One might, with a jaunty wave of the quill, dismiss Navitas Semiconductor (NVTS) as a rather dashing but somewhat reckless young man who has yet to master the art of balancing his pocketbook. The stock, dear reader, has been floundering since its SPAC debut in 2021, and its revenues, though modest, are outpaced by its expenditures. A most unbecoming spectacle, one might say, akin to a gentleman attempting to waltz in boots.

Yet, for those with a penchant for spotting potential in the most unlikely of candidates-think of it as the stock market’s version of rescuing a promising sapling from the clutches of a well-meaning but overzealous gardener-Navitas might just warrant a second glance. The next five years, one suspects, will see this young upstart don a new suit and strut its stuff with considerably more panache.

What’s Navitas, If You’ll Excuse the Phrase?

Navitas, in its most elegant guise, is the sort of company that makes one wish for a monocle to better appreciate its audacity. It has taken the stodgy old silicon, that workhorse of the semiconductor world, and replaced it with silicon carbide (SiC), a material so efficient it would make a Victorian inventor weep with envy. This SiC, one might imagine, is the Jeeves to silicon’s bumbling Bertie, allowing circuits to handle more power, more heat, and yet remain as cool as a cucumber in a summer breeze. Meanwhile, Navitas has also mastered the art of gallium nitride (GaN), which, like a diminutive but sprightly footman, accomplishes the same feats in a fraction of the space. From phone chargers to data centers to utility grids, it’s the sort of innovation that would have a man like J.P. Morgan scribbling notes in the margins of his napkin.

The only snag, of course, is that the world has yet to fully embrace the sort of engineering overhauls required to deploy this technology. But then, progress is rarely a matter of haste-it’s more a question of whether the butler has remembered to polish the silver for the next grand dinner party. And the signs, one must admit, are promising.

Changes Ahead, My Dear Sir

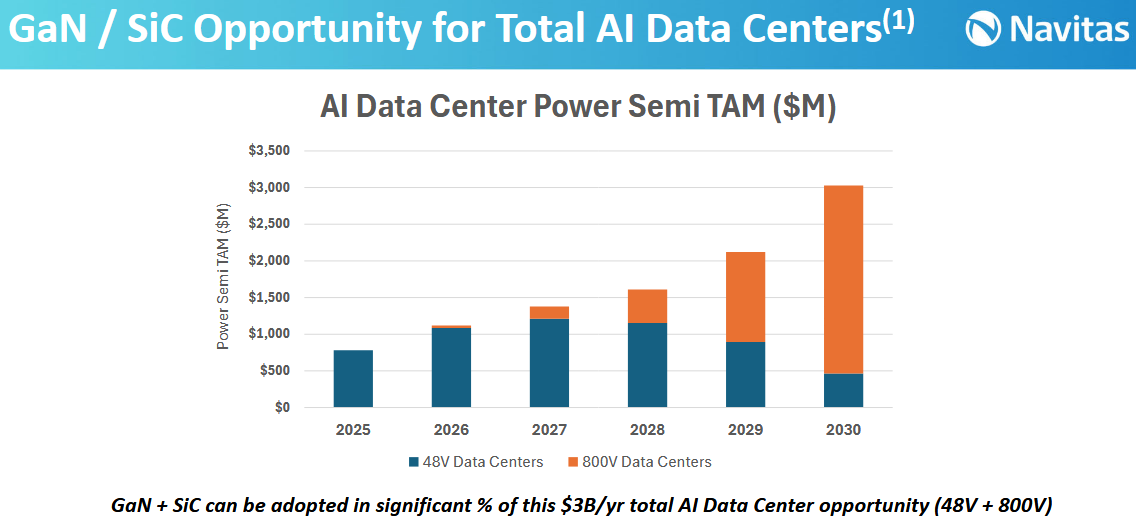

The future, it seems, is all about 800-volt equipment-a most modern affair. For electric vehicles, this means swapping their 400-volt batteries for something more robust, while data centers, those insatiable beasts of computation, will leap from 48-volt systems to the same 800-volt platforms. The result? A reduction in power consumption so elegant it would make a Victorian housemaid gasp at the efficiency. And for data centers, particularly those devoted to artificial intelligence, this means a significant dent in their ongoing operational costs. A most admirable achievement, one might say, if somewhat less thrilling than a game of bridge at Ascot.

Navitas, ever the optimist, believes this transition will begin in earnest next year and gather pace like a well-timed horse race, reaching a crescendo by 2030. By then, the opportunity, they reckon, will be worth $3 billion annually. One can almost hear the clink of champagne glasses in anticipation.

Other industries, too, are likely to follow suit, though they may do so with the same enthusiasm one might reserve for a trip to the dentist. Progress, after all, is rarely painless.

A Healthy Dose of Third-Party Optimism

Navitas is not alone in its bullish outlook. Industry research firms such as Global Market Insights and Straits Research have also taken note, with the former predicting a 25% annualized growth rate for SiC and GaN semiconductors through 2032. It’s the sort of consensus one might expect at a particularly successful garden party, where all the guests are in agreement and the tea is just the right temperature.

That said, investors would do well to remember that this stock is still a bit of a hoyden-charming, yes, but not yet fully refined. Its small size means it dances to a different tune, one that may not always align with the more stately waltz of the broader market. A dash of caution, therefore, is as much a necessity as a well-tied cravat at a ball.

And there we have it, dear reader: a company that, for all its current stumbles, may yet become the toast of the semiconductor world. Whether you choose to invest or not, it’s a most diverting story to follow. 🚀

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

2025-09-11 19:18