Warren Buffett, that paragon of fiscal prudence, has spent decades curating a portfolio so vast it could rival the Library of Congress. His investments in Apple-$38 billion over seven years-were a mere prelude to the true spectacle: a $77.8 billion commitment to repurchasing shares of his own company since 2018. One might call it magnanimity; others might murmur of self-regard. Either way, it is a performance of grandeur.

Buffett’s Hallowed Principles: A Satire in Five Acts

Buffett, that apostle of value investing, has long adhered to a creed of “steady growth,” “reliable profits,” and “strong management.” His portfolio, a mosaic of Coca-Colas and Duracells, is less a collection of businesses than a shrine to the virtues of patience and dividend checks. Yet for all his piousness, the man has never paid a dividend to Berkshire shareholders. Instead, he has opted for buybacks-a quieter, more fiscally discreet way to return capital, as though returning money to shareholders were a sin against shareholder-friendly aesthetics.

Coca-Cola, that amber-hued relic of Americana, has been a particular favorite. Buffett’s 400 million shares, purchased between 1988 and 1994 for $1.3 billion, now loom as a $27.1 billion asset. The dividends alone-$816 million in 2025-suggest a quiet triumph, though one wonders if the beverage giant’s executives ever paused to consider their role in this financial pantomime.

Berkshire’s subsidiaries, from Dairy Queen to GEICO, form an architectural excess of capitalism, a sprawling estate of brands and utilities. These cash cows, as they are quaintly termed, fund Buffett’s relentless pursuit of value-a pursuit that often circles back to the company itself. The man is a capitalist in the classical sense: a man who owns the means of production and, when in doubt, buys more of it.

Since 1965, Berkshire Hathaway has delivered a compound annual return of 19.9%, a figure so absurdly superior to the S&P 500’s 10.4% that it reads like a typo. Invest $1,000 in 1965, and you would now possess $44.7 million. Invest in the S&P 500, and you’d have $342,906-a sum so modest it might as well be pocket change. One cannot help but admire the elegance of the arithmetic.

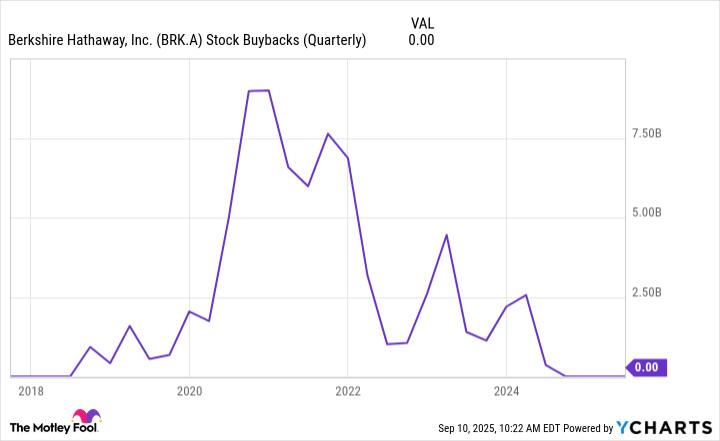

The Great Buyback Gambit

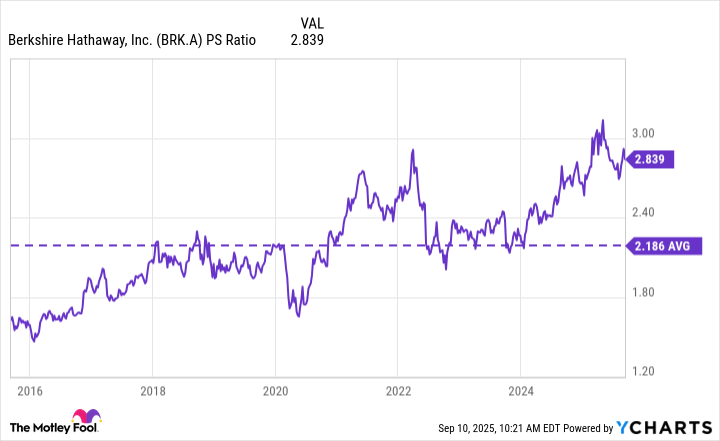

Berkshire’s market cap now exceeds $1 trillion, a figure so vast it defies comprehension. Buffett, ever the prudent steward, has spent $77.8 billion repurchasing shares since 2018-a sum that would make even Scrooge McDuck blush. This is not a return to shareholders but a grand gesture of fiscal vanity, a way to reduce the number of shares outstanding while preserving the illusion of growth. The stock’s P/S ratio, currently 2.84, suggests a valuation that even a Wall Street alchemist might struggle to justify. One suspects the buybacks have paused not out of financial prudence but because the price has become a bit too absurd for even Buffett’s standards.

The pause in buybacks, however, may signal a more profound shift. Buffett, who will step down at year’s end, is handing the reins to Greg Abel, a man whose approach to capital allocation remains a mystery. Perhaps Abel will see value in returning money to shareholders; perhaps he will follow the same path of self-aggrandizement. The future of Berkshire’s buyback program is as uncertain as the weather in Kansas-though one suspects the ritual will resume once the numbers look slightly more palatable.

Epilogue: A Horse of a Different Color

Berkshire’s cash reserves-$344 billion, a sum that could buy a small country-are a testament to the company’s fiscal discipline. Yet one cannot help but wonder if the pause in buybacks is less a matter of valuation and more a matter of organizational continuity. Buffett, after all, has spent decades building a cathedral of capitalism, and it is no small thing to hand the keys to a new steward. The buybacks may return, or they may not. Either way, the show goes on. 🐴

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Bitcoin, USDT, and Others: Which Cryptocurrencies Work Best for Online Casinos According to ArabTopCasino

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

2025-09-13 12:13