Behold, dear investor, the curious case of NextEra Energy (NEE), a stock that dances between the realms of utility and alchemy. With $10,000, you might acquire 135 shares of this peculiar beast-a creature not merely of wires and tariffs, but of solar demons and bureaucratic waltzes. The CORP-DEPO, that most solemn of scribes, declares it the world’s largest utility, yet its true allure lies in the grotesque fusion of regulation and rebellion.

What does NextEra Energy do?

In the sun-drenched labyrinth of Florida, NextEra tends to the mortal coil of its utility, Florida Power & Light. A regulated entity, yes, but one that thrives on the migration of souls to the Sunshine State. More residents mean more customers, and more customers mean a mechanical beast of capital spending that growls for balance between supply and demand. This is the dance of the regulated utility-a slow waltz with the state, where rates and investments must be approved by the bureaucratic priesthood. Yet even in this stately ritual, growth emerges, steady as the ticking of a clock, though as dry as a bureaucrat’s tea.

But NextEra’s true genius lies in its rebellion against the ordinary. While other utilities grovel in the dust of fossil fuels, NextEra has summoned legions of solar and wind demons. These are not mere turbines or panels, but capricious entities that demand 39 gigawatts of capacity and another 30 in the construction backlog. They are the grotesque children of progress, and their appetite is insatiable.

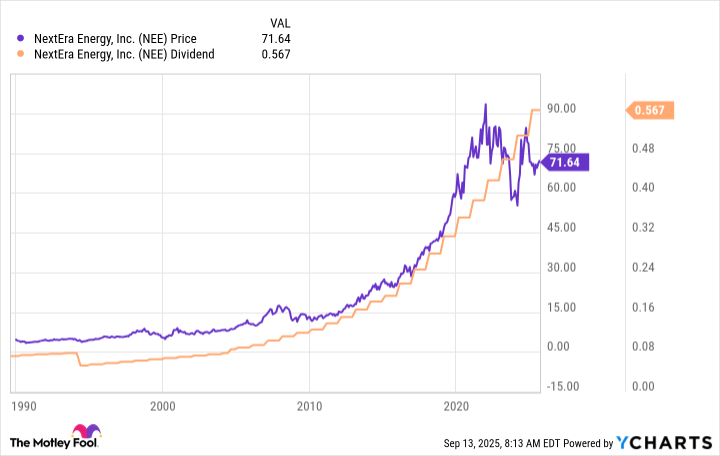

The proof of this alchemy lies in the dividend. For over three decades, NextEra has increased its dividend annually, a feat that would make even the most avaricious merchant weep. The past decade saw a 10% annualized increase-a rate so bold it would make the S&P 500’s paltry 1.2% yield blush with shame. For a utility, this is not merely growth; it is a sly fox outwitting the market’s sluggish hounds.

Why buy NextEra Energy now?

Consider the company’s audacious claim: “We will be disappointed if we are not able to deliver financial results at or near the top end of our adjusted EPS expectations through 2027.” Such bravado is the mark of a madman-or a genius. And given NextEra’s history, one might lean toward the latter. Management’s confidence is not mere hubris; it is a calculated gamble, a bet that the solar demons will continue their infernal dance and the bureaucratic machinery will turn ever so slowly in their favor.

Yet the true allure lies in the yield. At 3.2%, NextEra’s dividend is a siren’s song to the income-hungry investor. The average utility’s 2.7% is but a whisper, while the S&P 500’s 1.2% is a mere sigh. Here is a stock that offers both the steady beat of a dividend and the wild crescendo of growth-a rare harmony in the cacophony of markets.

NextEra is no ordinary utility. It is a chimera of regulation and rebellion, a creature that defies the grotesque normalcy of its peers. To invest in it is to ride a solar demon through a bureaucratic labyrinth, where the only certainty is the uncertainty of it all. And in this absurdity, there is brilliance.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 39th Developer Notes: 2.5th Anniversary Update

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Ray J Pushes Forward With Racketeering Accusations Against Kim Kardashian and Kris Jenner

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Elder Scrolls 6 Fans Got Excited When The Game Awards Showed Mountains

2025-09-17 05:02