In September 2015, I took a calculated gamble on Nucor (NUE), the steel titan. Almost a decade later, Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) made the same bet. Was I ahead of the curve, or did Buffett simply follow the crowd? Perhaps neither. There is, however, a certain logic to why both of us ended up here-and it’s worth exploring if you’re considering adding this steelmaker to your portfolio.

Let’s break down why this giant of American industry remains a compelling buy.

The Anatomy of Nucor

At its most basic, Nucor makes steel. But that’s where the simplicity ends. Steel manufacturing is a process of extremes-either the ancient, inefficient blast furnace or the more modern, adaptable electric arc furnace. The former relies on expensive raw materials and is prone to volatility, its profits directly tied to global economic cycles. In contrast, Nucor has sidestepped much of this unpredictability by using electric arc mini-mills, which recycle scrap steel using electricity. This allows the company to maintain more control over its costs and profitability, reducing reliance on the often unstable global markets.

But Nucor’s true advantage isn’t simply the technology it employs; it is the scale at which it operates. As the largest steelmaker in North America, it is deeply embedded in the very structure of American industry. Yet, it isn’t content with mere commodity production. The company has long sought to diversify, expanding into higher-margin steel products and acquiring businesses that serve booming sectors like clean energy and data centers. The logic is simple: diversify, build, grow. This forward-thinking approach positions Nucor to thrive over the long haul, far beyond the cycles of the steel industry.

The Cyclical Nature of Steel: A Double-Edged Sword

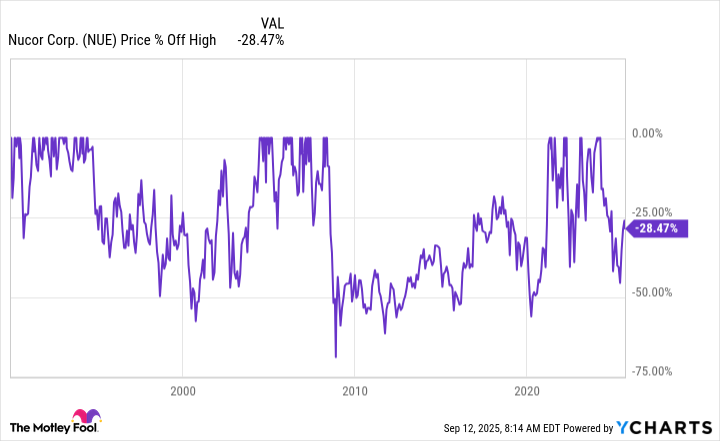

Steel is the backbone of industrial civilization-its ubiquity is a testament to its necessity. However, like all cyclical industries, the demand for steel rises and falls with the rhythm of the global economy. When times are good, demand soars; when they’re bad, production falters, and prices plummet. Nucor, though relatively insulated by its modern methods, is not immune to this. As the chart illustrates, steel prices-especially those of Nucor’s stock-tend to follow a familiar pattern: peaks and valleys.

This is the nature of the beast. Yet, for those with the patience to navigate this cycle, opportunities arise. Buffett, for example, has never been shy about buying quality businesses when they are out of favor, a principle clearly evident in his latest move. His strategy, though widely known, is still effective: buy when the price is right and hold for long-term value. Nucor, while cyclical, has proven itself a robust company that can weather these storms and emerge stronger.

Unlike many companies that falter under pressure, Nucor has displayed an enviable track record of resilience. This is not happenstance. It is the result of a long-term vision and consistent execution. The company has been a Dividend King for over fifty years-an exceptional feat, given the volatile nature of the steel business. The commitment to its shareholders is palpable, and the track record speaks for itself.

Consider also Nucor’s mantra: “higher highs, higher lows.” The company’s strategy is not just to endure downturns but to invest aggressively in growth during them. This year, the company has embarked on a $3 billion capital expenditure program, aimed at solidifying its position and preparing for the future. When these investments begin to yield returns, Nucor will likely emerge even more dominant, just as Buffett predicted.

Should You Buy Nucor Stock? The Case for a Contrarian Bet

There’s no sugarcoating it: investing in Nucor-like all steel companies-is not for the faint of heart. The cyclical nature of the industry means that stock prices can be highly volatile, and downturns can be painful. Conservative investors may shy away from such turbulence. However, if you’re willing to take a contrarian view and hold for the long term, the potential rewards are significant.

In my own experience, Nucor has become one of my best-performing investments, even in the wake of recent stock price declines. To many, this would be a red flag; to someone with a longer view, it’s an opportunity. Buffett’s decision to buy shares during a downturn is hardly surprising-it aligns with his philosophy of seeking long-term value. If you’re willing to take a similar approach, Nucor could very well reward you over the years to come.

The volatility might be uncomfortable, but if you follow Buffett’s example, the rewards of patience and perseverance may ultimately prove worth it. After all, Nucor has built a resilient business model that’s only going to become more valuable as the years go by. In the world of steel, Nucor stands as a testament to what can be achieved with sound strategy, smart reinvestment, and the willingness to bet on tomorrow.

If you can stomach the volatility, now might just be the moment to act-before others catch on. 📈

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR TRY PREDICTION

2025-09-16 13:17