SoFi Technologies (SOFI) is gatherin’ a heap of attention from the investors these days, and I reckon it’s no mystery why. The stock has galloped up more than 160% since its low point in April, and if you stretch your imagination a bit further, you’ll see it’s higher by an eye-popping 260% over the past year. Now, that’s a substantial leap for a critter that once crawled.

But, as is often the case in matters of speculation, one must ask: Is this stock truly the golden goose folk believe it to be? The answer swings like a pendulum – a resounding yes on one side, yet a stubborn no on the other.

Here’s a morsel of thought to chew on if this ticker’s made it into your line of sight but hasn’t scuttled its way into your investment basket just yet.

What’s SoFi Technologies, Anyway?

Now, don’t get twisted; SoFi ain’t your grandmother’s bank. It’s an online bank, and I mean exclusively online – no brick-and-mortar smokestacks polluting the air. Yet, don’t let that fool you into thinkin’ it offers any less than a traditional bank. If you need checking and savings accounts, investment services, loans, insurance, or credit cards, they’ve got ’em in spades.

This isn’t some flimsy startup either, folks. With a valuation around $30 billion, it’s serving up financial services to more than 11.7 million customers and holding a solid $36.3 billion in assets. Last quarter alone, it pulled in $855 million in revenue, turning almost $98 million of that into net income. Quite a piece of pie, wouldn’t you say?

But if you’re lookin’ for what really stands out, consider the headcount of SoFi’s current members. While 11.7 million might seem a wee bit shy compared to heavyweights like Wells Fargo and Bank of America, keep in mind this bank has been in the game since only January 2022. What’s more, this customer growth tale is one of triumph, having risen every single quarter since 2020, when SoFi was merely a fintech intermediary with the offerings of a store-bought pie. Last quarter, it chalked up a 34% year-over-year growth in members, yet again pushing its customer count to dizzying heights.

The New Normal

This company, you see, is well and truly plugged in to the seismic shifts in how folks conduct their business these days. They’re going online, and particularly fond of that little device that fits snugly in their pockets – the smartphone.

A survey from the American Bankers Association last year paints a clear picture. Of the 4,508 adults surveyed, only a measly 8% favored good ol’ branch visits for their banking needs, while a paltry 4% opted for telephone calls. On the flip side, 22% of these fine folks managed their banking via laptop or PC, but a whopping 55% fancied a mobile app to handle their affairs. And wouldn’t you know it, the younger generation was far more inclined to embrace this digital wizardry than their older counterparts.

SoFi’s growth surely reflects this emerging normal, which aligns seamlessly with the slow but steady aging of our digitally-adept populace.

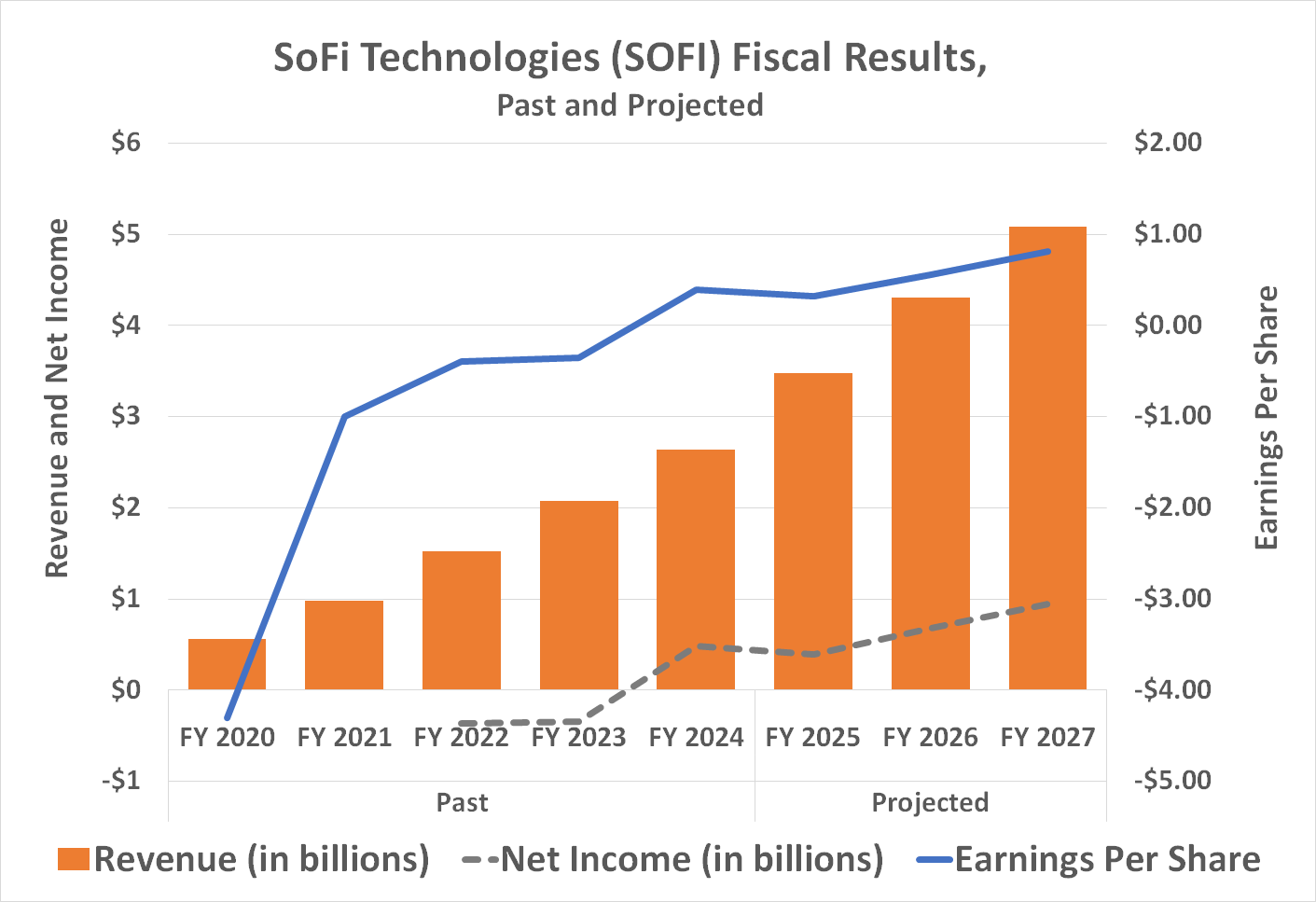

And before you assume the fun stops here, hold your horses! Market researchers over at Technavio forecast that the global digital banking sector is set to expand at a sprightly pace of over 16% annually up until 2029. The U.S. market, where SoFi sets up shop, is likely to lead the charge during this period. Analysts are whispering about a doubling of SoFi’s top and bottom lines between now and 2027, which is quite a tall tale indeed.

The kicker, my friends, is that at least some of this future growth will ride on the coattails of their ventures beyond plain banking. Just last July, they rolled out expanded private investments, and just a tick ago, they launched their very own sponsored exchange-traded fund – the SoFi Agentic AI ETF (AGIQ). This knack for branching out into new avenues shows that the company is casting nets as wide as the Mississippi River.

Right Stock, Wrong Time

So, is it a buying opportunity? Not just yet.

Now, folks, there’s certainly no erroneous time to invest in a great stock; however, some seasons are undoubtedly more favorable than others. Arguably, right now ain’t the best moment to paddle into these waters.

The crux of the matter is the sheer magnitude of SoFi’s run-up since last summer. While soarings of this nature are typically celebrated, this one’s – well, it’s a bit excessive, don’t you think? Just slightly over a year, and shares have more than doubled, reaching a height exceeding the analyst consensus price target of $20.72 by over 20%.

And let us consider the stock’s valuation, which is strutting around nearly 50 times the expected per-share earnings of $0.52 for the upcoming year. That’s a steep price for any stock, but downright extravagant for a banking entity, even one with SoFi’s galloping growth. I’d suggest potential investors take a deep breath and wait for a pullback before diving headfirst into the pool. The silver lining is, we’ve seen lulls from this ticker on more than one occasion.

But don’t get too picky if you’re hoping to buy in. The notion of scoring a bargain price is as wishful as finding a needle in a haystack; any little dip might be all you’re going to lay your hands on. The growth story here is far too vibrant, and the allure of the company’s narrative is too compelling to expect any major belly flop from the stock.

So there you have it, dear reader. Tread wisely, and keep your wits about you in this wild banking tale! 🏦

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Avantor’s Plunge and the $23M Gamble

- :Amazon’s ‘Gen V’ Takes A Swipe At Elon Musk: Kills The Goat

- Umamusume: All current and upcoming characters

- 20 Anime Where the Protagonist’s Love Interest Is Canonically Non-Binary

- Stranger Things 5 Ending Explained: Was Vecna Defeated? All About Eleven’s Choice and Hawkins’ Future

- Overrated Crime Movies Everyone Seems To Like

- Solana’s Price Secret: Traders Are Going NUTS!

- ‘Zootopia 2’ Just Shattered the Most Important Box Office Record Ever

- Why the Russell 2000 ETF Might Just Be the Market’s Hidden Gem

2025-09-10 04:07