Ah, the grand theater of finance unfolds once again! Grayscale Investments, that ever-ambitious titan of crypto innovation, has filed a registration statement with the all-powerful SEC. They seek to birth a Chainlink (LINK) exchange-traded fund (ETF), destined-assuming the gods of bureaucracy approve-for the hallowed halls of NYSE Arca under the ticker GLNK. Oh, what suspense! What intrigue! 🎭

The filing, dated Sept. 5, 2025, whispers promises of transformation: the humble Grayscale Chainlink Trust (LINK) shall don its new robes as the Grayscale Chainlink Trust ETF (GLNK). Its noble mission? To reflect the value of Chainlink (LINK), minus those pesky expenses and liabilities, using the Coindesk Chainlink Price Index at 4 p.m. like some high-tech oracle. 🔮

But wait, dear reader, there’s more! The trust plans to issue and redeem shares in bundles of 10,000 through authorized participants. For now, creations and redemptions will be conducted via cash transactions with a liquidity provider. In-kind transfers of LINK? Perhaps someday, if NYSE Arca grants further divine approval. Meanwhile, Bank of New York Mellon stands ready as administrator and transfer agent, while Coinbase Custody Trust guards the treasure trove, and Coinbase, Inc. plays prime broker. Quite the ensemble cast, isn’t it? 🎩✨

And here comes the plot twist: NYSE Arca proposes “Generic Listing Standards,” which could, if blessed by regulators, allow digital asset products to list without needing 19b-4 orders. Grayscale, ever cautious, vows not to push forward until these standards are approved-or unless they decide such approval is unnecessary. Ah, the delicate dance of compliance! 🕺

Let us not forget the fine print, for no tale of modern finance would be complete without it. This trust does not bow to the Investment Company Act, nor does it consider itself a commodity pool under the Commodity Exchange Act. Yet, like any good tragedy, the prospectus warns of risks aplenty: LINK price volatility, premiums or discounts to net asset value, regulatory whims, and reliance on service providers and trading platforms. How delightfully perilous! ⚡️

Now, let us address the elephant in the room-or rather, the staking condition. While the trust agreement permits staking of LINK, this fabled “Staking Condition” remains unmet. Until then, staking remains forbidden fruit. But should the stars align, the sponsor may stake a portion of holdings through third-party providers, with proceeds handled according to policies yet undisclosed. Intriguing, no? 🐘🔒

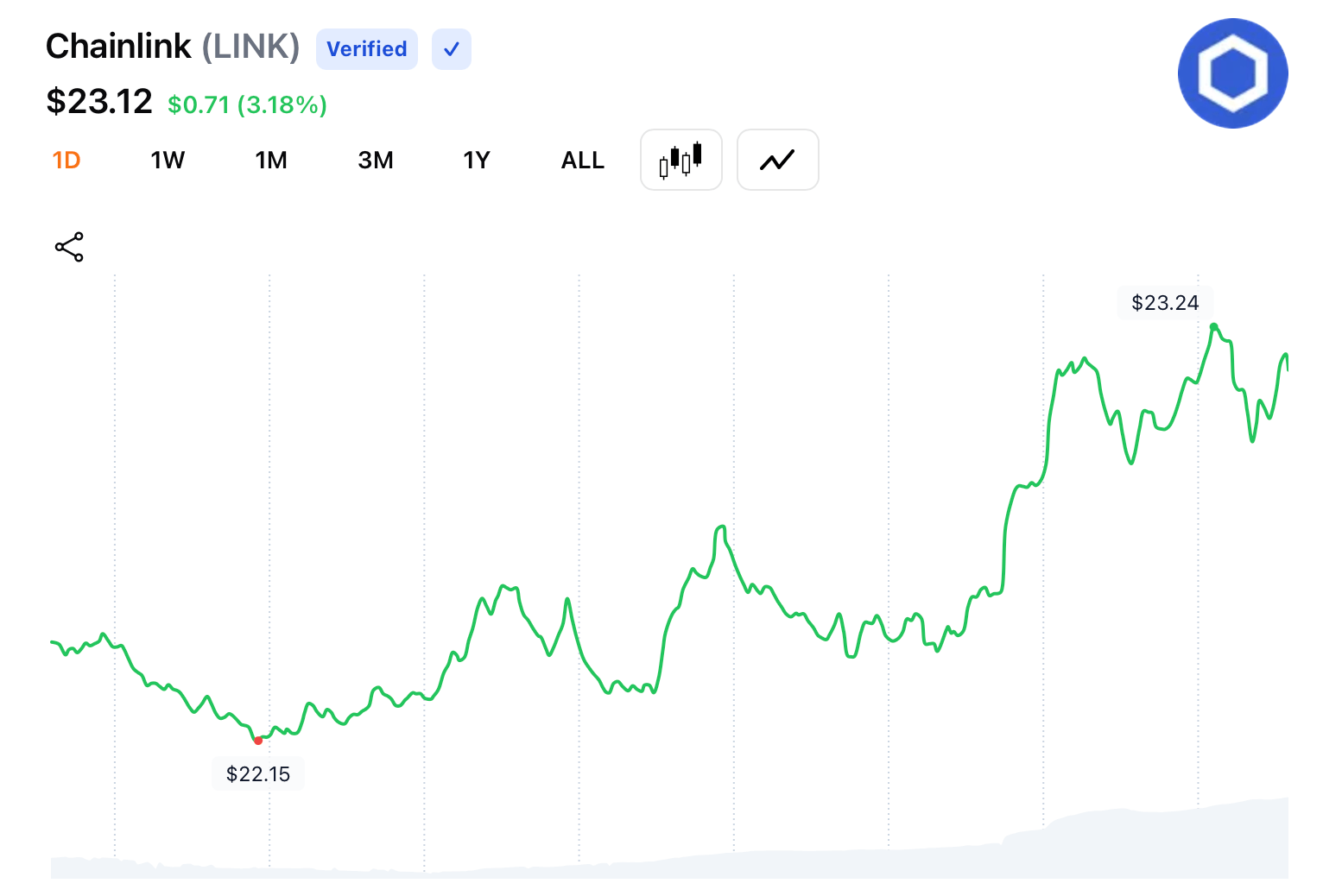

As for LINK itself, it rose 3.18% on Monday, though only a modest 0.8% over the past seven days. Over the last 12 months, however, LINK has soared an impressive 126%. Truly, a phoenix rising from the ashes of market chaos. 🦅🔥

So, dear reader, sit back and watch as Grayscale marches toward destiny-or perhaps just another chapter in the never-ending saga of crypto ambition. Will GLNK find its place among the stars of NYSE Arca, or will it stumble into the abyss of regulatory purgatory? Only time will tell. ⏳

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- USD RUB PREDICTION

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- 8 Board Games That We Can’t Wait to Play in 2026

- South Korea’s Wild Bitcoin ETF Gamble: Can This Ever Work?

- TV Pilots Rejected by Networks

2025-09-08 19:00