twin perils of overconfidence and panic. Review your portfolio with the detachment of a man sipping a martini at 11 p.m. Perhaps your convictions include the Ten Titans, or perhaps you prefer the steadier pace of dividend-paying stocks. Either way, remember: the market is a fickle companion, and the only certainty is that it will keep you on your toes.

And so, dear reader, we raise a glass to 2026-may it be less of a rollercoaster and more of a leisurely stroll. 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-09-17 11:43