dividend stocks are too often cast aside as the dusty relics of some bygone era, fit only for those who find excitement in knitting needles and bingo. But don’t be too hasty with that thought, my skeptical friends. A dividend-bearing nugget, well-selected, can transform one’s fortunes akin to finding a dollar bill stuffed in an old coat pocket. The key, my fellow wanderers in the wilderness of Wall Street, is to identify the rare breeds that don’t treat dividends as a chore, but as a natural byproduct of a profit-producing behemoth that’s impossible to stall.

Costco Wholesale (COST), now there’s a fellow that wears this badge with pride. True, a 0.54% yield may seem as appealing as a parched mouth at a forgotten well when compared to those sparkling bonds dishing out 4%. And goodness gracious, trading at 47 times its expected earnings while the good old market twirls around a more modest 20? Let’s just say the math makes you squint. Shares have lumbered up a mere 10% in the past year, seemingly outpaced by tech stocks zooming through the stratosphere. Ah, but here’s where the tale twinkles: Costco’s clever contraption of charging an annual fee merely to meander its isles creates a steady, predictable stream of cash flows that just might warrant a hearty chuckle from the future.

The Membership Model That Prints Money

Costco’s brilliance sparkles like a freshly polished silver dollar: collect an annual fee and sell goods with about as much margin as a flea market vendor. Typically maintaining net margins around 2% to 3% – a feat intentionally kept low to offer oodles of value – Costco stands in stark contrast to Walmart, which nets about 3%, while Target manages a paltry 3.7%. Now, if that isn’t a fine recipe for capturing the hearts and wallets of American shoppers, what is?

Now as of Q3 fiscal 2025, Costco brags about 79.6 million paying households, with a total gaggle of 142.8 million card-carrying customers. And they ain’t just idling; membership has graced the growth charts with a sprightly 6.8% increase year-on-year. Executive Members, those who cough up a hearty $130 each year (having been notified of an impending fee hike), represent nearly half of paid members but pull in around three-quarters of sales like a well-organized barn dance.

The membership fee income swelled to $1.24 billion in that same quarter, up a cracking 10.4% from the previous year. That’s golden revenue, my friends, flowing straight to the bottom line faster than catfish at a fry. Indeed, membership fees largely cover profits, while the sale of actual products helps keep the lights on.

The Dividend Story Wall Street Misses

Now, the regular dividend may yield only 0.54% – translating to a rather underwhelming $5.20 every year on a stock valued at a customer-begging $965 (as of September 8). Yield chasers, prepare for a snooze. However, with a payout ratio resting comfortably at a mere 27.1%, Costco holds onto most of its earnings, spreading the dough for growth whilst still tossing a bone to its shareholders. More captivating still are the special dividends, the unexpected turkeys among the pumpkins. This fine outfit has rewarded its patient shareholders with special distributions of $7 in 2012, $5 in 2015, and so forth – representing a notable windfall for those with the sense to stick around.

The company has churned out billions in free cash flow while maintaining modest regular dividends; with a hearty cash cushion and hardly any debt, Costco possesses a grand capacity for future special distributions. The consistent quarterly dividend has burgeoned like a spring bloom from a meager $0.10 back in 2004 to a robust $1.30 today-a remarkable thirteenfold increase. Those who were astute enough to purchase shares a decade past are now merrily enjoying a yield on cost approaching 3%. Not a bad gig for doing nothing!

Growth Hiding in Plain Sight

Now, one may gaze upon Costco’s 914 warehouses and think, “Well now, they must be reaching the heights of saturation.” But lo and behold! The company has continued to open about 27 locations in fiscal 2025 and aims for no less in 2026. The international stage presents the most promising pasture of growth; with 78 warehouses in Asia (37 in Japan, 20 in South Korea, and a measly 7 in China), it’s apparent there’s ample room for more expansion in a region housing a veritable 4.8 billion souls.

E-commerce growth is chugging along in the high teens, with an admirable 18.4% leap as of August 2025. Adjusted comparable sales found a breath of fresh air, climbing 8% in Q3 FY25, while its Kirkland Signature private label raked in roughly $86 billion in 2024, showcasing quality akin to national brands yet offered at around 20% less. These tremors of activity reflect a model that’s riding high without a hint of the old man ‘mature market’ dynamics; the wheel is indeed turning beautifully.

The Valuation That Makes Sense

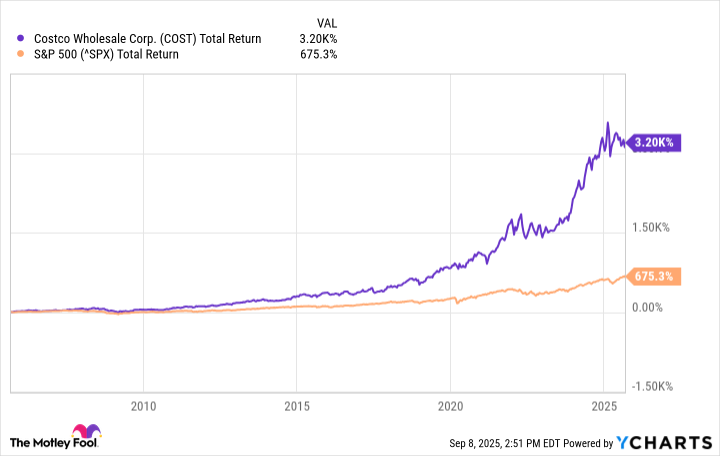

At 47 times forward earnings, one might accuse Costco of dressing itself in expensive finery. Charlie Munger, having scrutinized this institution from upon the rooftops of its board for decades, pointed out that “the trouble with Costco is it’s 40 times earnings.” But context, my dear friends, is like the seasoning in a good stew; it’s all about balance. Costco has never laced its price tags with cheapness but has trampled the market for decades. Over the last two decades, it has returned a staggering 3,200%-including dividends-compared to a mere 675% for the S&P 500.

This premium appears not from empty boasting but reflects quality of the enterprise. Membership renewal rates hovering near 90% unleash predictable revenue streams. The subscription model guarantees Costco its dollars before any goods even grace the shelves. International expansion beckons with decades of potential growth while a culture ensconced in a fanatical focus on customers makes it nearly impossible for competitors to replicate; they can no longer just throw money at the problem.

Your Future Self Will Thank You

Now, my good people, hold not your breath in expectation of getting rich overnight! Costco may not guarantee a sudden windfall, but that modest yield combined with steady dividend growth, periodic special payouts, and the gradual appreciation of a business that seems to grow stronger by the year can weave a tapestry of wealth that multiplies well beyond one’s fancy. Sometimes, the best investment isn’t the flashiest stock; it’s the kind of exceptional business a wise soul opts to hold for eternity. 🌱

Read More

- Fed’s Rate Stasis and Crypto’s Unseen Dance

- Blake Lively-Justin Baldoni’s Deposition Postponed to THIS Date Amid Ongoing Legal Battle, Here’s Why

- Ridley Scott Reveals He Turned Down $20 Million to Direct TERMINATOR 3

- Baby Steps tips you need to know

- Global-e Online: A Portfolio Manager’s Take on Tariffs and Triumphs

- Dogecoin’s Decline and the Fed’s Shadow

- The VIX Drop: A Contrarian’s Guide to Market Myths

- Top 10 Coolest Things About Indiana Jones

- Northside Capital’s Great EOG Fire Sale: $6.1M Goes Poof!

- WELCOME TO DERRY’s Latest Death Shatters the Losers’ Club

2025-09-10 16:07