Opendoor Technologies (OPEN) has shot through the roof in the past three months, almost as if a magic potion was poured into its very veins. Once a simple meme-stock mischief, it might now be poised for a real transformation. Or is it all just a bit of smoke and mirrors?

The company has tapped a new CEO, Kaz Nejatian, who was formerly the COO at Shopify, to steer the ship. And, as if to give it a new glint of hope, two of the co-founders have come back to the board-one of them, Keith Rabois, even took up the fancy role of Chair. Well, isn’t that just the thing-a good dose of shiny new leadership!

But there’s something more bubbling beneath this frilly surface-investors are clinging to the idea that the good old Fed will swoop in and rescue them with some delightful interest rate cuts. On August 22, Fed Chairman Jerome Powell gave a speech in Jackson Hole, hinting that it was time for the rates to come tumbling down. Investors perked up at the news, and the stock popped, soaring high like a kite on a windy day. Now, everyone’s betting that the Fed will cut the Fed funds rate by 25 basis points on Wednesday. Mortgage rates have already begun to drop, slipping down to one-year lows in anticipation.

As a company that thrives on flipping homes-buying them up, adding a pinch of spice, and selling them off at a tasty profit-lower mortgage rates should, in theory, be a lovely little gift for Opendoor. But alas, as our story goes, it may not be as simple as it seems. Let’s take a closer look, shall we?

The Sweet Dream of Lower Rates

Ah, yes. Lower mortgage rates are likely to sprinkle some much-needed fairy dust over the sluggish housing market. As it stands, rates are still stuck above 6%, a far cry from the sweet, dreamy lows we saw during the pandemic days. This rise in rates has cast a “lock-in effect” over the market-a terrible, sticky trap! Homebuyers who refinanced during the pandemic are now glued to their low rates, unwilling to let go, even if they fancy moving somewhere fresh.

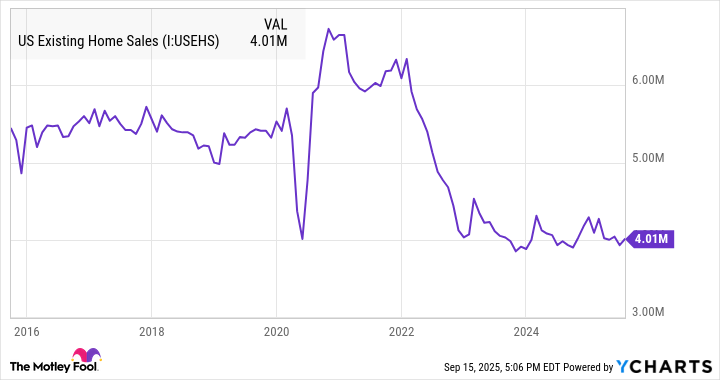

The result? A housing market that’s been utterly stagnant. Existing home sales have been stuck in the muck for the last three years, hovering around 4 million annually-down by 30% from where things stood before the pandemic. It’s a bit like a garden of weeds, untouched and unmoved.

Now, if those mortgage rates start to tumble, we might see a flurry of activity-more buyers and sellers flooding into the market like a stampede of eager ants. This would, of course, be good news for Opendoor, who could swoop in to buy homes and add to its inventory, making a profit from every turn. More homes mean more opportunities, and less time spent on the books, meaning fewer costs. An active housing market could be the secret ingredient for Opendoor’s recipe of success.

Plus, Opendoor, with its clever little financial shenanigans, uses debt to fund its home purchases. At the end of the second quarter, they were sitting pretty with $1.2 billion in asset-backed debt and a nice little stash of $1.5 billion in real estate inventory. Fancy, eh?

The Dark Shadows Lurking Behind the Curtain

But, dear reader, don’t be too quick to pop that champagne cork. The real trick isn’t just in the number of transactions; it’s in the prices of the homes themselves. Opendoor, after all, makes its living by riding the ups and downs of prices. And right now, the market is as puzzling as a house with no doors. Prices have remained stubbornly high, defying the slump that should have come with the increased rates.

The S&P CoreLogic Case-Shiller U.S. National Home Price Index hit 331.5 in June, a whopping 50% higher than before the pandemic. The median home price in July 2025? A chunky $422,400, according to the National Association of Realtors. And still, prices may keep creeping up, though the market is a bit of a tightrope walk-there’s a housing shortage of biblical proportions, with some estimates claiming the deficit is in the millions!

And as if that weren’t enough, the gap between prices and income has never been wider. Homes are becoming less and less affordable, and that, my friends, could be a bit of a thorn in Opendoor’s side.

Sure, a drop in mortgage rates could help ease those monthly payments, encouraging more buyers to enter the market. But-and this is the real kicker-the “lock-in effect” unwinds, more homes will come onto the market, and prices could very well face the dreaded squeeze. Let’s not forget the weakening labor market, which may dull the demand for homes like a sword losing its edge.

What’s Next for Opendoor?

As the winds of the housing market blow in all sorts of unpredictable directions, Opendoor’s fate will depend on a few things: macroeconomic winds, the Fed’s careful maneuvers, and whether or not the housing market can wake from its slumber.

Jerome Powell, the wise (and cautious) wizard of the Fed, has already signaled that he’s walking a tightrope-afraid to let inflation get too out of hand, and cautious about the 2% target. So, while any signs of a brighter macroeconomic picture would surely be a boost for Opendoor, don’t expect miracles just yet. As investors update their expectations, they should remember that housing prices are already skating dangerously close to their limits. Any upside from here could be as fragile as a glass house on a windy day.

It will be a slow burn, but Opendoor may yet turn its fortunes around. Or it may find itself lost in the fog of market uncertainty. We’ll just have to wait and see. ⏳

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

2025-09-16 13:45