The human soul, in its infinite contradictions, seeks salvation in numbers and graphs. Cryptocurrencies-this modern Prometheus-ignite both fervent hope and paralyzing despair. Exchange-traded funds, those mechanical beasts of finance, compound the torment. When these two worlds collide, what emerges is not merely a ledger of inflows and outflows, but a tragicomedy of human folly. One might ask: does the market dance to the rhythm of logic or the fevered pulse of the crowd? The answer, as ever, lies in the abyss of our own contradictions.

The terms “inflow” and “outflow” are not mere financial jargon; they are the siren songs of capital’s migration. When the crowd whispers of inflows, it is not the market that sings, but the collective delirium of those who mistake liquidity for salvation. Outflows, in turn, are the ghostly wails of disillusionment. And yet, these metrics often contradict the broader market’s mood-a cruel irony that mirrors the human condition. The crowd roars bullish when the sun shines, yet trembles at the first shadow. Is this not the essence of our eternal struggle between reason and irrationality?

What are inflows and outflows, anyway?

Let us dissect this beast. Inflows are the blood that sustains the ETF’s body; outflows are the hemorrhage that threatens its soul. These metrics do not directly shape an investor’s fate, yet they are the barometers of a fund’s popularity-a cold, clinical measure of which beast the crowd chooses to worship. The money added or withdrawn is but a proxy for the crowd’s faith, a fleeting testament to the transience of human conviction. Like the weighing of bananas at a market, the process is both absurd and essential. Yet, for the average ETF, the scales rarely tip enough to move the world. The market, that great indifferent god, remains unmoved by the petty rituals of capital.

A tale of two Bitcoin ETFs

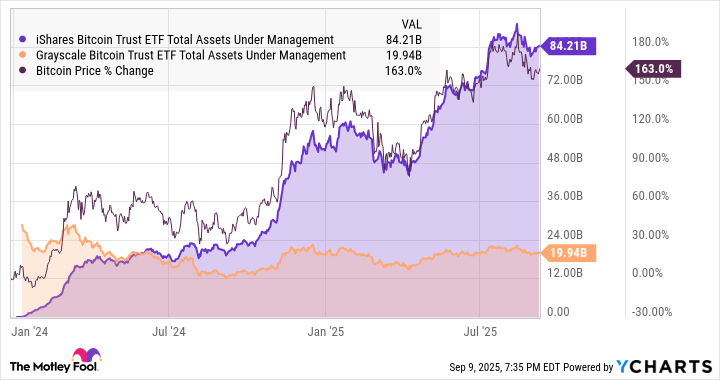

Behold the two titans: iShares Bitcoin Trust (IBIT) and Grayscale Bitcoin Trust (GBTC). They are not merely funds, but embodiments of competing philosophies. iShares, the newborn giant, strides into the arena with the weight of BlackRock’s name and the audacity of a fresh ledger. Grayscale, the elder, clings to its throne with the desperation of a dying dynasty. The former’s $84.2 billion AUM is a testament to the crowd’s fickle loyalty; the latter’s $19.9 billion is a fading echo of its former glory. The tragedy is not in their numbers, but in the human drama they represent-the clash between innovation and tradition, between the promise of a new dawn and the weight of legacy.

Grayscale’s journey is a parable of delayed reckoning. It began as a mutual fund in 2015, a noble experiment in the alchemy of finance. Yet, by 2021, it filed to become an ETF, a transformation that would take two years to complete. iShares, the usurper, entered the fray in 2023, a latecomer with the arrogance of a new god. When the SEC’s seal was placed upon it in 2024, the old order began to crumble. The crowd, ever fickle, abandoned the elder for the younger, not out of malice, but out of the inexorable pull of the new.

The great Bitcoin ETF migration

The migration of capital from Grayscale to iShares is not a mere transaction; it is a mass exodus of the soul. On the day the SEC’s verdict was pronounced, Grayscale’s AUM stood at $28.6 billion-a fleeting moment of triumph before the tide turned. iShares, born from nothing, began its ascent. The crowd, in its infinite madness, poured into the new, while the old withered. The chart of Bitcoin’s price, like the sun in a storm, illuminates this paradox: the fund’s AUM and the asset’s price often diverge, yet the crowd insists on their union. It is as if the market seeks to reconcile the irreconcilable-faith and reason, hope and despair.

Fees may matter more than you think

The iShares fund, with its 0.25% fee, is a siren song to the rational investor. Grayscale’s 1.5% fee, in contrast, is the price of sin-a tax on the soul of those who cling to the past. The difference, 1.25%, may seem trivial, but in the long march of time, it becomes a chasm. Consider the institutional investor: $100,000 in Grayscale costs $1,500 annually; in iShares, a mere $250. The former is a penance; the latter, a liberation. Yet, the crowd, blinded by the allure of familiarity, clings to the elder, even as it withers. Is this not the essence of human folly?

The iShares fund’s 82% inflow versus Grayscale’s 17% outflow is not a mere statistic; it is a verdict. The two funds, though offering similar returns, are judged not by their performance, but by the weight of their fees. The crowd, in its infinite wisdom, has chosen the path of least resistance. Yet, in doing so, it has condemned itself to the slow erosion of wealth. The moral is clear: the market is not a place for sentiment, but for cold calculus. And in this calculus, the soul of the investor is the first casualty.

The tragedy of Bitcoin ETFs is not in their mechanics, but in the human drama they reveal. In the end, the crowd will always choose the path of least resistance, even if it leads to ruin. And the wise investor, armed with reason and a cold heart, will navigate the tempest with the precision of a Dostoevsky protagonist. But what is salvation, if not the acceptance of our own contradictions?

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

2025-09-11 03:35