Investing, that grand charade of modern capitalism, is often sold as a game of wit and patience. Yet here we are, clutching a $500 note like a talisman, hoping to outsmart the market’s labyrinthine whims. Exchange-traded funds (ETFs), those glorified index ponies, promise simplicity. But let us not confuse simplicity with certainty-after all, even a stopped clock is right twice a day.

The financial alchemists have conjured thousands of ETFs, each a vial of distilled greed or hubris. Some chase sectors like hounds after a hare; others, like modern-day astrologers, divine fortunes from geographic constellations or the mystical properties of “value” and “growth.” But let us focus on two Vanguard offerings-less a roadmap to riches than a pair of dueling canaries in a coal mine.

Vanguard High Dividend Yield ETF

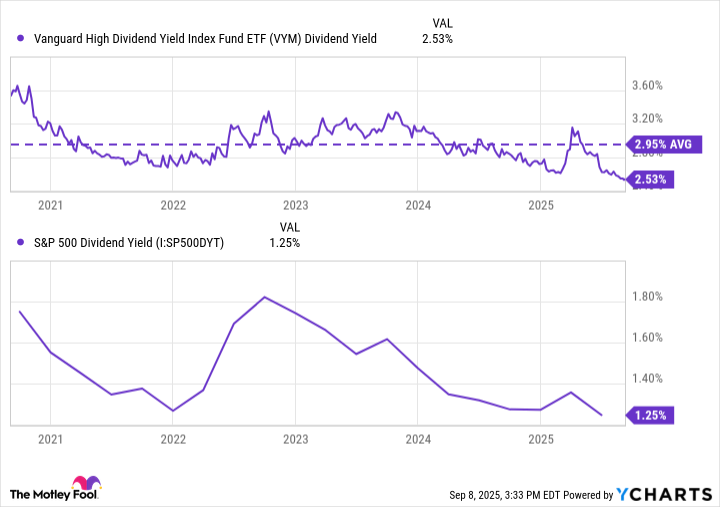

Dividends, that quaint Victorian relic of corporate generosity, are often touted as a “cushion” against market tremors. A charming notion, if only shareholders weren’t occasionally left with a cushion of sawdust. Consider the Vanguard High Dividend Yield ETF (VYM), a portfolio of 580 large-cap stocks that, like a well-heeled aristocrat, distributes 2.5% of its wealth to shareholders annually. Twice the S&P 500’s meager offering, yet still a fraction of what these companies might squander on executive jet charters.

Among its holdings: JPMorgan Chase, ExxonMobil, Walmart, and Coca-Cola. A veritable hall of fame for corporations that have mastered the art of shareholder appeasement while dodging existential crises with the grace of a bureaucrat avoiding accountability. Financials (21.6%), industrials (13.6%), and healthcare (11.6%) dominate-a diversified diet of sectors that, like a well-tailored suit, looks impressive until the seams start fraying.

Reinvesting dividends? A noble endeavor, if you fancy watching a glacier carve a canyon. A $500 stake yields $12.50 annually-a sum sufficient to purchase a single cup of overpriced coffee and a sigh of resignation. Yet! If one possesses the patience of a saint and the faith of a cultist, this “snowball effect” might one day roll into something resembling wealth. Or a very expensive napkin.

Vanguard Total International Stock ETF

Diversification, that financial mantra, is less about balance and more about hedging your bets against the inevitable collapse of one’s chosen Ponzi scheme. The Vanguard Total International Stock ETF (VXUS), with its 8,600 stocks spanning developed and emerging markets, is a global buffet of opportunity. Or, as the more cynical might say, a roulette wheel with a 5% house edge.

Europe (39%), emerging markets (27.2%), and the Pacific (25.4%) form VXUS’s geopolitical stew. Developed markets, with their “mature economies” and “stable stocks,” are the financial equivalent of a grandmother’s knitting-safe, predictable, and prone to unraveling. Emerging markets, meanwhile, promise the thrill of volatility, like betting on a racehorse that might trip over its own hooves. Brazil, India, and China-countries where growth is a religion and regulation a suggestion-comprise the spice in this global dish.

To allocate $500 here is to toss a pebble into the Grand Canyon of uncertainty. It is a gesture, a nod to the gods of diversification, but whether it placates them remains a matter of faith. After all, what is an international portfolio but a way to spread your losses across continents?

So, with $500 and a dash of skepticism, one might dabble in these ETFs. But remember: markets are not puzzles to be solved, but riddles posed by a mischievous deity. The true art is knowing when to laugh. 🤷♂️

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-12 14:51