Ah, the eternal tale of two cryptos: Bitcoin ETFs bask in a glorious $368 million inflow, courtesy of Fidelity and Ark 21Shares, while Ether ETFs stumble through their sixth consecutive day of exits. How delightfully predictable.

Institutional Love for Bitcoin, While Ether Watches $97 Million Walk Out the Door 🚪💔

Investors, those fickle creatures, have returned to Bitcoin exchange-traded funds (ETFs) with the enthusiasm of guests at an open bar. Meanwhile, Ether funds are stuck in a tragic opera of red streaks, unable to shake off their melancholy. Truly, it’s a tale of diverging paths-one bathed in sunlight, the other shrouded in gloom. Where institutional conviction flows, so too does drama.

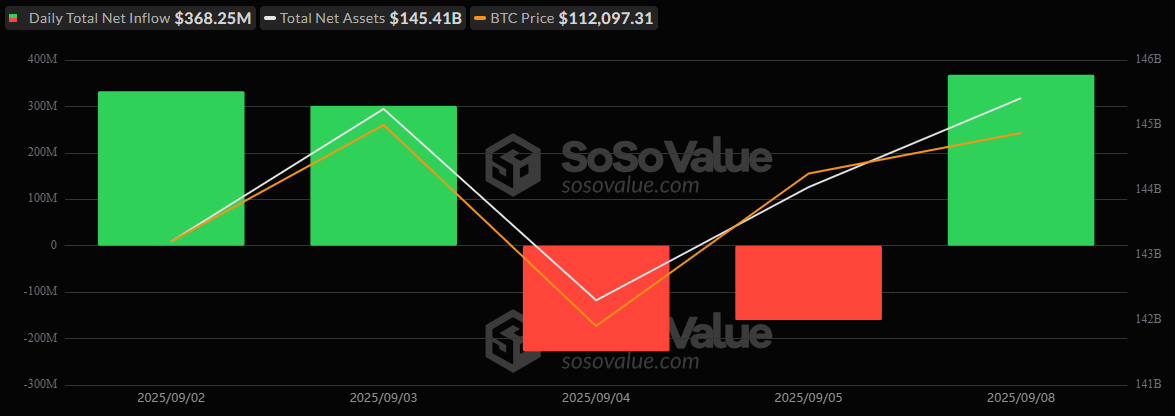

On Monday, Sept. 8, Bitcoin ETFs enjoyed their finest hour since early September, pulling in $368.25 million. Fidelity’s FBTC led the charge like a triumphant general, raking in $156.50 million, while Ark 21Shares’ ARKB followed close behind with $89.47 million. Bitwise’s BITB added a respectable $42.71 million, Blackrock’s IBIT pitched in $25.48 million, and Vaneck’s HODL tossed $20.63 million into the pot. Even the smaller players joined this green parade-Grayscale’s Bitcoin Mini Trust (+$11.91 million), Invesco’s BTCO (+$6.71 million), Franklin’s EZBC (+$6.49 million), Grayscale’s GBTC (+$4.40 million), and Valkyrie’s BRRR (+$3.96 million). Remarkably, not a single Bitcoin ETF saw an outflow. Total trading volume soared to $3.02 billion, with net assets climbing to $145.41 billion. One might say Bitcoin is having its moment in the sun-or perhaps just basking in its own brilliance.

And now, dear reader, we turn to the tragic figure of Ether ETFs, which sank deeper into despair, shedding $96.69 million and marking their sixth consecutive day of losses. Fidelity’s FETH did attempt a valiant rescue mission with $75.15 million in inflows, alongside $11.31 million for Grayscale’s Ether Mini Trust and $9.55 million for ETHE. Alas, Blackrock’s ETHA suffered a devastating blow, losing $192.70 million-enough to overshadow any fleeting victories. Total value traded amounted to $1.52 billion, leaving net assets steady at $27.39 billion. Poor Ether-it seems no amount of charm can save it from its current plight.

The divide grows ever sharper: Bitcoin ETFs continue to attract steady institutional commitments, while Ether ETFs remain burdened by outsized redemptions. Will this divergence persist? Only time will tell-but until then, let us savor the spectacle of Bitcoin’s triumph and Ether’s woes. After all, life without a little drama would be insufferably dull, wouldn’t it? 🎭📈

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

2025-09-09 22:30