The city of Wall Street hums with the same old lies. Two titans-Apple (AAPL) and Alphabet (GOOG)-stand like monoliths in the fog, their shadows stretching over market caps that could swallow smaller players whole. One wears a Cupertino crown, the other a Mountain View disguise. But crowns rust, and disguises slip. The question isn’t whether they’ll dominate-it’s which one will outlast the other when the lights go out.

I’ve seen enough balance sheets to know the truth: both are playing the long game. But one is cheating. The other is waiting for the table to collapse.

Both businesses want to maintain the status quo

Apple’s throne is built on an iPhone, a device that glows like a modern-day oracle. Its ecosystem? A walled garden where the flowers never wilt. Alphabet, meanwhile, hoards the keys to the kingdom-Google’s search bar is the modern-day water cooler, though it’s starting to leak. Generative AI looms like a ghost in the machine, whispering that the game might be rigged. But Google? It’s still got the fastest horses in the race, even if the track’s cracking.

A court ruling let Alphabet keep paying Apple to be the default search engine on iPhones-a cash grab that smells like a dying man’s last gamble. Apple, on the other hand, hasn’t invented a new trick since the ’60s. Its next big thing? A mystery novel with a cliffhanger ending. Investors are holding their breath, but the market doesn’t care about hope. It cares about results.

Both companies are like old detectives who’ve forgotten how to solve crimes. They shuffle through the same motions, hoping the world won’t notice they’ve run out of answers. Alphabet’s got the better alibi. Apple’s just hoping the jury nods off.

Winner: Tie

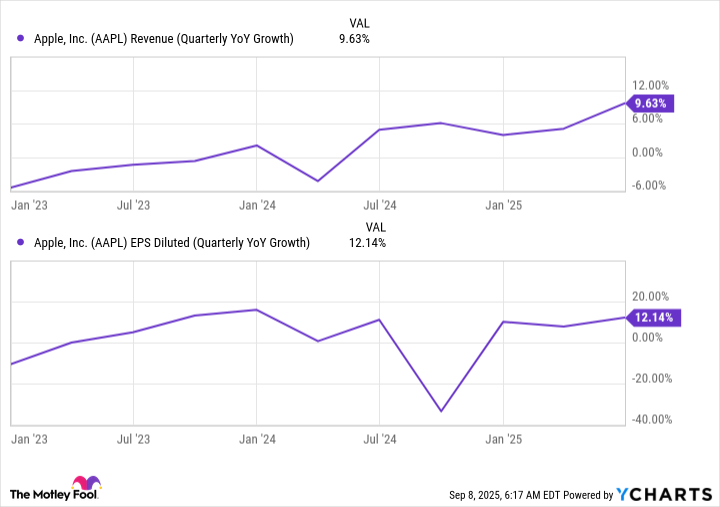

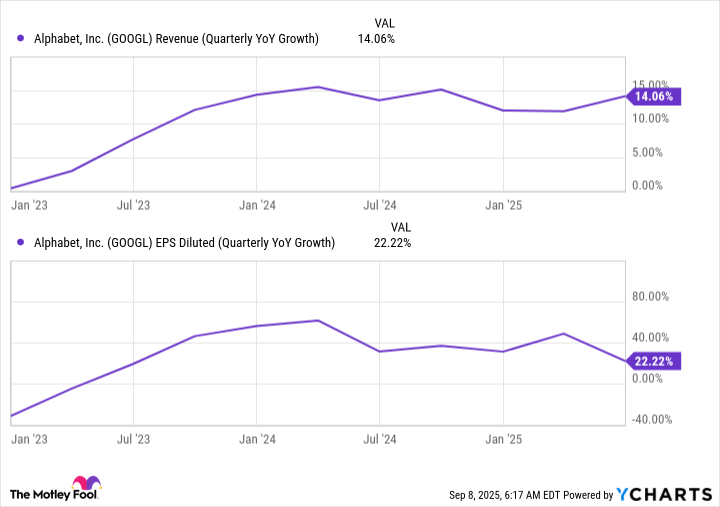

Alphabet is putting up better growth figures

Apple’s growth since 2023? A flatline with a few tremors. Q3 FY2025 gave it a 10% revenue bump and 12% EPS growth, but that’s like a corpse twitching in a morgue. Alphabet? It’s dancing on the grave. Q2 revenue jumped 14%, EPS up 22%-numbers that scream louder than a neon sign in a blackout. The pattern’s clear: Alphabet’s engines are still hot. Apple’s are idling.

Google Cloud and Waymo aren’t just sidekicks-they’re the muscle. Apple’s got nothing comparable but a vault full of cash and the hope that nostalgia pays dividends. It doesn’t. Not for long.

Alphabet’s growth isn’t a fluke. It’s a slow, silent takeover. The numbers don’t lie-they just don’t talk back.

Winner: Alphabet

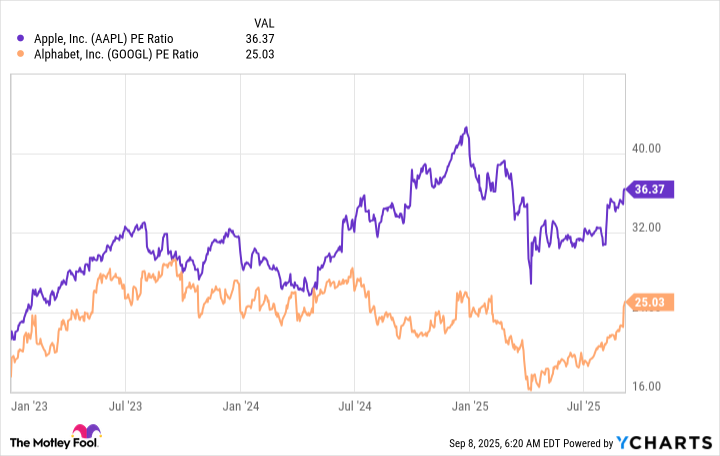

Alphabet’s stock is far cheaper

Valuation’s the knife between the ribs. Apple’s stock is a luxury car with a dead battery-expensive, but stuck in neutral. Alphabet’s? A used sedan that still purrs. Since mid-2024, their P/E gap has widened like a canyon. Apple’s price-to-earnings ratio? A monument to complacency. Alphabet’s? A bargain basement for dreamers.

Apple’s valuation is a house of cards in a hurricane. Alphabet’s is a brick wall with a leaky roof. One’s a gamble. The other’s a guarantee. Pick your poison.

Winner: Alphabet

The market’s a ruthless editor. It cuts the fat, leaves the bones. In this duel, Alphabet’s got the sharper blade. Apple? It’s still polishing the hilt. 🕵️♂️

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2025-09-13 16:08