Oh, what a delightful mess we find ourselves in! The stock of Metaplanet, that most audacious of Bitcoin proxies, has plummeted like a startled penguin off a Japanese cliff, correcting a staggering 8.37% on the Tokyo Stock Exchange. One might say it’s been on a 70% rollercoaster from its June highs of 1,900 JPY, all while the financial bigwigs-UBS, Goldman Sachs, and Morgan Stanley-have been busy as terriers herding short positions like they’re at a particularly chaotic garden party. 🐾

Financial Giants Build Short Positions for Metaplanet Stock

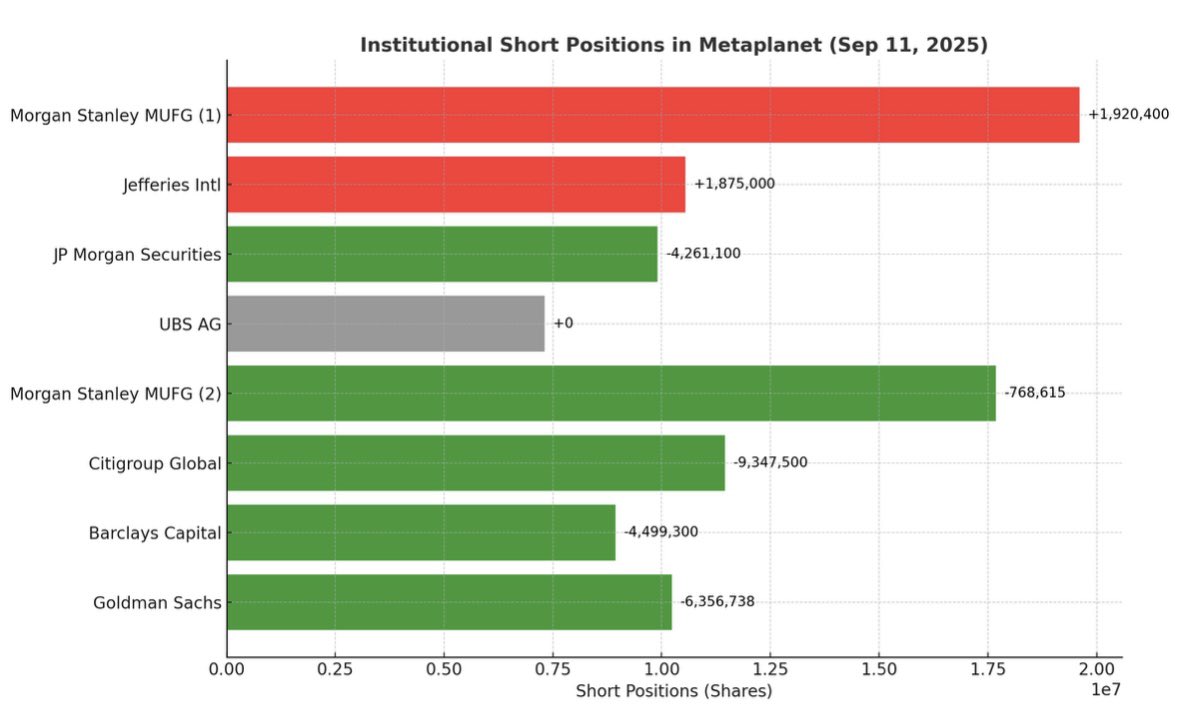

Behold! The last week has seen a veritable ballet of institutional short positions. Some banks have trimmed their wagers, while others have expanded with the enthusiasm of a man who’s just discovered the last slice of pie. Morgan Stanley MUFG, our old friend, remains the king of the short pile, clutching 20 million shares (2.83%) after adding 1.92 million. Oh, but they trimmed 768,000 shares first-how considerate of them! 🤷♂️

Metaplanet stock short positions | Source: Vincent

Jefferies International, ever the overachiever, has expanded its short to 10.54 million shares, while UBS AG has returned to the fray with a new position of 7.31 million. Meanwhile, Goldman Sachs, JP Morgan, and company have been trimming their sails like sailors avoiding a storm. What a charmingly chaotic romp! 🎭

Now, the cost to borrow Metaplanet stocks has soared to an annualized 54% at Interactive Brokers-a price that would make a champagne-soaked toff think twice about borrowing a hatpin. This scarcity of lendable stock is turning shorting into a game of Russian roulette with a side of expensive caviar. 🐟

Analysts, those paragons of wisdom, suggest this could leave our remaining shorts vulnerable to a squeeze if a positive catalyst, such as Bitcoin purchases or index inflows, decides to waltz into the room. One might say it’s a high-stakes game of “Wait for it…” 🕺

More Bitcoin Purchases Ahead?

Earlier this month, Metaplanet and its shareholders advanced their Bitcoin acquisition strategy with the approval of a new funding mechanism. Investors, ever the optimists, backed a proposal to raise up to 555 billion JPY ($3.8 billion) via preferred shares. This puts the Japanese firm on track to achieve its 30,000 BTC Treasury goal by year-end. Some analysts believe the recent stock correction is a “buy-the-dip” opportunity, as the stock is “undervalued”-a term as subjective as a man’s opinion on pineapple on pizza. 🍕

Moreover, Bitcoin’s price action is a tale of two halves: trying to breach $116,000 while facing resistance like a polite Englishman refusing to interrupt a conversation. One might say it’s a dance of caution and ambition, with the floor as slippery as a greased walnut. 🐿️

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

2025-09-15 15:00