Now, friends and fellow travelers in the great circus of capitalism, gather ’round while I tell you a tale of a peculiar beast known as Ares Capital (ARCC). It’s not just any old stock-it’s a Business Development Company, or BDC for short. And before you get all starry-eyed over its 8.5% dividend yield (which is enough to make even the stingiest miser salivate), let me remind you that this creature operates under rules stranger than those governing Mississippi riverboat gamblers.

What Does Ares Capital Do?

Picture this: Ares Capital struts about like a banker at a county fair, lending money to small businesses that can’t exactly waltz into Wall Street’s grand ballroom. These are companies so desperate for cash they’d probably take out a loan from their own shadow if it came with favorable terms. Now, don’t misunderstand-Ares isn’t some back-alley shark; it’s one of the more respectable BDCs in town. But respectability doesn’t mean safety, mind you. Oh no, far from it.

You see, there’s a reason these borrowers come to Ares instead of heading to your friendly neighborhood bank. Banks have standards, after all-or at least they pretend to-and won’t hand over a dime unless you’ve got collateral shinier than a new brass spittoon. Ares, on the other hand, charges interest rates high enough to make a highwayman blush. We’re talking double-digit percentages here, folks. If these little enterprises could find cheaper funding elsewhere, they’d sprint faster than a jackrabbit fleeing a fox.

And then there’s the matter of size. The clients Ares serves aren’t titans of industry; they’re more like scrappy barnstormers trying to keep their biplanes aloft. Small businesses are inherently risky propositions. They’re fragile things, prone to collapsing under the weight of bad luck or rising costs. Add to that the fact that much of Ares’ debt floats on variable rates, and suddenly you’ve got a recipe for financial heartburn when interest rates climb higher than a cat chased up a tree by an excitable terrier.

Is Ares Capital Worth Buying?

Well now, that’s the million-dollar question-or perhaps the $8.50 question, given the current yield. Let’s talk turkey, shall we? In the second quarter of 2025, Ares boasted a weighted-average yield on its loans of 10.9%. Sounds impressive, doesn’t it? Like a preacher quoting scripture to justify his third helping of pie. But hold your horses, pilgrim, because nearly 70% of those loans carry floating rates. That means every time the Federal Reserve decides to play pin-the-tail-on-the-interest-rate-donkey, Ares’ clients feel the pinch-and sometimes, they buckle under the strain.

To be fair, Ares has positioned itself fairly well. Nearly 60% of its debt holds first-lien status, meaning it gets dibs on whatever scraps remain if a borrower goes belly-up. But even the best lifeboat leaks during a hurricane. When interest rates rise, defaults tend to follow like vultures circling a carcass. And when rates fall? Well, Ares’ income takes a nosedive too, leaving shareholders clutching thinner envelopes come dividend day.

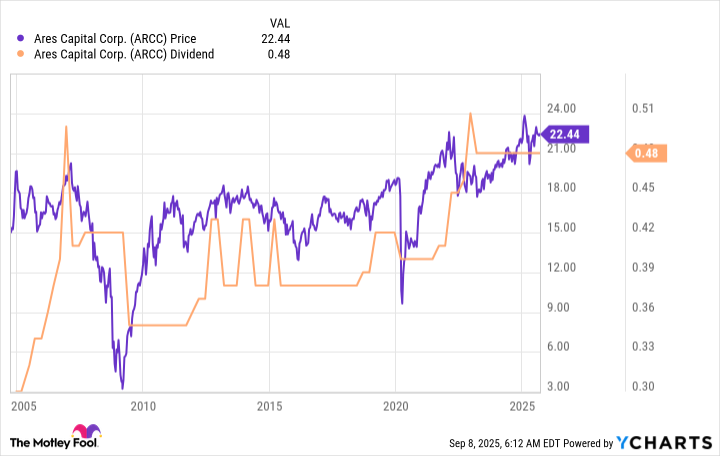

Take a gander at that chart above, won’t you? Notice how the orange line zigzags like a drunkard stumbling home after a night at the saloon. Yes, Ares survived the Great Recession of ’07-’09, unlike many of its peers. But survival didn’t come without scars. During that dark stretch, Ares slashed its dividend deeper than a barber giving a convict a last haircut before the gallows. Not because it wanted to, mind you, but because it had no choice.

Ares Capital Could Let You Down When You Least Expect It

Here’s the crux of the biscuit, as they say: If you’re the sort of soul who needs steady dividends like a parched man needs water, Ares might not be your cup of tea. Its payouts ebb and flow like the tide, and often at the worst possible moments. Imagine counting on that quarterly check to cover your grocery bill only to find it shriveled up like yesterday’s lettuce. That’s the gamble you take with BDCs, my friend.

Now, none of this is to say Ares Capital is a villain. Far from it. It plays the game according to the rules laid out for it, and it does so with a degree of skill and prudence. But the game itself is rigged, and anyone stepping onto the field should know what they’re signing up for. If you can stomach the uncertainty-if you can laugh off a missed payment or two and still sleep soundly-then maybe, just maybe, Ares deserves a spot in your portfolio. Otherwise, steer clear, lest you end up chasing fool’s gold down a rabbit hole.

So there you have it-a cautionary tale wrapped in the trappings of opportunity. Invest wisely, dear reader, and remember: The house always wins… unless the house burns down first 🔥.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Avantor’s Plunge and the $23M Gamble

- :Amazon’s ‘Gen V’ Takes A Swipe At Elon Musk: Kills The Goat

- Umamusume: All current and upcoming characters

- 20 Anime Where the Protagonist’s Love Interest Is Canonically Non-Binary

- Stranger Things 5 Ending Explained: Was Vecna Defeated? All About Eleven’s Choice and Hawkins’ Future

- Overrated Crime Movies Everyone Seems To Like

- Solana’s Price Secret: Traders Are Going NUTS!

- ‘Zootopia 2’ Just Shattered the Most Important Box Office Record Ever

- Why the Russell 2000 ETF Might Just Be the Market’s Hidden Gem

2025-09-10 03:26