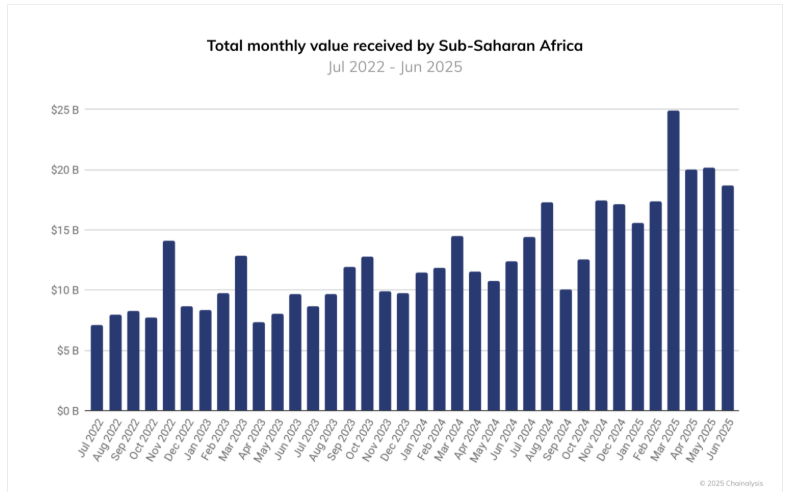

Sub-Saharan Africa is on a crypto binge, reaching a whopping $25 billion in monthly on-chain volume in March. Spoiler alert: Nigeria is leading the charge! 🌟

Nigeria: The Crypto Rockstar of Sub-Saharan Africa

So, folks, Sub-Saharan Africa (SSA) had a major fintech fling in March, hitting an eye-popping $25 billion in on-chain volume. That’s a record since-wait for it-January! Chainalysis, our techy friends in blockchain security, noted this spike was like, totally against the grain of what everyone else was up to.

Fast forward a couple of months, SSA’s monthly love affair with crypto dropped to $20 billion. But hey, it’s still cool with over $15 billion in the wallet since the new year started! And guess who was flirting most? Centralized exchange activity in Nigeria, my crypto cats.

“People there are suddenly treating crypto like a hot new boyfriend after a sudden currency breakup,” says the Chainalysis report. “More folks are hoarding crypto as an anti-inflation BFF, and boom-your already inflated wallet now looks like a small fortune in local currency.”

Between July 2024 and June 2025, the SSA region got more than $205 billion in on-chain value, up by 52% since the year before. That’s like when you finally find out your favorite show is on Netflix – good news arrives! But not quite as awesome as Asia-Pacific or Latin America, which still hold the lead.

Bitcoin and the Stablecoin Squad Are Taking the Stage!

Over the same period, Bitcoin (which is now just BTC for everyone) was basically having a monopoly on fiat-to-crypto love affairs. Nigeria scored 89% Bitcoin love, South Africa 74%-and these numbers are flirting on steroids compared to the whole USD-based market.

“BTC’s strutting around like the king of crypto because it’s also the diva of stores of value and the VIP door to the crypto party, especially in the currency-challenged clubs,” Chainalysis explains.

“Meanwhile, USDT is more of the friendly neighbor next door in Nigeria, snagging 7% of crypto buys, versus the modest 5% seen in FPS-rich markets,” the report added, not without a smirk.

Chike Okonkwo from YDPay (who, by the way, is their marketing guy-props for consistency) says BTC’s popularity in Nigeria is as believable as Tina Fey’s Ellen makeover: trust and accessibility-are you surprised?

“Nigerians are super sensible about crypto,” Okonkwo reveals. “Bitcoin’s like the classic comfy pajama set-recognizable, reliable, but also comes in flashy sleek packages. And stablecoins? They’re your Sunday funday-fiat savings without the FX drama. What matters most to Nigerians is fighting inflation, snappy value, and fairness.”

According to Okonkwo, Ethereum (ETH) and other altcoins are trendy for trading, making them the metaphorical stocks you’d buy for extra cash-not unlike that Pinterest board you swore you’d start.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-16 06:58