Palantir Technologies (PLTR) has been the talk of the town, a stock so hot it could melt a thermometer. Its artificial intelligence platform, a veritable Swiss Army knife for organizations and governments, has sparked a firestorm of demand. Yet, as the old saying goes, “the flame that burns twice as bright burns half as long.”

Palantir’s stock has soared 5x in a year, its market cap now a gilded $385 billion. But here’s the rub: such meteoric rises often come with a side of “what happens when the meteor lands?” Enter the underdog with a blueprint for the future-ASML Holding (ASML), the Dutch titan of semiconductor machinery.

ASML, the wizard behind the curtain of chip manufacturing, wields a near-monopoly on extreme ultraviolet lithography (EUV) machines. These are the tools that carve silicon into the future, enabling everything from smartphones to self-driving cars. A company that turns “magic” into machinery, if you will.

Its Q2 net bookings surged 40% to 5.5 billion euros, and while 2025 guidance seems modest, the company’s recent resilience to tariffs and a 34% revenue jump in H1 2025 suggest a tale yet untold. The global thirst for AI chips? A thirst that could outlast the Sahara.

Consider this: McKinsey estimates $3.1 trillion will be spent on AI hardware through 2030. SEMI forecasts semiconductor equipment spending to double by 2028, with “2nm and below” tech seeing a funding boom. ASML’s EUV machines, the keys to this kingdom, are poised to unlock fortunes.

The Schemer’s Dilemma: Palantir’s Premium or ASML’s Prudence?

Palantir now trades at 114x sales-a price tag that screams “investment” but whispers “speculation.” Its growth must be a sprint, not a marathon, to justify the premium. Meanwhile, ASML’s 8x sales ratio is the calm in the storm, a bet on fundamentals rather than fantasies.

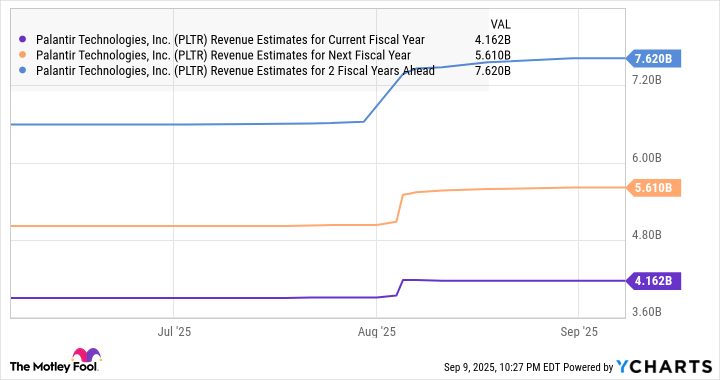

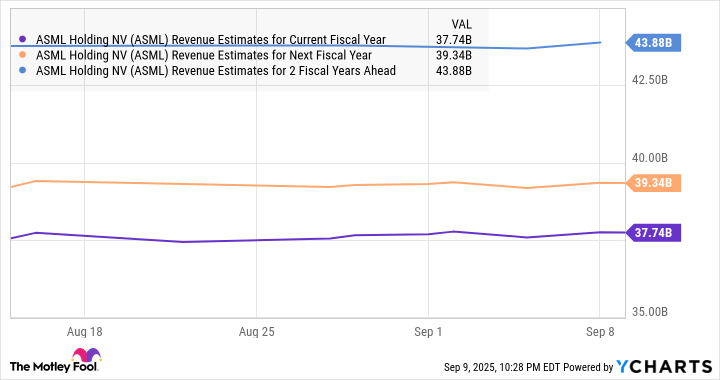

Even if Palantir hits $7.6 billion in revenue, its valuation could crumble under its own weight. ASML, with $44 billion in projected revenue, could command a $352 billion market cap. A 24% gap? A bridge, not a chasm, in the grand scheme of things.

The market, that fickle lover, may yet lower Palantir’s curtain if growth falters. ASML, however, plays the long game-a Dutchman’s patience in a world of instant gratification. The future belongs to those who build the tools, not just the apps.

So, while Palantir dazzles like a fireworks show, ASML quietly forges the steel. In the end, the question isn’t who will be worth more, but who will be remembered as the architect of the age.

🚀

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-15 03:03