When we speak of “monster stocks,” we are not indulging in hyperbole. These are companies that have already delivered extraordinary value to their investors, and whose potential for future growth seems as vast as the industries they dominate. Today, two such entities stand out-one leading the charge in the weight loss drug market, and the other commanding the burgeoning field of artificial intelligence (AI). Both operate in sectors projected to explode in size over the next decade, making them worthy of attention for anyone with a stake in the future.

The weight loss drug market, currently valued at $28 billion, is expected to swell to $95 billion by 2030, according to Goldman Sachs Research. Meanwhile, the AI market, already worth billions, could reach $2 trillion by the early 2030s. These figures are not mere projections; they are warnings-or promises-of seismic shifts in how we live and work. To ignore them is to risk being left behind. Let us examine each company in turn.

Eli Lilly: The Weight Loss Revolution

Eli Lilly (LLY) has risen more than 130% over the past three years, driven by its groundbreaking weight loss drugs. Its flagship product, tirzepatide, is marketed under two names: Mounjaro for type 2 diabetes and Zepbound for weight loss. Though initially intended for diabetes, doctors have prescribed it widely for weight management, creating demand so intense that it briefly landed on the FDA’s drug shortage list.

Tirzepatide is no longer in short supply, but its popularity endures, fueling remarkable growth for Eli Lilly. In the most recent quarter, revenue surged by 38%, exceeding $15 billion. Yet this is not merely a one-trick pony. Eli Lilly boasts a diverse portfolio of pharmaceuticals, spanning multiple therapeutic areas. However, its weight loss division is poised to be the engine of future growth.

What could further accelerate this momentum is the potential approval of an oral weight loss drug-a significant departure from today’s injectable options. Eli Lilly has completed successful clinical trials for orforglipron, a pill-based candidate, and plans to seek regulatory approval soon. If approved, this innovation could lower barriers to access, broadening the market and solidifying Eli Lilly’s dominance.

In short, Eli Lilly’s leadership in the weight loss drug market has transformed it into a formidable force. With both market expansion and internal innovation on its side, the company appears well-positioned to maintain its upward trajectory.

Taiwan Semiconductor Manufacturing: The Backbone of AI

When people think of AI, they often picture Nvidia, the titan of AI chips. But behind every Nvidia chip lies another giant: Taiwan Semiconductor Manufacturing Company (TSMC). Without TSMC, Nvidia’s designs would remain just that-designs. TSMC manufactures not only Nvidia’s chips but also those of other industry leaders like Advanced Micro Devices and Broadcom.

This dual reliance gives TSMC a unique advantage. It benefits not only from Nvidia’s success but also from the collective growth of the entire semiconductor ecosystem. As companies like Meta Platforms and Alphabet pour resources into AI infrastructure, TSMC stands to gain. These firms will turn to chip designers like Nvidia, who in turn depend on TSMC for production.

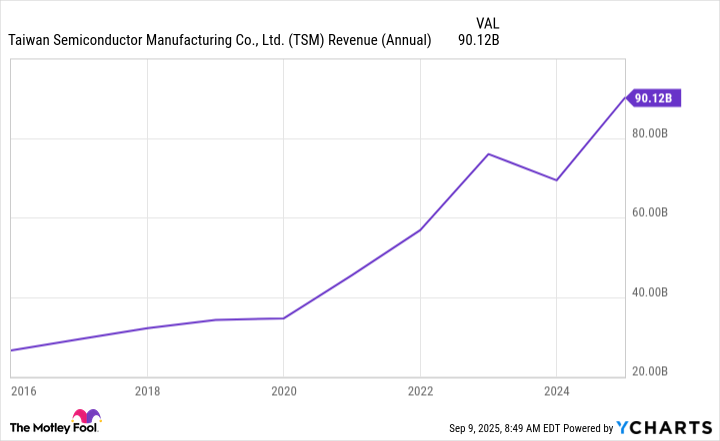

TSMC’s revenue has grown steadily over the years, but it has skyrocketed with the rise of AI. Recently, the company expressed confidence in sustained high demand, driven not only by corporations but also by governments investing in technology. Moreover, Nvidia’s commitment to annual chip updates ensures a steady stream of business for TSMC.

TSMC’s decision to invest $165 billion in U.S. manufacturing facilities adds another layer of resilience. By reducing its exposure to import tariffs and strengthening ties with American clients, the company positions itself as a cornerstone of global technological progress. Over the past three years, TSMC’s stock has surged 200%. For those willing to look beyond the headlines, this is a company built to endure-and thrive.

In conclusion, these two companies represent more than mere investments; they embody the forces shaping our world. Whether through the pursuit of health or the advancement of artificial intelligence, Eli Lilly and TSMC are carving paths that others will follow. To hold their shares is to place a bet not just on their futures, but on the future itself. And in uncertain times, such clarity is worth its weight in gold. 🌟

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- USD PHP PREDICTION

- 9 Video Games That Reshaped Our Moral Lens

2025-09-11 12:28