Ah, Bitcoin, that ever-dramatic diva of the financial world. Currently twiddling its digital thumbs between a price range of $115,000 and $110,000, it seems the cryptocurrency is having a quiet moment of self-reflection. A tight little consolidation period, as if the bulls are trying to work up the courage to charge, while the relentless selling pressure is doing its best impression of a weighty anchor. Tension fills the air, yet the momentum ever-so-slightly leans towards bullish, with buyers stubbornly holding key support levels. Don’t worry, though, it’s not all doom and gloom-there’s hope for the next great breakthrough!

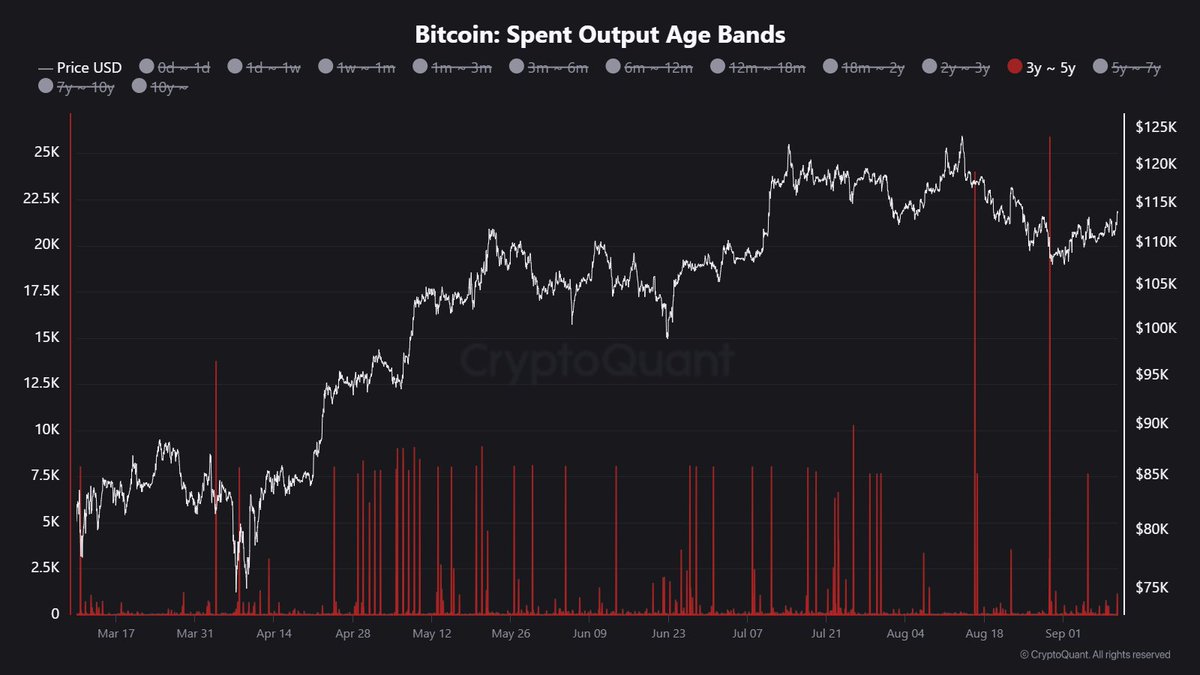

Now, in an unexpected twist worthy of a Netflix series, analyst Maartunn comes out with a juicy tidbit: dormant Bitcoin coins are stirring from their slumber. Oh yes, these long-forgotten treasures, left undisturbed for years, are now making their grand entrance onto the blockchain. It seems the long-term holders, the ones who never flinch at volatility, are shifting positions. A change in the wind? Possibly. It’s like a new season of a reality show where Bitcoin’s biggest players finally decide to show their hand-and this time, it’s about more than just personal drama.

For those wondering if this means a big shift in market dynamics, the answer is a resounding yes. These moves aren’t just some routine shuffle; they could be the signal of capital rotating between Bitcoin and Ethereum. You know, the usual suspects. And as these dormant coins rattle to life, it’s clear that the stage is set for the next episode of this crypto soap opera.

Bitcoin’s Big Awakening: Is it a Breakout or Just a Nap?

Hold onto your wallets, folks. According to Maartunn, over 604,000 BTC, tucked away in the digital equivalent of an attic, have made their way back on-chain since March 9, 2025. This is not a small feat; it’s one of the largest moves in Bitcoin’s long-term holder behavior in recent memory. These are the coins that have lived through multiple cycles-like seasoned veterans who know better than to panic. The market is watching, breath held, to see what happens next.

Why the sudden movement? Analysts are split. Some are screaming “Profit-taking!” after seeing Bitcoin surge toward $115,000. These whales, those large holders who never make a decision without considering the entire ocean of possibilities, might just be cashing out after their long wait. They’ve seen enough of the peaks and valleys and could be ready to make their exit. Sounds familiar, doesn’t it?

Others, however, suggest it’s all part of a greater plan: capital rotation. From Bitcoin to Ethereum, they say. Who could blame them? Ethereum’s transaction fees are looking downright attractive, and let’s not forget its rising prominence in DeFi and layer-2 ecosystems. It’s like the cool kid at the party that everyone’s suddenly paying attention to. And perhaps, just perhaps, Bitcoin holders are moving their chips to greener pastures.

Regardless of whether this is a grand profit-taking move or just a cheeky capital shuffle, one thing is certain: Bitcoin’s dormant supply is awake, and it’s causing quite a stir. Who could have predicted such drama? This marks a critical juncture in the current cycle, so get your popcorn ready.

Bitcoin’s Price: Stuck in Traffic or Just Building Momentum?

Bitcoin, ever the drama queen, is currently chilling around $113,897. After bouncing from the deep, dark lows of $110,000, it seems like BTC is getting its act together. The daily chart paints a hopeful picture of recovery, but there’s a catch. A major roadblock looms: the 50-day SMA sitting just above at $114,587. This is the equivalent of a pesky traffic jam that every bull has to navigate before hitting the open road. If they can break through, a price surge towards $116,000 (and maybe even $123,217) could be on the horizon. Fingers crossed, eh?

On the downside, the 100-day SMA at $112,204 provides a modest cushion, while the 200-day SMA at $102,077 remains a crucial long-term lifeline. As long as Bitcoin hovers above $112,000, the bulls can breathe easy. But if they fail to clear that 50-day hurdle, we might see another round of sideways consolidation. So, buckle up. It’s going to be an interesting ride.

The current structure suggests Bitcoin is gearing up for a move-again. Whether that move leads to a breakout or more stagnant traffic depends entirely on how it handles the resistance ahead. Let’s hope it doesn’t get stuck in another loop of indecision.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- Celebs Slammed For Hyping Diversity While Casting Only Light-Skinned Leads

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- USD RUB PREDICTION

- TV Shows With International Remakes

- 8 Board Games That We Can’t Wait to Play in 2026

- All the Movies Coming to Paramount+ in January 2026

2025-09-11 16:12