Ah, the alluring Powerball. Its siren call echoing through the collective psyche of the masses, tantalizing us with the forbidden fruit of improbable wealth. A jackpot-an absurdly high $1.7 billion, no less-that floats in the imagination like a mirage. And yet, as I ponder the seductive absurdity of it all, I find my gaze veering towards a more stable, more intelligent path. The Vanguard S&P 500 ETF (VOO), dear reader, for it is in this modest, infinitely more predictable endeavor that the true beauty of wealth lies. Let me tell you why.

They Want You to Buy Lottery Tickets

We are told, ad nauseam, that one must be “in it to win it.” Yet, what is this “it” we speak of? The lottery, a carnival of chance that promises untold riches to the lucky few, while ensuring that the vast majority of hopeful participants are left with little more than the bitter residue of their folly. In 2023 alone, this grand spectacle raised a staggering $103 billion in ticket sales. But how much of that was actually redistributed to the winners? Oh, around $69 billion, perhaps, a sum that sounds less than princely once you realize that the cost of running such a beastly machine-administrative expenses, commission, the usual tolls of bureaucracy-reduces the figure considerably. The states might have netted a paltry $30 billion, but this too, dear reader, is not the treasure trove it seems, for the states collect a mere 2.3% of their total revenue from this ephemeral pursuit.

And then we arrive at the crux of the matter: the odds. The odds of winning the Powerball’s $1.7 billion jackpot are a nauseating 1 in 292 million. Yes, I said it-292 million. An incomprehensible number. The kind of odds that should make a rational soul recoil in horror. And yet, here lies the tragedy of it all: the so-called “odds of winning a prize” are far more palatable-1 in 25. Oh, how this tantalizes the mind! But these minor, ephemeral prizes, small in comparison to the grandeur of the jackpot, are what keep the dreamers dreaming, the gamblers gambling. And yet, the overwhelming majority will never see their prize exceed a few dollars, if that. You, my friend, are far more likely to lose than win. It is the tragic comedy of it all.

Think Long-Term, Build Your Wealth

The lottery, if one may call it such, is not the path to wealth. It is a mirage-a fleeting distraction that draws your eye away from the steady, reliable growth that can only be achieved through patient, disciplined investment. If you are serious about wealth, the lottery is a fool’s errand. It is spending, not saving. In fact, let us leave the lottery to the daydreamers and focus on a far more tangible pursuit-the cultivation of wealth over time.

It begins with saving. But, alas, that is only the first step. To truly build, one must invest-methodically, strategically, and for the long term. And there, the wise investor has a trusted companion: the S&P 500 index fund. A shining example of such an instrument is the Vanguard S&P 500 ETF. Here, we have an investment that would receive the nod of approval from none other than Warren Buffett, the Oracle of Omaha himself, a man who has long advocated for the simplicity and reliability of this very approach. He recommends that investors, in the pursuit of long-term growth, simply buy the S&P 500 and hold it. Simple, isn’t it?

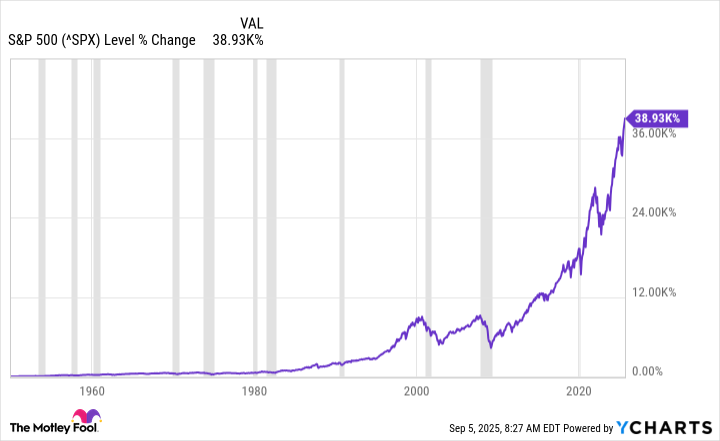

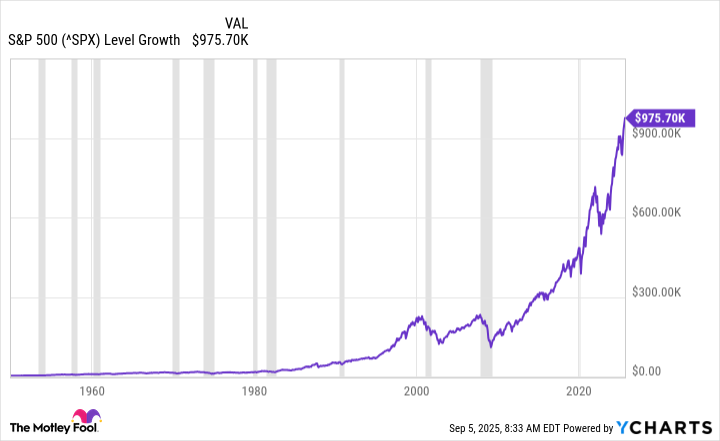

But why, you ask, has this titan of Wall Street-this sage-endorsed such a strategy? The answer is elegantly simple. Look at the chart before you. Since 1950, the S&P 500 index has risen by nearly 39,000%. That’s right-thirty-nine thousand percent. Yes, there were rough patches, dark days when the market seemed to collapse in on itself, but the key is this: those moments, though harrowing, are mere blips on the chart of history. Had you been disciplined enough to stay the course, you would now be basking in a wealth that only time could bestow.

In the past fifty years, the average return of the stock market has hovered around a modest 10% per annum. Of course, the actual returns will fluctuate from year to year-such is the nature of this volatile game. But over time, the long-term trend is unmistakably clear. If you had invested $2,500 at the start of 1950, and had added no further contributions, your investment would be worth nearly $1 million today. Compare that to the odds of winning the Powerball-a rarefied pipe dream that offers you a one-in-292-million shot at unimaginable wealth. Ah, but in the world of the S&P 500, your jackpot is assured, though it takes a touch of patience to realize it.

Fortunately, Most Have Figured It Out

The lottery is a thrilling pursuit-a topic of lively conversation, the stuff of office chatter, a way to bond with fellow humans over a shared, if entirely illusory, hope. It captivates, yes. But it is ultimately a poor investment choice, one that hardly warrants serious attention from a rational mind. In contrast, investing in the S&P 500 index is-dare I say it-boring. It is not a subject that will ignite wild discussions at cocktail parties, nor will it spark envy in the eyes of your peers. And yet, it is precisely this lack of drama that makes it so valuable.

But take solace, dear reader, for over 60% of U.S. adults have figured it out. They have embraced the quiet wisdom of long-term stock market investing. They know that the S&P 500 is not thrilling, not exhilarating, but it is reliable. It will not make for scintillating dinner party conversation, but it will make you wealthier over time. So, my advice to you is simple: invest in the S&P 500, and let others dream of their fleeting Powerball fortune, while you build your wealth with the quiet assurance that time, indeed, is on your side.

And should you find yourself at a cocktail party, feeling a strange discomfort in your inability to engage in the giddy Powerball chatter, remember this: there is something infinitely more satisfying in the quiet, steady growth of your wealth. Even if it makes you the most boring guest in the room. 🥂

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- Shocking Split! Electric Coin Company Leaves Zcash Over Governance Row! 😲

- Live-Action Movies That Whitewashed Anime Characters Fans Loved

- Here’s Whats Inside the Nearly $1 Million Golden Globes Gift Bag

- All the Movies Coming to Paramount+ in January 2026

- Game of Thrones author George R. R. Martin’s starting point for Elden Ring evolved so drastically that Hidetaka Miyazaki reckons he’d be surprised how the open-world RPG turned out

- ‘Bugonia’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Once Again

- USD RUB PREDICTION

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

2025-09-08 16:43