The market cap of Oracle, that faceless automaton of enterprise software, has swelled from a paltry $200 billion to $922 billion in five years, a mechanical inevitability as inscrutable as the algorithms it sells. To suggest it might breach $2 trillion by 2030 is to whisper a prophecy into the void, where numbers bloom like mold on forgotten spreadsheets.

If this ascent materializes, Oracle will join a pantheon of digital oligarchs-Nvidia, Microsoft, Apple, and others-each a bureaucratic leviathan in the $2 trillion club. Broadcom and Meta Platforms, currently clinging to the periphery, require merely 16% more growth to complete this surreal tableau of excess. The S&P 500 now trembles under the weight of the “Ten Titans,” whose combined 39% share resembles a corporate coup disguised as market logic.

Oracle’s case for inclusion in this cabal rests on a single, unyielding claim: its cloud infrastructure will outpace AWS in four years. A claim as audacious as it is arbitrary, yet one that has been etched into quarterly forecasts and multi-cloud data center blueprints with the solemnity of divine law.

A Labyrinth of Data Centers and Delusion

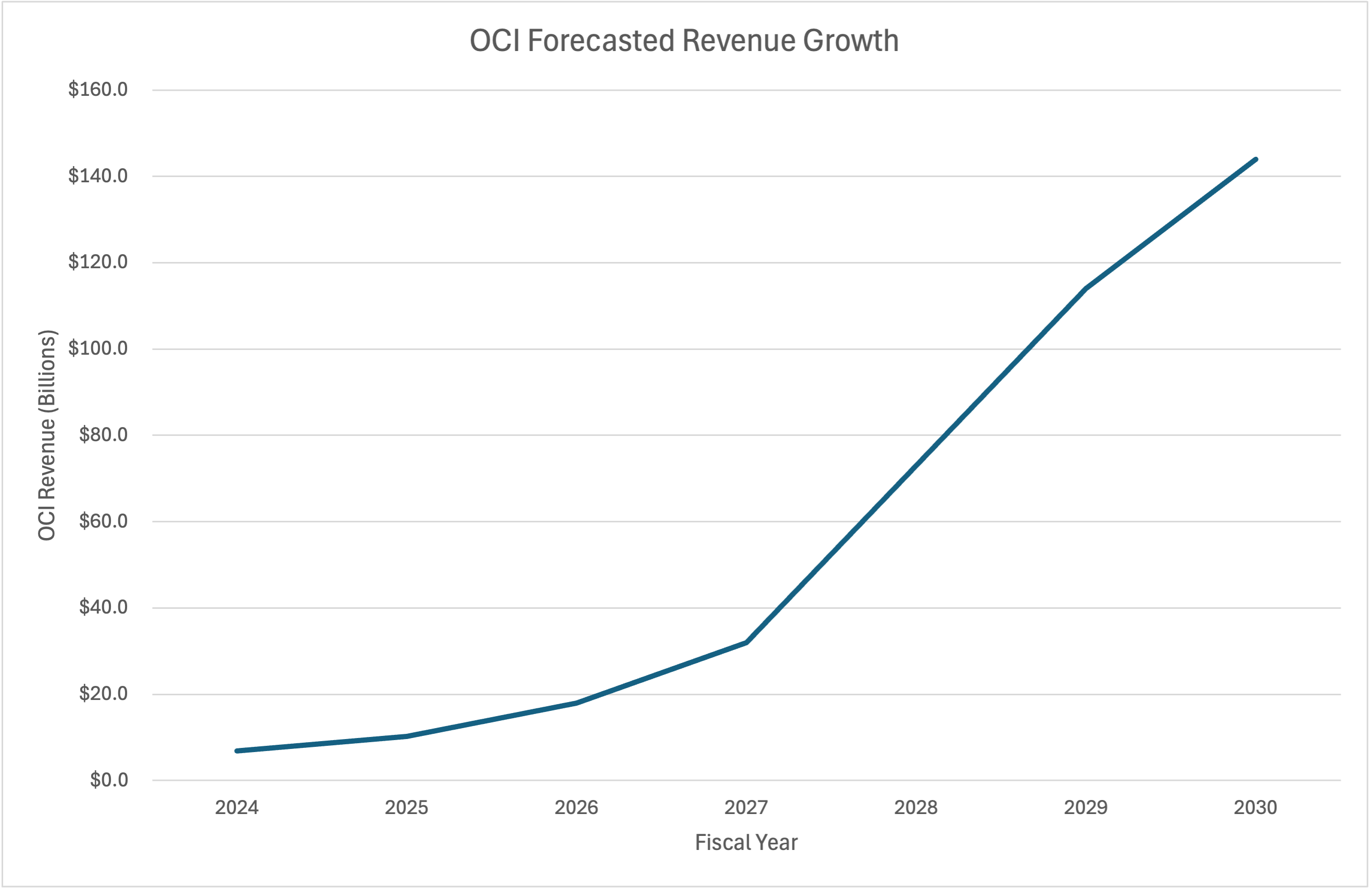

Oracle’s fiscal 2026 earnings release-a document thicker than a tax code-predicted OCI revenue would balloon from $18 billion to $144 billion by 2030. This is not growth; it is a bureaucratic fever dream, a numbers game where the rules are written in vapor. For context, Amazon Web Services generated $108 billion in 2024, a figure Oracle now treats as a historical footnote.

The path to this utopia involves 71 multi-cloud data centers, their construction proceeding like a Sisyphean ritual. Oracle promises 37 new facilities for Amazon, Microsoft, and Alphabet, as if these rivals are not also building their own labyrinths of silicon and shadow. The latest quarter saw 10 data centers added, a pace that suggests Oracle treats reality as a suggestion.

The Illusion of Efficiency

Oracle’s next-generation data centers are marketed as marvels of efficiency, yet they resemble nothing so much as a Kafka novel written in SQL. Their “bare metal instances” and “microsecond-latency RDMA networking” are less technological breakthroughs than incantations to placate investors. The company’s pricing bundles, which combine cloud services with enterprise software, are not strategies but bureaucratic tautologies: “We are cheaper because we say we are.”

Here, Oracle mirrors Broadcom, another corporate automaton that sells custom XPU chips as alternatives to Nvidia‘s GPUs. Both companies thrive in a paradoxical ecosystem where they are both collaborators and competitors with the very entities they seek to disrupt. It is a dance of symbiosis and strangulation, performed to the tune of investor expectations.

A Gamble Built on Phantom Profits

If Oracle’s OCI revenue forecasts are realized, its stock could double. But this is a gamble where the house always wins. Consider AWS‘s $1.5 trillion valuation-a figure Oracle now treats as a baseline. The logic is circular: OCI must surpass AWS to justify its $2 trillion market cap, which in turn requires it to surpass AWS. It is a bureaucratic Möbius strip.

Oracle’s current spending spree-necessary to build this infrastructure-renders its earnings meaningless. The company’s future margins, it claims, will improve once the data centers are operational. This is the corporate equivalent of promising utopia after the next fiscal quarter.

To buy Oracle stock is to purchase a talisman in a ritual whose rules are known only to the high priests of Wall Street. To hold it is to accept the absurdity of a world where numbers, not value, dictate destiny. Yet some investors, ever the optimists, choose to wait and see-a passive act of faith in a system that demands nothing less than total surrender.

🌀

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

2025-09-15 12:58